Big Credit Bureaus, Big Mistakes: The CFPB’s Consumer Complaint Database Gets Real Results for Victims of Credit Reporting Errors

New report finds that the most complained-about credit reporting agency in Massachusetts is Experian.

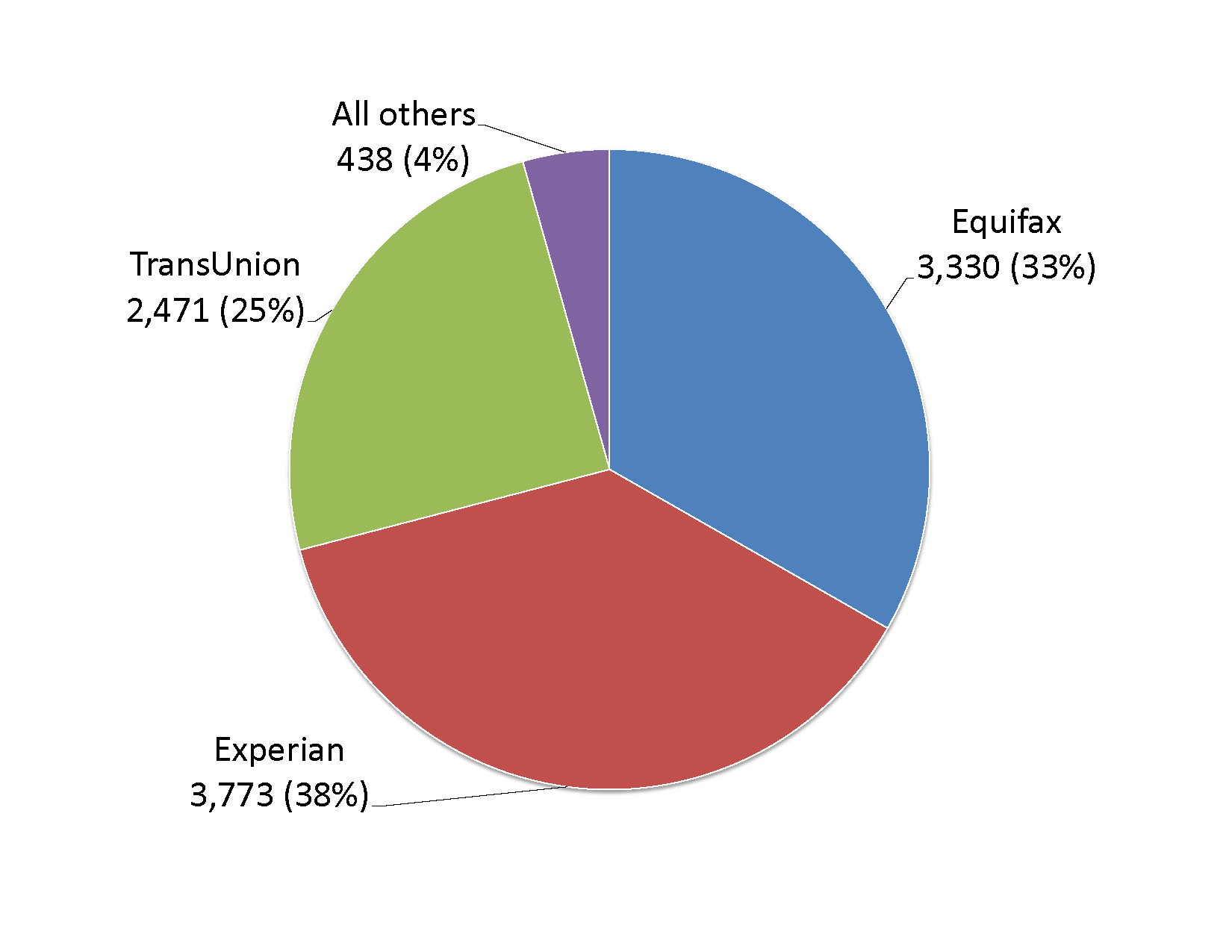

The report used data collected by the Consumer Financial Protection Bureau’s public Consumer Complaints Database, which was created to help consumers resolve problems with their credit reports. The report compared complaints against the three nationwide credit reporting agencies (Equifax, Experian, and TransUnion), commonly referred to as credit bureaus, who were together responsible for 96% of all complaints about credit reporting.

