House to take key vote to protect consumers today

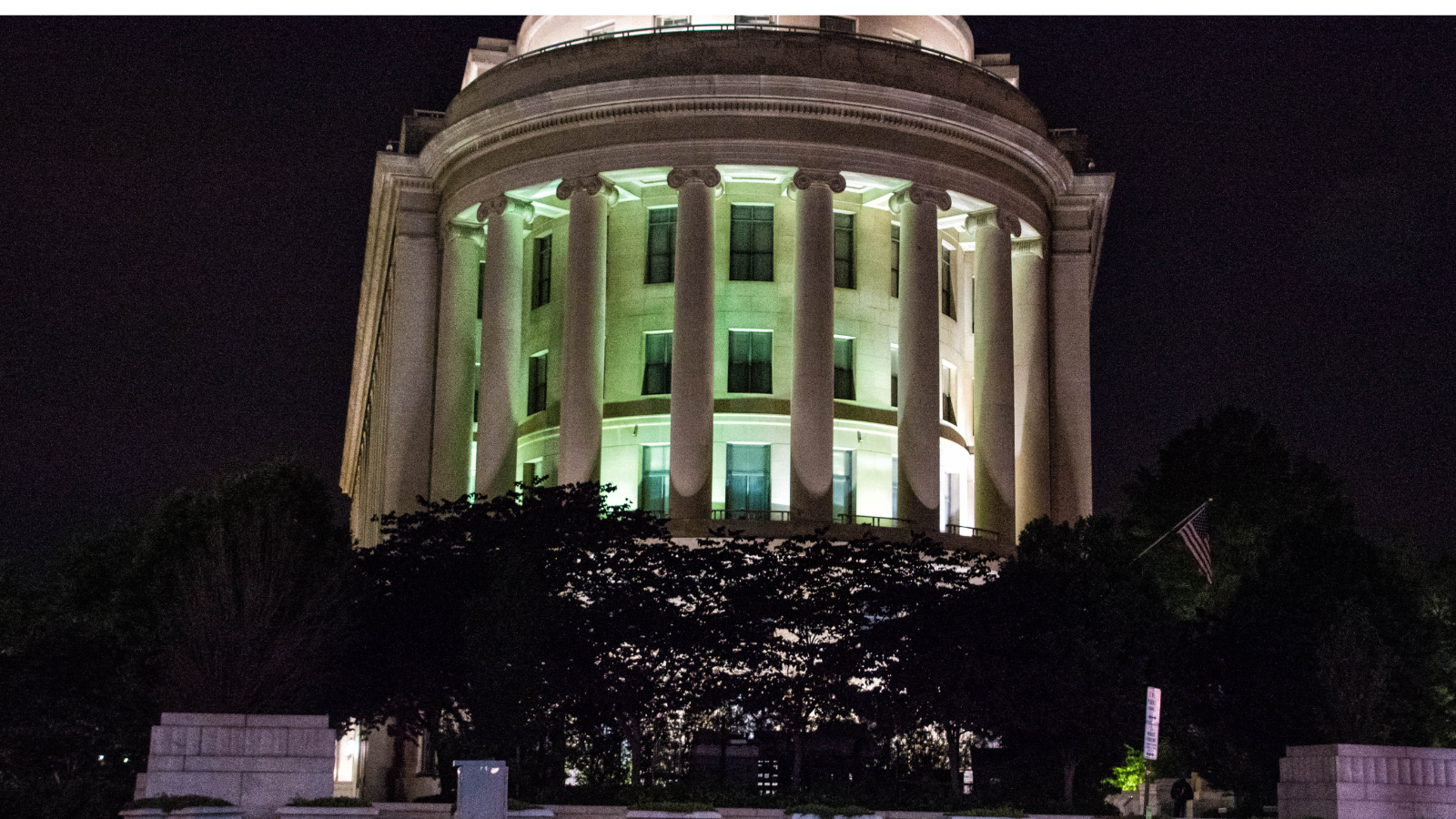

Today, the U.S. House takes a key vote. HR2668, the Consumer Protection and Recovery Act, would restore the FTC's Section 13(b) authority to hold wrongdoers accountable and compensate consumer-victims harmed by their actions. The Supreme Court had recently ruled that the power, used for over 40 years to recover billions, was not clearly articulated in law. Cover photo via Flickr by Mr. Blue MauMau, some rights reserved.

