DC to Travelers: Stop Insuring Climate Risks

Join DC residents who are urging Travelers to stop enabling polluting fossil fuels

It’s ironic — and infuriating — that the companies charged with insuring our homes and livelihoods against disasters are contributing to the devastating effects on our homes and lives from climate change-related floods, hurricanes and wildfires.

It’s all hands on deck when it comes to fighting climate change. And major insurance companies have a big role to play. Here in the District of Columbia, Travelers Companies, Inc. is the number one provider of homeowners and commercial insurance. Travelers’ Chairman and CEO, Alan D. Schnitzer, is also the board chair of the American Property Casualty Insurance Association (APCIA), the “primary national trade association for home, auto, and business insurers.”

How Travelers and others put the financial well-being of homeowners, retirees, investors and small businesses at risk:

The role of Travelers and the insurance industry

Without insurance, fossil fuel projects have difficulty getting the financing and investments they need to operate. By insuring fossil fuels Travelers and others in the insurance industry contribute to the very risk they are insuring against. To make matters worse, they also invest their premiums in the fossil fuel industry, which further pollutes our air and harms our climate.

Mayor Bowser recently released the Carbon Free DC strategy when she attended COP28, where leaders from across the globe convened to remain on target to limit global warming to 1.5°C. According to Insure Our Future’s 2023 Scorecard on Insurance, Fossil Fuels and the Climate Emergency, an assessment of the fossil fuel policies of 30 leading global insurers, none, including Travelers, are aligned with the 1.5°C target. According to that scorecard, Travelers ranks among the lowest-scoring companies for underwriting policies.

According to an August 2023 analysis of 2019 data collected by the California Department of Insurance, of the top 16 U.S. property & casualty insurers ranked by assets under management, Travelers was the 4th largest holder of fossil fuel-related investments. The research also shows that the amount of fossil fuel-related investments by the insurance sector in the 2019 dataset totaled $536 billion.

Although Travelers adopted a policy in 2022 committing to no longer insure the construction and operation of new coal-fired plants and to restrict its underwriting of and investments in companies with thermal coal mining, coal energy production, or oil sands activity, it has not adopted policies for conventional oil and gas-related projects. According to 2020 research conducted by Finaccord, an insurance industry market research firm, Travelers was one of the top three providers of coverage for the oil and gas industry.

Putting DC residents at risk

According to the Fifth National Climate Assessment published last year, urban residents in the United States’ Northeast region, of which the District of Columbia is a part, can expect to “still face increased exposure to extreme heat events, flooding, and episodes of poor air quality” due to the impacts of climate change.

Putting homeowners at risk

Global warming is making severe weather events both more frequent and more destructive — which means a higher chance of property owners’ deaths, injuries, property loss, property damage or diminished property values.

But the damage doesn’t stop there: Insurance companies hike premiums to pass on the higher costs of claims to their customers, tightening household budgets and freezing more people out of the market entirely. Those who have insurance could lose it altogether.

Putting investors at risk

Increases in insured losses also increase the risk to investors whose portfolios include stocks in insurance companies. In addition, more fossil fuel projects will likely expose companies across all industry sectors to financial risks related to climate change, which may depress the value of virtually all assets and hurt investors.

Putting small businesses at risk

Small businesses face many of the same risks as these insurers’ home-owning customers. Underwriting policies for fossil fuel projects contributes to climate change-related weather events that put revenues and properties at risk, increase the costs of claims and increase the likelihood of premium hikes for their business customers as well.

It’s time to reverse course. If we convince Travelers, an industry leader, to stop propping up polluting projects, it could lead to a domino effect across the industry. Join others in DC and make your voice heard!

Add your name to our petition and have your voice heard.

We will deliver petition signatures to Travelers and also submit them with U.S. PIRG Education Fund’s public comments to the DC Council to show wide community support for a fossil-free insurance sector.

Topics

Authors

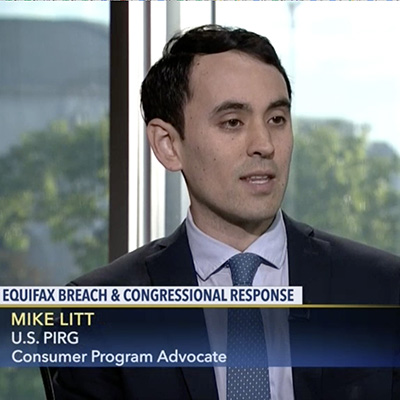

Mike Litt

Director, Consumer Campaign, U.S. PIRG Education Fund

Mike directs U.S. PIRG’s national campaign to protect consumers on Wall Street and in the financial marketplace by defending the Consumer Financial Protection Bureau, and works for stronger privacy protections and corporate accountability in the wake of the Equifax data breach. Mike lives in Washington, D.C.

Find Out More

Apple AirPods are designed to die: Here’s what you should know

New report reveals widespread presence of plastic chemicals in our food

FTC goes after second tax prep firm, H&R BLOCK joins INTUIT TURBOTAX for deceptive claims of “Free tax prep”