Downloads

Executive Summary

The Consumer Financial Protection Bureau was established in 2010 in the wake of the worst financial crisis in decades. Its mission is to identify dangerous and unfair financial practices, educate consumers about these practices, and regulate the financial institutions that perpetuate them.

To help accomplish these goals, the CFPB has created and made available to the public the Consumer Complaint Database. The database tracks complaints made by consumers to the CFPB and how they are resolved. The Consumer Complaint Database enables the CFPB to identify financial practices that threaten to harm consumers and enables the public to evaluate both the performance of the financial industry and of the CFPB.

This report is the third of several that review complaints to the CFPB nationally and on a state-by-state level. In this report, we explore consumer complaints about credit bureaus with the aim of uncovering patterns in the problems consumers are experiencing with credit reporting.

The three nationwide consumer reporting agencies (NCRAs) – Equifax, TransUnion and Experian – collect, centralize and aggregate information about the credit and repayment records of consumers. They source this information from public databases – including court records, state and federal tax liens, and bankruptcy records – and from a wide variety of private actors, called “furnishers,” who forward consumer credit information to them voluntarily. The NCRAs then distribute the information to “users” – often companies providing financial products, from student loans to credit cards to mortgages – who use the information to evaluate consumers’ eligibility for financial services. Increasingly, reports are also being used for employment and insurance purposes. In addition to the three NCRAs, a large number of “specialty” consumer reporting agencies track a variety of specialized information; for example, some collect information on whether consumers have written bad checks to merchants or left banks with negative balances, while others may screen tenants based on previous evictions, and still others review public records or other histories of employment applicants.

Since the Consumer Financial Protection Bureau began collecting complaints about credit reporting in October 2012, the CFPB has recorded more than 10,000 complaints about credit reporting.[i]

- The so-called “Big Three” NCRAs – Equifax, TransUnion and Experian – were the subject of 96 percent of all consumer complaints. Experian was the subject of 38 percent of consumer complaints to the CFPB about credit reporting, Equifax was the subject of 33 percent, and TransUnion was the subject of 25 percent.

- Hundreds of consumer complaints concerned institutions other than the NCRAs, including specialized credit reporting agencies, banks and other financial institutions.

Figure ES-1. The Three NCRAs Account Collectively for 96 Percent of Complaints to the CFPB About Credit Reporting

