While crying poor and hiking rates, Allstate sends half a billion dollars to shareholders

Allstate is aggressively raising rates in Illinois and across the country, pointing to a need to return to profitability. But it sent more than a half a billion to shareholders in the fourth quarter of 2022 alone.

Illinois-based Allstate lost money in 2022. And it has pointed to its struggle to return to profitability in 2022 as a justification to aggressively raise car insurance rates in Illinois and other states.

Allstate filed an Illinois car insurance rate hike in January, which, combined with two rate hikes in 2022, raised average annual Illinois premiums by $760.

Yet Allstate returned $582 million to shareholders in the 4th quarter of 2022 alone, through a combination of dividends and stock buybacks. It even bragged about how it increased dividends by 5% compared to the previous quarter.

These are common tools publicly traded companies use to distribute profits to shareholders, but it is somewhat unusual to do so when the company … has no profits. One reason Allstate may be comfortable increasing its dividend while losing money is that it is confident it will be able to raise rates to make up for it later in a state like Illinois where regulators have no power to reject or modify excessive rate hikes.

As the Allstate CEO said about its rate hikes at an investor conference in December “We may end up overshooting a little bit, don’t know.”

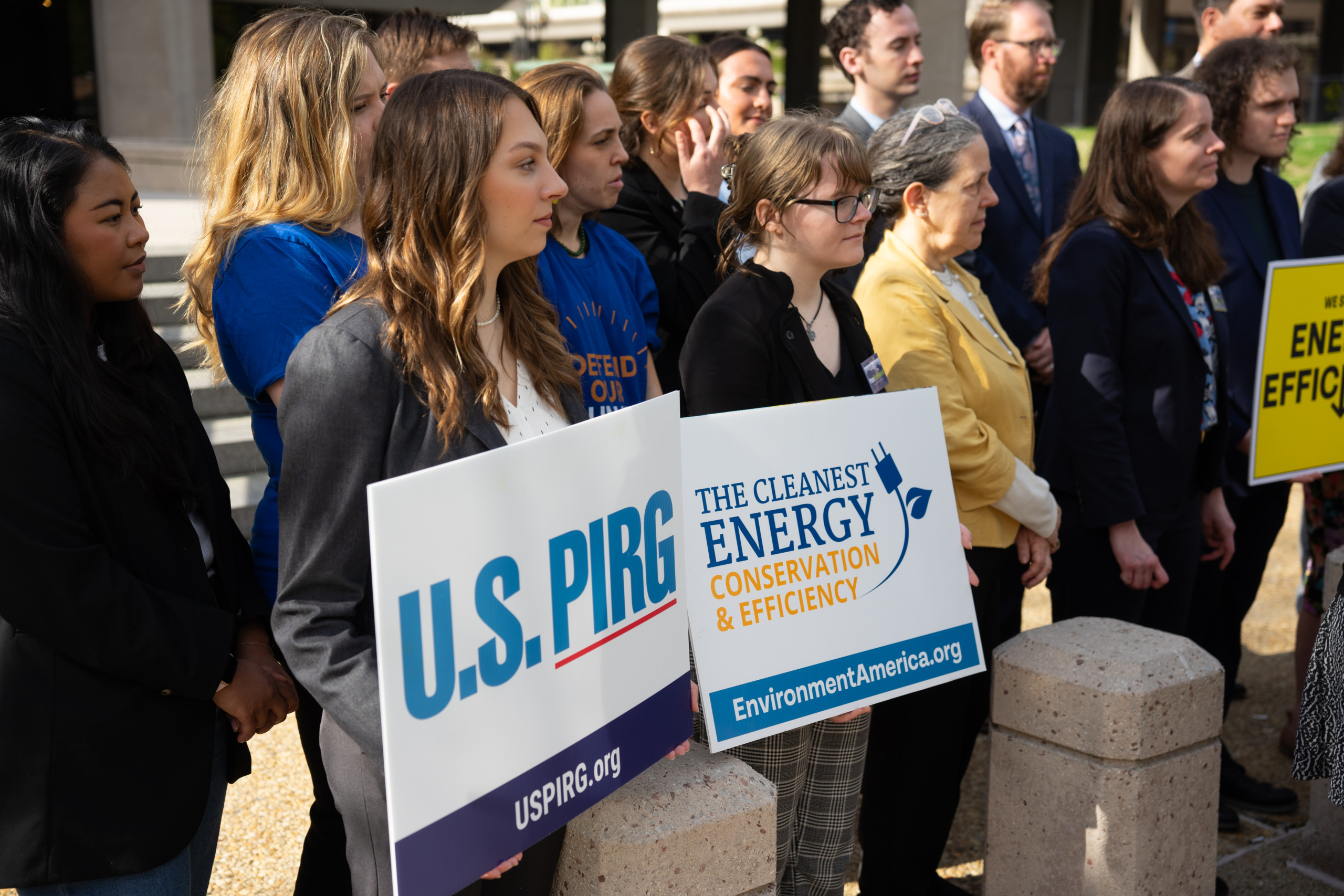

When an insurance company “overshoots” with an excessive rate hike, regulators should have the power to protect customers. That’s why, after Illinois car insurers raised rates by more than $1.1 billion in 2022, we are working to pass HB2203, which would empower the Illinois Department of Insurance to reject or modify excessive rate hikes.

Topics

Updates

Energy Conservation & Efficiency

Clean lighting bill clears Illinois House

Lobby day secures bipartisan support for the Plastic Pellet Free Water Act

Stop The Overuse Of Antibiotics

Panera Bread backs off of no antibiotics policy

Energy Conservation & Efficiency

Groups urge Biden to ‘Finish the job’ on appliance efficiency

Energy Conservation & Efficiency