Big Banks, Big Complaints

CFPB's Consumer Complaint Database Gets Real Results for Consumers

This report is the first of several that will review complaints to the Consumer Financial Protection Bureau nationally and on a state-by-state basis. In this report we explore thousands of consumer complaints about bank accounts and services with the aim of uncovering patterns in the problems consumers are experiencing with their banks.

Downloads

The Consumer Financial Protection Bureau (CFPB) was established in 2010 in the wake of the worst financial crisis in decades. Its mission is to identify dangerous and unfair financial practices, to educate consumers about these practices, and to regulate the financial institutions that perpetuate them.

To help accomplish these goals, the CFPB has created and made available to the public the Consumer Complaint Database. The database tracks complaints made by consumers to the CFPB and the responses of financial institutions to those complaints. The Consumer Complaint Database enables the CFPB to identify financial practices that threaten to harm consumers and enables the public to evaluate both the performance of the financial industry and of the CFPB.

The CFPB’s searchable complaint database is the newest of a set of federal government consumer complaint databases that help consumers make better economic and safety choices by reviewing others’ experiences and searching for problems or product recalls. This transparency also helps firms improve their products and services. In short, transparency improves the way markets work.

This report is the first of several that will review complaints to the CFPB nationally and on a state-by-state basis. In this report we explore consumer complaints about bank accounts and services with the aim of uncovering patterns in the problems consumers are experiencing with their banks.

Since the Consumer Financial Protection Bureau began collecting data on banking in March 2012, the agency has recorded nearly 19,000 complaints by consumers about bank accounts and services.*