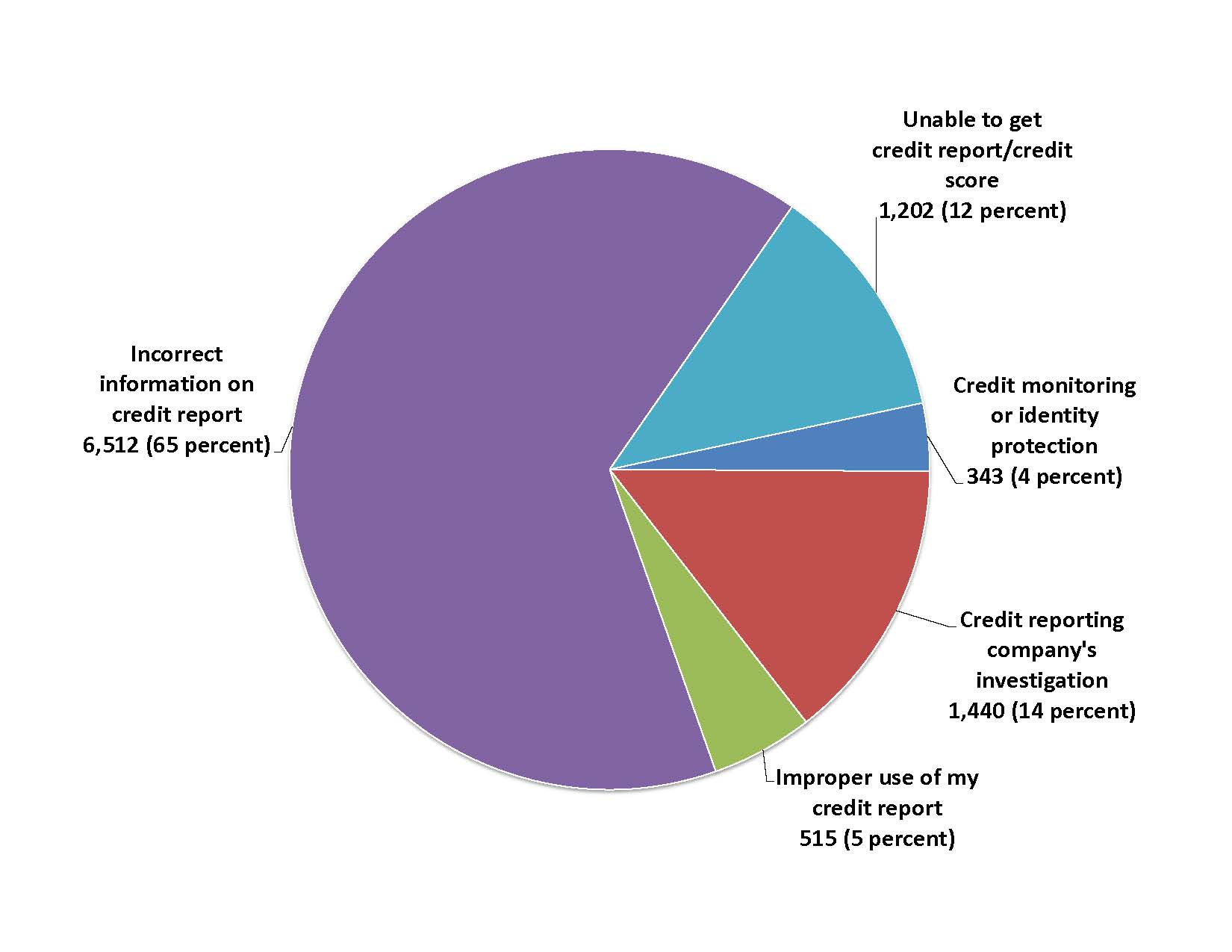

- Consumers complained most frequently about incorrect information appearing on their credit report regarding the status of an account, with such complaints accounting for roughly one-quarter of all credit reporting complaints to the CFPB. About one in five complaints came from consumers who felt that information on their credit reports was not actually theirs, followed by complaints concerning incorrect information about account terms, and trouble getting a legally mandated free annual credit report.

- There were only slight variations among the three major credit bureaus in the types of issues that drew complaints from consumers.

Figure ES-2. Consumers Are Most Likely to Complain about Having Incorrect Information on Their Credit Report

