Deirdre Cummings

Legislative Director, MASSPIRG

617-747-4319

[email protected]

Legislative Director, MASSPIRG

617-747-4319

[email protected]

Boston, October 4 – In 2015, more than 73 percent of Fortune 500 companies – including 8 headquartered in Massachusetts – maintained subsidiaries in offshore tax havens, according to “Offshore Shell Games,” released today by MASSPIRG Education Fund, Citizens for Tax Justice and the Institute on Taxation and Economic Policy. Collectively, multinationals reported booking $2.5 trillion offshore, with just 30 companies accounting for 66 percent of this total.

As the discussion of tax reform heats up on the campaign trail, in Congress, and in state legislatures this report provides important details about a major problem with the current tax system. By indefinitely stashing profits in offshore tax havens, the biggest corporations are avoiding up to $717.8 billion in U.S. federal taxes. General Electric (GE) for example, newly head quartered in Boston, holds $104 billion in more than 20 offshore tax havens including the Bahamas and Luxemburg.

“When corporations dodge their taxes, the public ends up paying,” said Deirdre Cummings, Legislative Director for MASSPIRG. “When corporations like Apple or GE use American infrastructure, the American educated work force, and American markets, and yet don’t pay what it owes in taxes, we lose out on funding for public programs, paying down national debt, or lowering taxes. The E.U. is taking a stand against this unfairness, and it’s time the U.S. does the same.”

Key findings of the report:

● 367 Fortune 500 companies collectively maintain 10,366 tax haven subsidiaries. The 30 companies with the most money booked offshore for tax purposes collectively operate 2,509 tax haven subsidiaries.

● Fifty eight percent of companies with any tax haven subsidiaries registered at least one in Bermuda or the Cayman Islands, countries with no corporate tax. The profits that American multinationals collectively claim to earn in these island nations totals 1,884 percent and 1,313 percent, respectively of each country’s entire yearly economic output, an impossible feat.

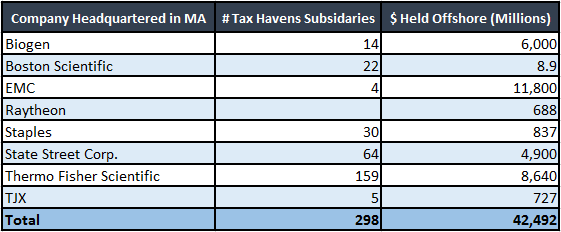

● The 8 companies headquartered in Massachusetts maintain at least 298 tax haven subsidiaries holding $42 billion in profits off shore.

● The 30 companies with the most money booked offshore for tax purposes collectively hold nearly $1.65 trillion overseas. That is 66 percent of the nearly $2.5 trillion that Fortune 500 companies together report holding offshore.

● Only 58 Fortune 500 companies disclose what they would expect to pay in U.S. taxes if these profits were not officially booked offshore. In total, these 58 companies would owe $212 billion in additional federal taxes, equal to more than 5 times the entire state budget of Massachusetts. The average tax rate the 58 companies currently pay to other countries on this income is a mere 6.2 percent, implying that most of it is booked to tax havens.

Companies highlighted included:

– Apple: Apple has booked $214.9 billion offshore — more than any other company. It would owe $65.4 billion in U.S. taxes if these profits were not officially held offshore for tax purposes. A recent ruling by the European Commission found that Apple used a tax haven structure in Ireland to pay a rate of just 0.005 percent on its European profits in 2014, and has required that the company pay $14.5 billion in back taxes to Ireland, where the company was paying significantly less than even the tax haven’s standard low tax rate. A U.S. Senate investigation in 2013 uncovered Apple’s two Irish subsidiaries that were tax residents of neither the United States, where they are managed and controlled, nor Ireland, where they are incorporated.

– Nike: The sneaker giant officially holds $10.7 billion offshore for tax purposes on which it would owe $3.6 billion in U.S. taxes. This implies Nike pays a mere 1.4 percent tax rate to foreign governments on those offshore profits, indicating that nearly all of the money is officially held by subsidiaries in tax havens. The shoe company, which operates 931 retail stores throughout the world, does not operate one in Bermuda.

– Goldman Sachs reports having 987 subsidiaries in offshore tax havens, 537 of which are in the Cayman Islands despite not operating a single legitimate office in that country, according to its own website. The bank officially holds $28.6 billion offshore.

“The rest of us aren’t hiding our incomes in some offshore account. We are paying our fair share. We think everyone should play by the same rules,” said Nathan Proctor director of Massachusetts Fair Share. “We face continual budget tightening here in Massachusetts and nationally that shrink important programs. Why should we cut things like early education while these companies are dodging hundreds of billions in taxes?”

“Every year, corporations collectively report that they have tens of billion more in cash stashed offshore than they did the year before, “ said Matthew Gardner of the Institute on Taxation and Economic Policy. “The hard fact is that the U.S. tax code incentivizes tax haven abuse by allowing companies to indefinitely defer taxes on offshore profits until they are ‘repatriated.’ The only way to end this kind of tax avoidance is by closing the loopholes in the tax code that enable it.”

The report concludes that to end tax haven abuse, Congress and state legislatures should end incentives for companies to shift profits offshore, close the most egregious offshore loopholes, strengthen tax enforcement, and increase transparency. And while much of the reform necessary to stop this offshore tax dodge must happen at the federal level, states can act. This year a bipartisan group of 57 Massachusetts lawmakers, filed An Act closing a corporate tax haven loophole, HB 2477 and SB 1524. Already a law in place in Oregon and Montana, the bill would require that companies treat profits made in Massachusetts and funneled to known tax havens like the Cayman Islands as domestic taxable income. The Massachusetts Department of Revenue has estimated that making this change to the tax code would save Massachusetts taxpayers between $64 and $94 million a year.

“Offshore Shell Games” is available for download at: http://masspirgedfund.org/reports/maf/offshore-shell-games-2016

# # #

MASSPIRG Education Fund works to protect consumers and promote good government. We investigate problems, craft solutions, educate the public, and offer meaningful opportunities for civic participation.

The Institute on Taxation and Economic Policy is a nonpartisan 501(c)(3) non-profit, non-partisan research organization that works at the local, state and federal levels to ensure elected officials and the general public have access to straightforward information about the effects of current and proposed tax policies.

Citizens for Tax Justice, founded in 1979, is a 501(c)(4) public interest research and advocacy organization focusing on federal, state and local tax policies and their impact upon our nation. CTJ’s mission is to give ordinary people a greater voice in the development of tax laws.