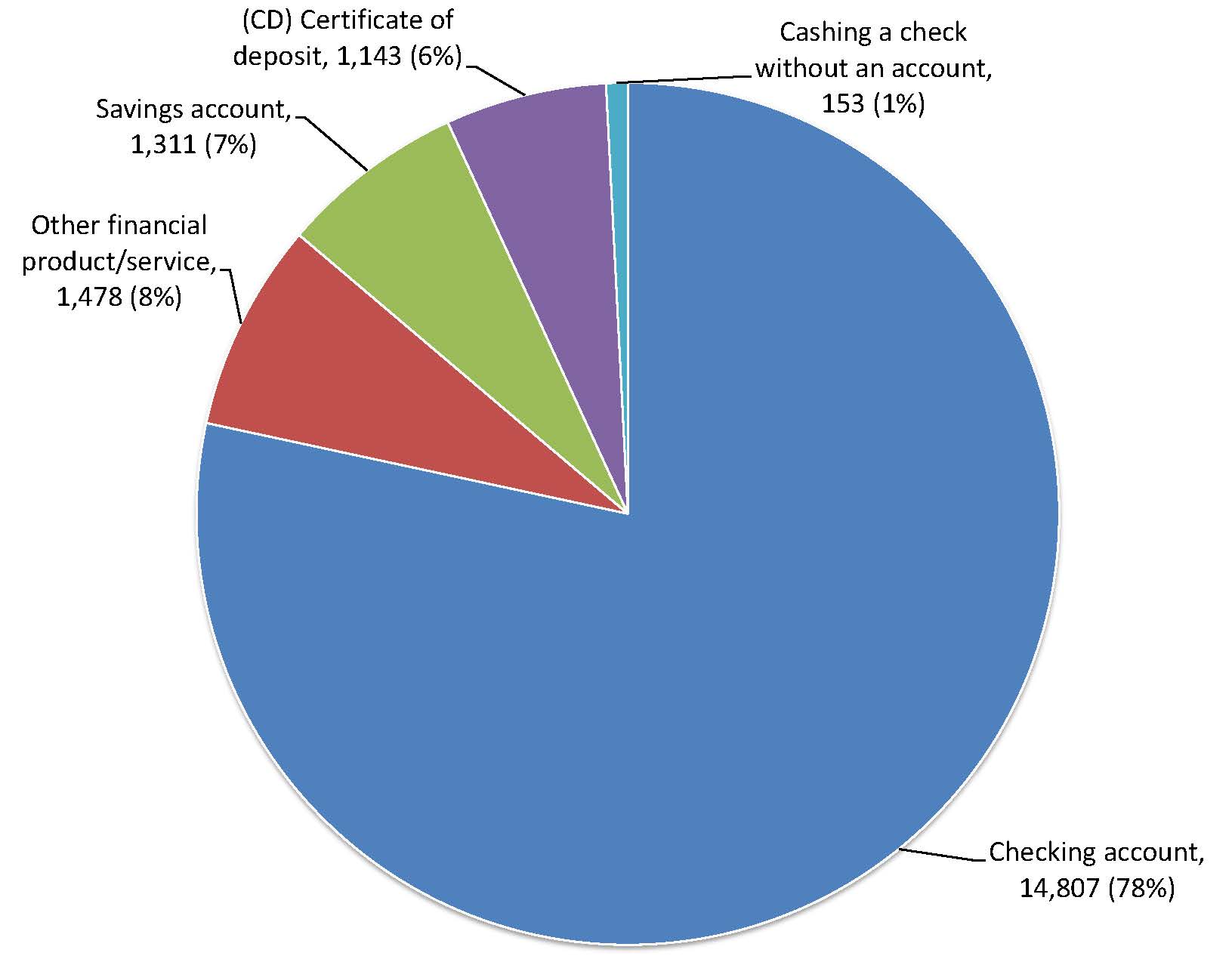

• Checking accounts were by a large margin the most common cause of complaints for consumers. They were the subject of 78 percent of all complaints filed.

• Difficulties with opening, closing or managing accounts were the most frequently cited issues consumers had with banking, followed by problems with deposits and withdrawals.

Twenty-five U.S. banks account for more than 90 percent of all complaints to the CFPB.

• Wells Fargo Bank, Bank of America, and JPMorgan Chase were the most complained-about banks in the United States, as measured by total number of complaints. They are also the nation’s three largest banks based on the size of their deposits.

• Midwest-based TCF National Bank had by far the highest ratio of complaints to total deposits among banks supervised by the CFPB, with 24.9 complaints per billion dollars of deposits. Sovereign Bank (9.1 complaints per billion of deposits) and Capital One Bank (6.5 complaints per billion of deposits) ranked second and third, respectively.

• Several banks ranked toward the top for highest ratio of complaints to deposits in multiple categories of banking services. Sovereign Bank and Capital One Bank, for example, ranked in the top 10 for highest complaints-to-deposits ratio across all four major banking services (checking, savings, certificates of deposit, and other services) and all five issues (problems with account management, deposits and withdrawals, low funds, making or receiving payments, and the use of ATMs or debit cards) tracked by the CFPB. TCF National Bank ranked first for complaints-to-deposits ratio for complaints related to checking and savings accounts, as well as in all five issues tracked by the CFPB.

Figure ES-1. Complaints by Banking Service

Complaints about banks vary by state and by the federal safety and soundness supervisor of the bank. All banks and credit unions, as well as non-bank financial firms, are subject to the CFPB’s regulations. In addition, the CFPB supervises and examines all large banks and credit unions (>$10 billion in assets) for their compliance with consumer protection laws. Large banks and credit unions also have a separate prudential, or safety and soundness, supervisory agency as well.

• Consumers filed 2.9 complaints for every billion dollars in deposits held by large national banks chartered by the Office of Comptroller of Currency, compared to 2.3 complaints about large state-chartered banks supervised for safety and soundness by the Federal Reserve System and 1.6 complaints about large state-chartered banks supervised for safety and soundness by the Federal Deposit Insurance Corporation.