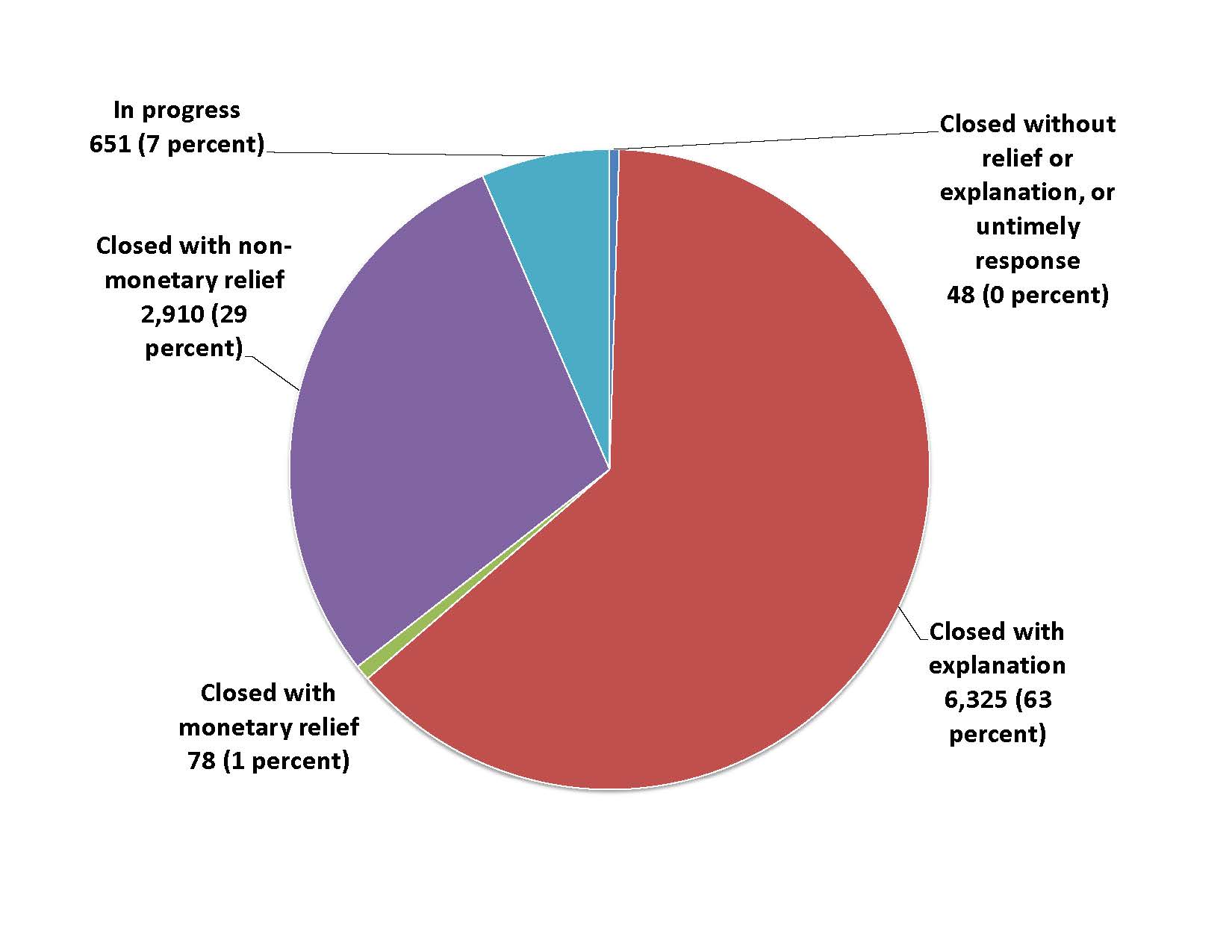

- Nearly 3,000 consumers received monetary or non-monetary relief from credit bureaus through the CFPB complaints process. Non-monetary relief includes actions such as a credit bureau fixing incorrect information, ensuring that consumers receive the annual credit report to which they are entitled, or correcting incorrect account status information. About 30 percent of all complaints resulted in monetary or non-monetary relief, while 63 percent of all consumer complaints regarding credit reporting were closed with an explanation to the consumer.

Figure ES-3. Nearly 3,000 Consumers Received Relief after Complaining to the CFPB

The three NCRAs reported very different responses to consumer complaints.[ii]

- Equifax responded to 63 percent of its complaints with non-monetary relief, while Experian did so in only 5 percent of cases and TransUnion in 22 percent.

- Equifax provided monetary or non-monetary relief nearly three times as often as TransUnion and more than 10 times as often as Experian. Equifax alone accounted for 72 percent of all complaints closed with non-monetary relief.

- Consumers disputed the companies’ responses to about 18 percent of all complaints. The NCRAs differed slightly in the percentage of complaints disputed by consumers. Equifax had consumers dispute its responses 21 percent of the time, while consumers disputed 15 percent of Experian’s responses and 18 percent of TransUnion’s.

