A chance to build team “Colorado Consumer Protection” – FTC Commissioner Chopra and Attorney General Weiser connect with Colorado consumer advocates

At a joint listening session between the Federal Trade Commission and the Colorado Attorney General’s office, I recruited a team of consumer advocates to raise issues from fraud and price gouging to abusive predatory products and debt collection. One theme that stands out - we’ve got a lot of talented players in Colorado working to protect consumers, but we’re not yet playing as part of a larger “Colorado Consumer Protection” team.

It’s unfortunately not shocking that people are being taken advantage of during this COVID crisis, an unprecedented time when so many people are vulnerable.

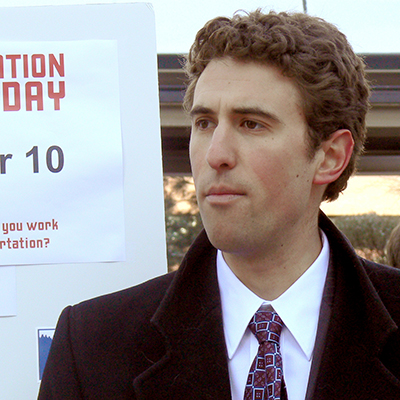

So I applaud both the Federal Trade Commission’s Rohit Chopra and Colorado’s Attorney General Phil Weiser who spent an hour and a half listening to Colorado consumer advocates highlight the problems we’re seeing on the ground and identify steps that we need to take to protect consumers and build financial empowerment among Coloradans.

A wide range of issues were raised during the listening session and I brought up three specific topics.

Price Gouging

CoPIRG and our national network continue to find examples of price gouging online. During the COVID pandemic, many people have turned to online marketplaces to purchase everything from masks to toilet paper.

In March, our online survey found numerous examples of price gouging. Unfortunately, in September, six months into the pandemic, we did another survey and found price gouging still persists on Amazon’s platform. We found ten essential products priced 2 to 14 times as high on Amazon than by other retailers.

In July, a new law went into effect that gives the Colorado Attorney General the tools he needs to push back. Based on our most recent survey – it’s time for action.

Right to Repair

Even before COVID, Coloradans were losing their right to repair the stuff they buy. From smartphones to electric-powered wheelchairs, tractors to ventilators, increasingly manufacturers design their products with software and parts that make it hard for you to fix it or for you to take it to a local third party repair shop.

Sure, you can take it to the manufacturer but with limited competition they can charge an arm and leg to fix it…or just choose not to and force you to throw it away and buy a brand new one.

During the COVID pandemic, the last thing we need is a marketplace that forces people to buy an expensive new product instead of fixing what they got. We’ve seen local repair shops go out of business across Colorado because the number of devices they are no longer allowed to fix has swelled, something that is made even more problematic during COVID.

I was glad to continue to put this topic in front of the FTC, something CoPIRG’s Right to Repair campaign director Nathan Proctor has been doing for the last year.

Office of Financial Empowerment

We’ve been working with local governments, community groups and community leaders across Colorado to move strategies forward to not just block bad financial actors but to implement strategies that can financially empower Coloradans. One of those strategies is to create an Office of Financial Empowerment (OFE) built on three legs:

- More one-on-one, free, personal financial counseling, navigators, and assistance programs that not only educates but trains people to be empowered participants in our financial system and connects them to the services and people they need

- Support for products and services that are low-cost, low fee, and give people the tools to build financial stability and wealth versus creating cycles of debt

- Government action that ensures the market is free from predatory products and traps that seek to take advantage of people.

This financial empowerment strategy offers a chance to more systematically get at the personal financial challenges that COVID is exacerbating. During the 2020 legislative session, we supported a bill, SB20-193, sponsored by Senators Gonzales and Moreno, and Representatives Coleman and Tipper, that would have created an Office of Financial Empowerment in the Attorney General’s office but the bill stalled when the COVID pandemic hit.

Talented Consumer Protection Players Across Colorado

A dozen other consumer advocates spoke at the listening session on a range of topics and while each of those topics was important and offered a chance to move a specific consumer protection forward, what really stood out in this listening session is that we have some great consumer advocates but we’re not all playing as one big Consumer Protection team.

