How places of worship can go solar in Colorado

Federal tax credits (through direct pay) and other resources are available right now for mosques, churches, synagogues and other places of worship to add solar on their buildings

Updated

Whether it’s acting on their faith to help the planet or reducing their electricity bills, installing solar panels is a great way for churches, synagogues, mosques and other places of worship in Colorado to take action.

That opportunity now comes with a lower price tag thanks to the federal Inflation Reduction Act (IRA), which passed in 2022. For the first-time ever, faith-based, tax-exempt entities can take advantage of clean energy tax credits.

What are the federal tax credits available for places of worship to go solar?

The IRA includes tax credits for faith-based, tax-exempt entities that can cover at least 30% of the cost of solar installation.

These tax credits are what’s known as “elective pay” but is more commonly known as “direct pay.” They kick in for projects this year.

Our friends at Environment America describe it this way:

- “How it works is that the IRS will treat you as if you did pay this tax, and you will get refunded the owed amount for your solar project. To receive this credit, make an election on a tax filing in the year in which the project is placed in service…the solar project must be completed and capable of connecting to the grid before filing this election.”

What are the steps for places of worship to get federal financial support for going solar?

Make sure you contact your tax advisors for expert assistance.

The White House has a website to walk through the detailed steps here. Generally, they are:

- Identify your solar project for your place of worship and check to make sure it is eligible for the direct pay tax credit.

- Complete your project and place it into service, thus determining the corresponding tax year.

- Determine when your tax return will be due.

- Complete pre-filing registration with the IRS before your tax return is due.

- Once you receive a valid registration number, file your tax return by the due date.

- Receive your direct payment.

Other things to know about federal direct pay tax credits including ways to maximize the amount you get and other clean improvements they can fund

You can get more than 30% of your project covered if you meet certain benchmarks including:

- The project is more than 1 megawatt of power

- The project is in a low-income community (known as an energy community) – increases credit by 10%

- The project uses domestically manufactured products – increase credit by 10%

Places of worship may also be able to receive direct pay credits for electric vehicles, geothermal, energy storage and combined heat and power.

- Check out this factsheet for a breakdown of all your options.

- Those eligible for electric vehicles are a subset of those eligible for solar panels.

- The credit available is up to $40,000 for commercial passenger vehicles, buses or ambulances.

Shopping around for the right solar installer

- The US Department of Energy developed this guide that provides a list of questions to ask, attributes to look for, and tactics to seek out reputable installers.

- The Colorado Solar and Storage Association also has a page of tips and information.

- You can also visit Environment America and EnergySage’s tool to find the best solar installer near you.

Funding options for solar energy – While at least 30% of the cost of your solar energy system can be covered, raising the remaining sum can seem daunting.

- One example of what other faith-based communities have done is setting up LLCs from members’ investments and then selling the electricity back at a lower rate than the utility.

- Financing may also be available from a “green bank” like the Colorado Clean Energy Fund.

Are there any other funding options in Colorado to help places of worship go green?

Yes.

In Denver, the Office of Climate Action, Sustainability, and Resiliency (CASR)’s Renewables and Resilience Program can fund up to 100% of the costs associated with installing solar panels, battery storage and EV charging. Applicants must be a Human Service Provider and places of worship are eligible.

Eight entities received awards in 2023 including Colorado Family Church.

Places of worship should also contact their local utility, which often have incentives and programs that can help reduce energy waste, transition to electric vehicle fleets and upgrade heating systems to heat pumps.

Colorado also has financial assistance for weatherization – eliminating energy waste. Currently the program targets individuals so we encourage places of worship to share this information with their congregations.

Topics

Authors

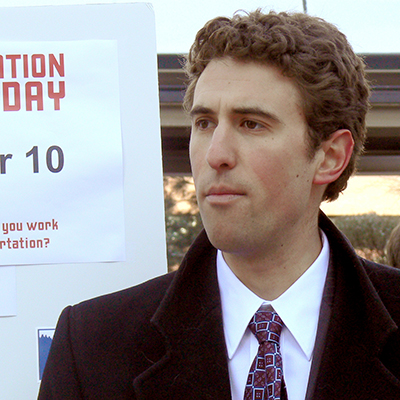

Danny Katz

Executive Director, CoPIRG Foundation

Danny has been the director of CoPIRG for over a decade. Danny co-authored a groundbreaking report on the state’s transit, walking and biking needs and is a co-author of the annual “State of Recycling” report. He also helped write a 2016 Denver initiative to create a public matching campaign finance program and led the early effort to eliminate predatory payday loans in Colorado. Danny serves on the Colorado Department of Transportation's (CDOT) Efficiency and Accountability Committee, CDOT's Transit and Rail Advisory Committee, RTD's Reimagine Advisory Committee, the Denver Moves Everyone Think Tank, and the I-70 Collaborative Effort. Danny lobbies federal, state and local elected officials on transportation electrification, multimodal transportation, zero waste, consumer protection and public health issues. He appears frequently in local media outlets and is active in a number of coalitions. He resides in Denver with his family, where he enjoys biking and skiing, the neighborhood food scene and raising chickens.

Find Out More

Efficient water heaters will cut pollution, save money, save lives

What is Clean Heat?

A look back at what our unique network accomplished in 2023