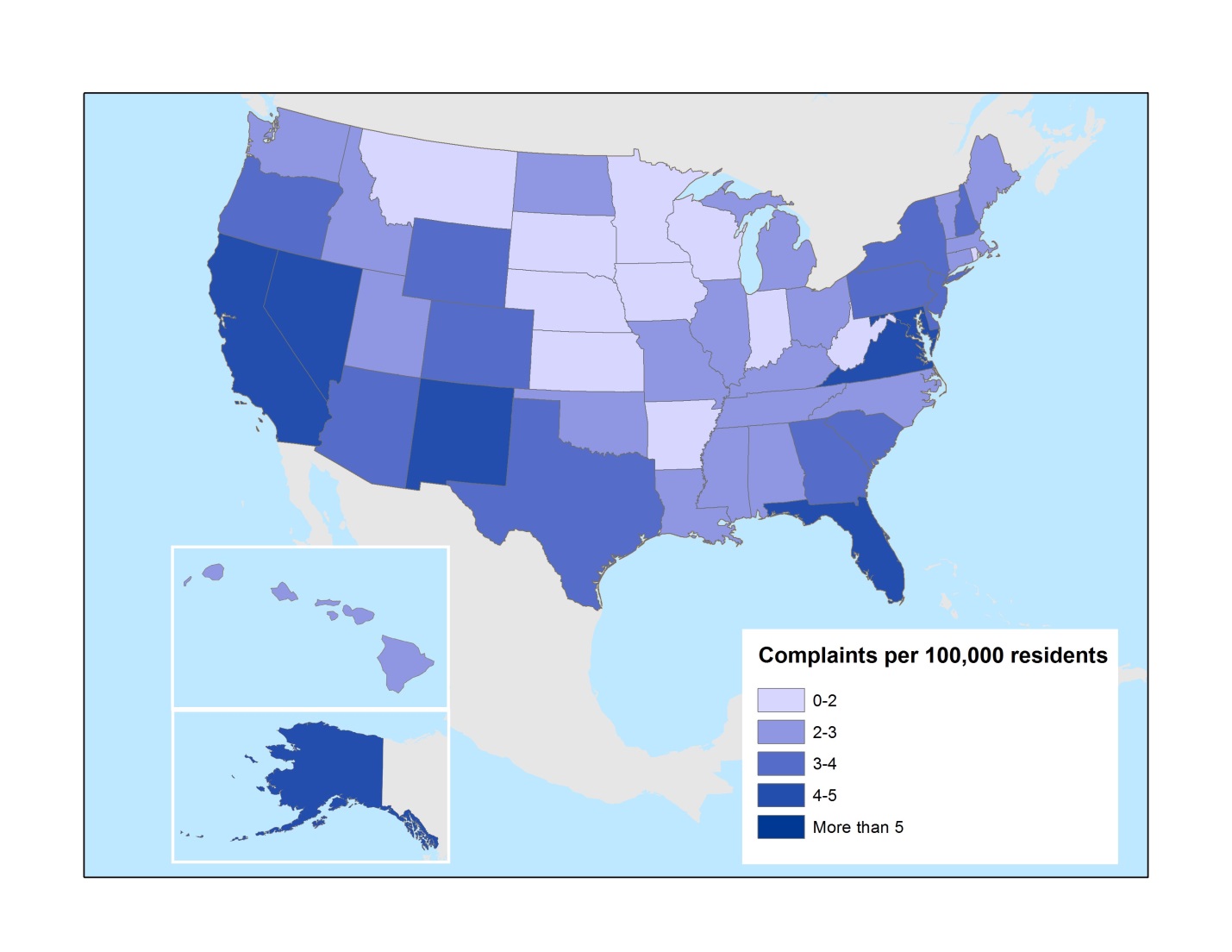

- Consumers across the country varied in their tendency to complain to the CFPB about credit reporting. Consumers in the District of Columbia, whose residents were most likely to complain, complained more than 20 times more frequently per capita than did residents of Nebraska, whose citizens were least likely to complain. After D.C., the states in which consumers were most likely to complain were Florida, Maryland, Nevada, Virginia, Alaska, California, New Mexico and Georgia.