The Colorado Consumer Health Initiative was able to talk about their Consumer Assistance Program and the problems they are seeing from surprise medical bills to medical debt collection. The Bell Policy Center highlighted the need to watchdog for-profit higher education institutions and also facilitates the Financial Equity Coalition, whose dozens of members tackle everything from retirement security to predatory lending. The Colorado Center on Law and Policy publishes a State of Working Colorado report that provides important details on who is struggling to make ends meet in our state.

One participant shared their experience trying and failing to get small loans. Their main message – don’t bring back payday loans. It’s time to move beyond the model of making money on loans people cannot afford.

Maria Gonzalez with Adelante, an organization empowering the Latino community, shared stories of predatory and fradulent practices online including GoFundMe pages that don’t give the money to the intended people.

Advocates from the Roaring Fork Valley highlighted the vulnerabilities facing the Coloradans living in the over 300,000 mobile homes in Colorado. With an anticipated eviction wave coming, mobile home residents are likely going to be hit hard.

Down in Southern Colorado, Ashleigh Winans with NeighborWorks, which helps connect residents to homeownership, highlighted the ridiculous barriers people are facing as credit score and down payment requirements have shot up pushing even people with consistent employment out of reach of a mortgage.

Colorado Legal Services also spoke at the listening session. Their team of attorneys are dedicated to providing legal services to low-income Coloradans seeking assistance with civil legal needs. They are overwhelmed right now helping their clients deal with debt collection issues and aggressive landlord actions. Cases involving car repossessions and the sale of faulty vehicles provides a double whammy – you owe money and you don’t have the vehicle you relied on to get you to your job. Moving their services online during the COVID crisis has been particularly difficult given many of the digital barriers low income Colordans face.

In addition to the consumer advocates that participated in the listening session, Colorado cities and counties are working to provide critical consumer protection programs for their residents.

A few municipalities in Colorado are doing great work developing their own versions of an Office of Financial Empowerment. Denver’s Office of Financial Empowerment and Protection, launched in 2013, has provided 8,000 people annually with financial counseling and 20,000 people tax preparation, helped 29 families avoid foreclosure, and reduced consumer debt by $5 million. The City of Pueblo is in the midst of developing a navigator program that can connect residents with assistance and help thanks to a grant from the Cities for Financial Empowerment (CFE) Fund, which works with a number of municipalities across the country to develop financial empowerment strategies.

Time for Team Colorado Consumer Protection

From local governments to nonprofits to individual consumers, there are talented advocates working to fill the numerous consumer protection gaps that hinder individual financial empowerment and financial stability.

But too often these different efforts are being implemented in silos with little statewide connection.

Put another way, we’ve got some talented players but we’re not playing as a team.

This is an incredible opportunity for the Colorado Attorney General’s office to step in and provide the statewide coordination that can turn Colorado’s consumer advocates into a cohesive team, leveraging what’s working and filling in gaps so we can expand financial empowerment strategies to everyone in the state.

With a Colorado Office of Financial Empowerment, the Attorney General’s office can add to its enforcement and regulatory program resources that support statewide efforts to expand counseling, navigation, and assistance programs and raise up non-predatory products and services.

This listening session and the survey they distributed afterwards provided the FTC and the Colorado Attorney General plenty of on-the-ground examples of problems they can address right now and I look forward to seeing the actions they take.

But I’m equally eager to continue the work we did with the Attorney General’s office in the spring on SB20-193 – moving beyond individual problems and building the statewide infrastructure so our talented consumer advocates can more effectively play on the same team with our state’s law enforcement agency to bring real consumer protections, financial empowerment and financial stability to all Coloradans.

Authors

Danny Katz

Executive Director, CoPIRG

Danny has been the director of CoPIRG for over a decade. Danny co-authored a groundbreaking report on the state’s transit, walking and biking needs and is a co-author of the annual “State of Recycling” report. He also helped write a 2016 Denver initiative to create a public matching campaign finance program and led the early effort to eliminate predatory payday loans in Colorado. Danny serves on the Colorado Department of Transportation's (CDOT) Efficiency and Accountability Committee, CDOT's Transit and Rail Advisory Committee, RTD's Reimagine Advisory Committee, the Denver Moves Everyone Think Tank, and the I-70 Collaborative Effort. Danny lobbies federal, state and local elected officials on transportation electrification, multimodal transportation, zero waste, consumer protection and public health issues. He appears frequently in local media outlets and is active in a number of coalitions. He resides in Denver with his family, where he enjoys biking and skiing, the neighborhood food scene and raising chickens.