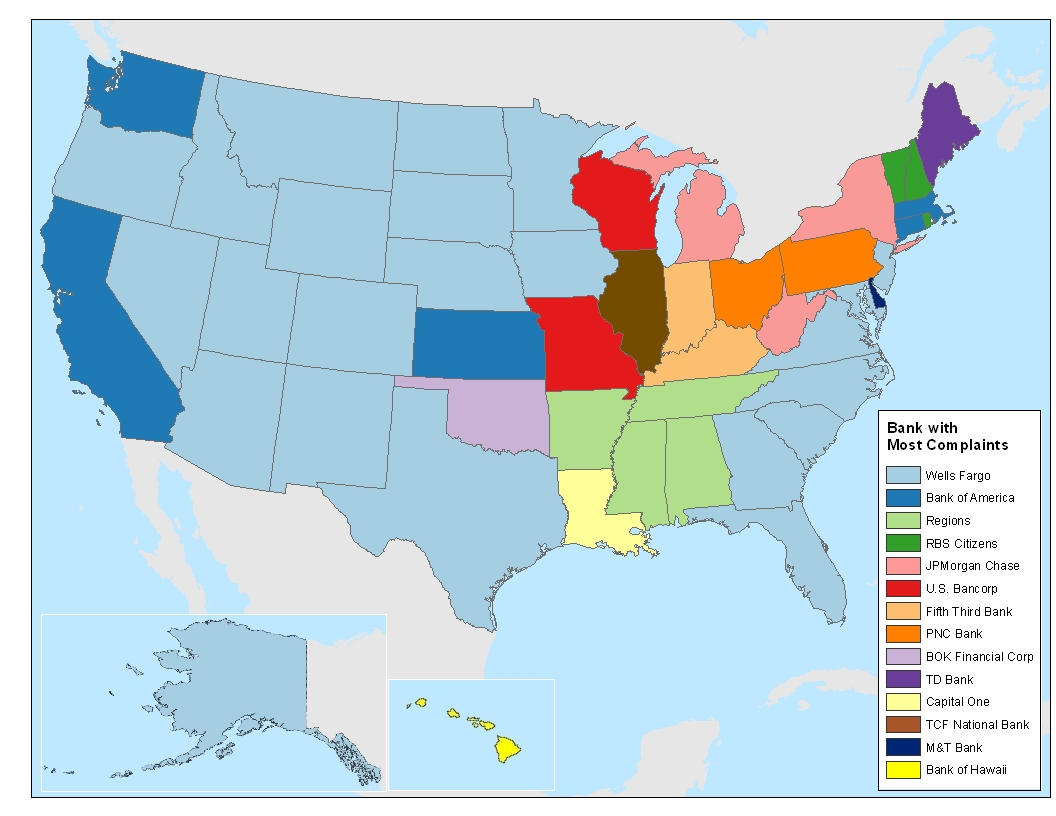

• Wells Fargo was the most frequently complained-about bank in 23 states and Washington, D. C. (based on total number of complaints filed), Bank of America was the most frequently complained-about bank in five states and Regions Bank was the most frequently complained-about bank in four states. (See Figure ES-2.)

Figure ES-2. Most Complained-About Bank by State.

More than one in four complaints about banking services processed by the CFPB ended with the consumer receiving some form of financial relief. However, consumers disputed the resolution of roughly 20 percent of all complaints.

• The CFPB has helped more than 5,000 consumers to receive monetary compensation to resolve their complaints. The median amount of monetary relief was $110. Additionally, nearly 1,000 consumers had their complaints closed with some form of non-monetary relief (such as a bank contacting a credit bureau to request a change in a credit report.)

• Bank responses to complaints vary based on the issue raised by the complaint. Nearly half of all complaints related to an individual’s funds being low were resolved with monetary relief, compared with 28 percent of all complaints. Low funds issues include overdraft fees, non-sufficient funds fees and bounced checks.

• Banks vary in the degree to which complaints are resolved with monetary relief. TCF National Bank responded to more than half of all complaints with offers of monetary relief, compared to just 4 percent of responses by New Orleans-based Whitney Bank.

• Consumers were less likely to dispute company responses that included monetary or non-monetary relief than other responses. Only one out of every nine consumers who received monetary relief disputed the company’s response, compared to one out of five of all consumers.

• TCF National Bank had the highest ratio of disputed responses to deposits, followed by Sovereign Bank and Capital One Bank.

The Consumer Financial Protection Bureau’s Consumer Complaint Database is a key resource for consumer protection. To enhance the effectiveness of the CFPB in assisting consumers in pursuing and resolving complaints:

• The CFPB should make the Consumer Complaint Database more user-friendly by adding, among other data, more narrative information and detailed information about consumer complaints, including how they were resolved, and the reasons for and outcomes of any disputes, with specific monetary relief amounts, if any, included. The CFPB should also conduct more frequent analyses of trends and give users the tools to undertake their own analyses of the data. In addition, the CFPB should make it easier for analysts to link the Consumer Complaint Database to other banking databases.

• The CFPB should expand public awareness of how to file complaints and access the Consumer Complaint Database by working with the prudential regulators to disseminate information about the complaints process to banking customers.

• The CFPB should develop free applications (“apps”) for consumers to download to smartphones to access information about how to complain about a firm and how to review complaints in the database.

To improve the effectiveness of the CFPB, the agency should:

• Expand the Consumer Complaint Database to include discrete complaint categories for high-cost credit products such as payday and auto title loans, and prepaid cards.

• Continue to use the information gathered from the Consumer Complaint Database, from supervisory and examination findings and from other sources to require a high, uniform level of consumer protection, through guidance and rules, to protect consumers and ensure that responsible industry players can better compete with those who are using harmful practices.

• Move quickly to implement strong consumer protection rules based on consumer complaints and findings from recent reports to protect consumers from unfair overdraft practices and high-cost direct deposit advance bank loans and payday loans. Move quickly to complete the mandatory arbitration studies required before it can proceed to banning or effectively regulating the use of pre-dispute mandatory arbitration in consumer financial contracts

Topics

Find Out More

Safe At Home in 2024?

5 steps you can take to protect your privacy now