Figure ES-4. Credit Reporting Complaints per 100,000 Residents

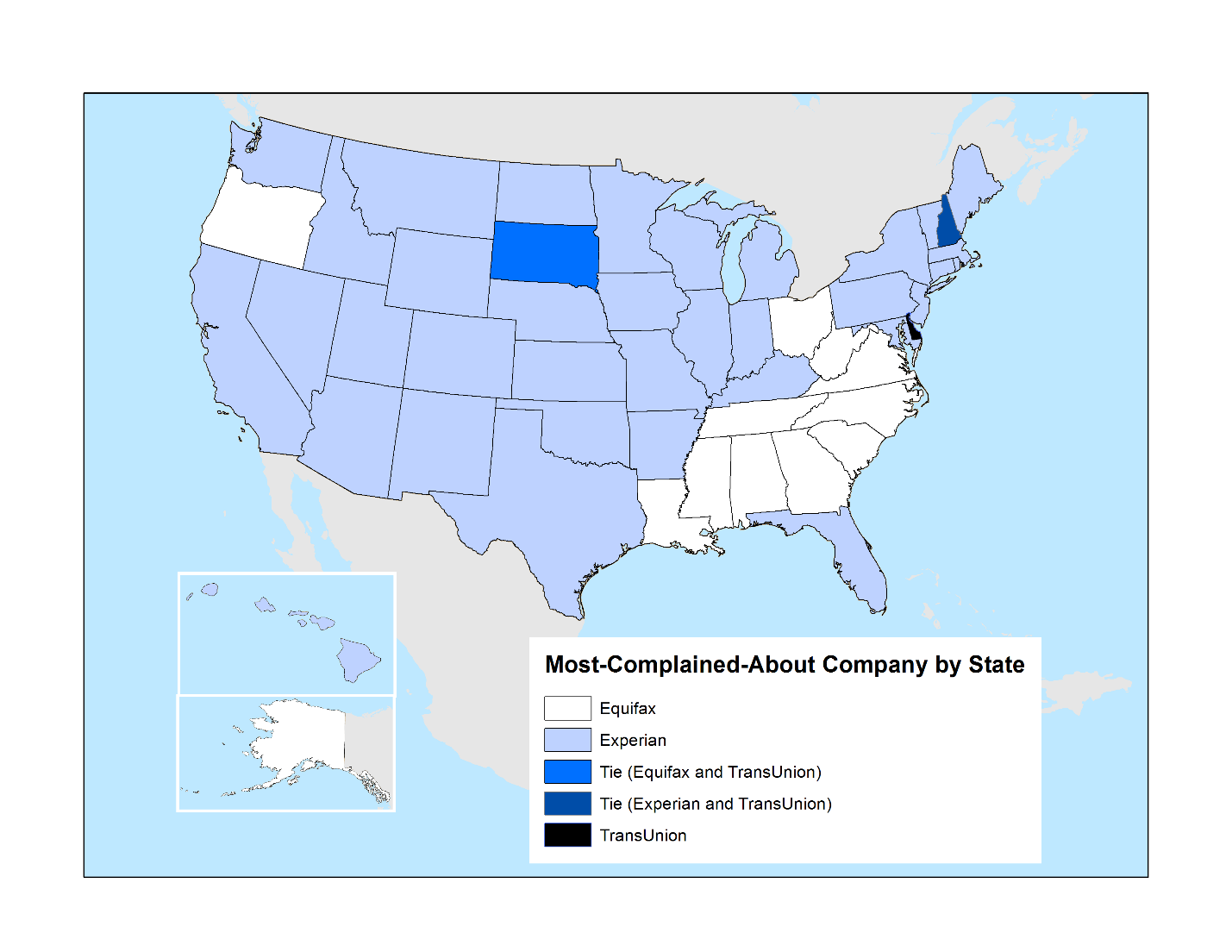

- Experian was the most complained-about company in 35 states, while Equifax received the most complaints of any company in 12 states, primarily in the South, and in the District of Columbia. TransUnion was the most complained-about company in Delaware. Equifax and TransUnion received the same number of complaints in South Dakota, while Experian and TransUnion tied in New Hampshire. Differences in regional complaint levels may reflect variances in market share derived from each credit bureau’s history.

Figure ES-5. Most Complained-About Credit Bureau by State

The Consumer Financial Protection Bureau’s Consumer Complaint Database is a key resource for consumer protection. To enhance the effectiveness of the CFPB in addressing consumer complaints:

- The CFPB should make the Consumer Complaint Database more user-friendly by adding, among other data, more detailed information about consumer complaints, including how they were resolved, and the reasons for and outcomes of any disputes. The CFPB should also conduct more frequent analyses of trends and give users the tools to undertake their own analyses of the data. In addition, the CFPB should make it easier for analysts to link the Consumer Complaint Database to other public databases.

- The CFPB should expand public awareness of how to file complaints and access the Consumer Complaint Database, through a continuing publicity campaign targeted to the consumers most likely to face difficulties with credit reporting.

- The CFPB should develop free applications (apps) for consumers to download to smartphones to access information about how to complain about a firm and how to review complaints in the database.

To improve the effectiveness of the CFPB, the agency should:

- As a first step, expand the Consumer Complaint Database to include discrete complaint categories for high-cost credit products such as payday and auto title loans and prepaid cards.

- Move quickly to implement strong consumer protection rules in order to protect consumers from predatory practices.

- Where problems are identified, use the information gathered from the database, from supervisory and examination findings, and from other sources to continue to require a high, uniform level of consumer protection to ensure that responsible industry players can better compete with those who are using harmful practices.

- While recent legislation has increased the availability of free credit scores, the CFPB should eliminate artificial distinctions created by industry lobbying that have prevented free credit reports provided by law from routinely including credit scores. All credit reports should include a consumer’s most recent credit scores, and those scores should be comparable to scores sold in the marketplace to creditors (not so-called “educational” scores).

- The CFPB should enact rules requiring credit bureaus to conduct manual reinvestigations of consumer disputes, involving actual verification of disputed items through telephone calls or other communications and review of consumer-provided materials, rather than automated reviews.

- The Bureau, as it has done in the credit card industry, should consider imposing enforcement penalties upon major players that have marketed deceptive add-on products.

[i] As of August 26, 2013.

[ii] Company response type is self-reported.

Topics

Find Out More

Junk fees should be banned, U.S. PIRG tells FTC

How to use iPhone privacy settings 2024