Today, the U.S. House takes a key vote. HR2668, (Cardenas-CA), the Consumer Protection and Recovery Act, would restore the FTC’s Section 13(b) authority to hold wrongdoers accountable and compensate consumer-victims harmed by their actions. The Supreme Court had recently ruled that the power, used for over 40 years to recover billions, was not clearly articulated in law. Here is an excerpt from a group letter to Congress from U.S. PIRG and other consumer and civil rights groups in support of HR 2668:

“For decades, the FTC relied on Section 13(b) of the Federal Trade Commission Act to hold bad actors accountable when they violate the law. Under 13(b), the FTC has returned their ill-gotten gains to harmed consumers and small businesses. Since July 2018, it has returned $11.5 billion to nearly 10 million people across the country. However, the Supreme Court’s recent decision in AMG Capital Management, LLC, et al. v. Federal Trade Commission has seriously compromised this valuable law enforcement tool.”

As I noted in a recent blog, AMG is the company controlled by convicted payday loan kingpin Scott Tucker:

“Disappointingly, this SCOTUS ruling both harms the victims of his illegal schemes and leaves the door open for other bad actors — fraudsters, scammers, prescription drug companies, payday lenders, tech companies, credit bureaus — virtually any violator of the FTC Act, to follow his lead without fear of serious financial repercussions.”

Passing HR2668 into law is a critical step to reinstate FTC power to recover funds from wrongdoers and compensate victims. Ideally, the House and then Senate will pass it. Section 13(b) has been used by the commission for over 40 years, under both Republican and Democratic commissioners.

Congress can do more to strengthen the FTC. Last week, we supported Rep. Kathy Castor (FL) in the introduction of her 21st Century FTC Act. As I said in her release:

“U.S. PIRG supports Rep. Castor’s bill to give the FTC streamlined rulemaking authority and the power to impose civil penalties for first violations of the FTC Act. U.S. PIRG has long supported removing the shackles of Magnuson-Moss rulemaking, which is unique to the FTC and prevents it from policing the marketplace, and also taking away industry’s favorite “first bite of the apple is free” clause, which has allowed wrongdoers both to avoid sanctions and then negotiate sweetheart settlements. It’s not any way to run a law enforcement agency.”

You may recall that when the FTC, CFPB and state Attorneys General recently took action against and fined Facebook an (inadequate) $5 billion for its wrongdoing, that fine was due solely to the powers of the CFPB and states, not the FTC. Unless a company is under sanction for violating an existing FTC order (there was none), the FTC generally cannot impose civil penalties.

Further, as I testified in 2010 to the Senate Commerce Committee, unsuccessfully urging that the FTC also be strengthened in what became the Dodd-Frank Wall Street Reform and Consumer Protection Act, the FTC’s unique, time-consuming, limited rulemaking authority constrains its ability to protect consumers and police the wide marketplace it is responsible for:

“First, the Obama proposal as enacted in the House passed bill changes the FTC’s cumbersome Magnuson Moss rulemaking process to the more prevalent Administrative Procedures Act (APA) rulemaking process used by other agencies. In his recent testimony to this committee, FTC Chairman Jon Leibowitz called Magnuson-Moss rulemaking both “draconian” and “medieval.” He was not being redundant. As many have noted, the FTC’s inability to swiftly enact predatory mortgage lending rules was a contributor to the mortgage meltdown.”

Representative Castor’s 21st Century FTC Act would add important tools to this under-funded, under-resourced agency that fights with one hand tied behind its back. Shouldn’t we give new FTC Chair Lina Khan and her colleagues all the tools that they need to fight both bottom-feeder scammers and also BigTech, big bank, BigPharma and other monopolies and oligoplies? Markets need rules and the FTC needs the tools to enforce them. Today, the House should approve HR2668; but Congress should not forget the 21st Century FTC Act.

Topics

Authors

Ed Mierzwinski

Senior Director, Federal Consumer Program, PIRG

Ed oversees U.S. PIRG’s federal consumer program, helping to lead national efforts to improve consumer credit reporting laws, identity theft protections, product safety regulations and more. Ed is co-founder and continuing leader of the coalition, Americans For Financial Reform, which fought for the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, including as its centerpiece the Consumer Financial Protection Bureau. He was awarded the Consumer Federation of America's Esther Peterson Consumer Service Award in 2006, Privacy International's Brandeis Award in 2003, and numerous annual "Top Lobbyist" awards from The Hill and other outlets. Ed lives in Virginia, and on weekends he enjoys biking with friends on the many local bicycle trails.

Find Out More

Apple AirPods are designed to die: Here’s what you should know

New report reveals widespread presence of plastic chemicals in our food

FTC goes after second tax prep firm, H&R BLOCK joins INTUIT TURBOTAX for deceptive claims of “Free tax prep”