Who is watching out for students?

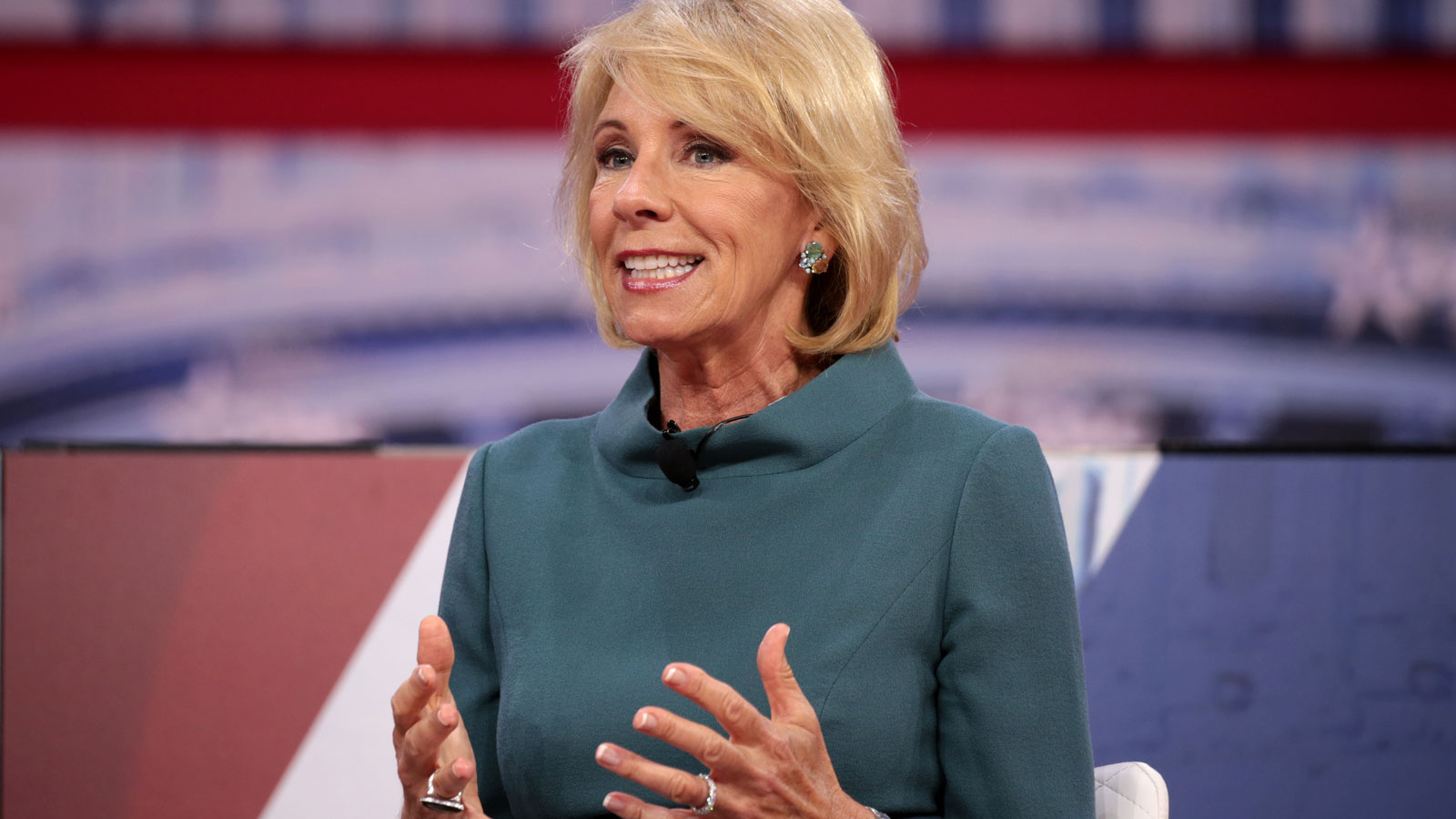

In the past, the Consumer Financial Protection Bureau (CFPB) was an effective independent watchdog that helped shield consumers from predatory banking practices, but under the leadership of Mick Mulvaney and Kathy Kraniger, its willingness to protect young consumers is in question. Further, under the direction of Secretary Betsy DeVos, the Department of Education, which is ultimately responsible for enforcing regulations on these campus banking relationships, has ignored CFPB analysis showing that there are problems in the campus banking marketplace, and has failed to provide diligent and consistent oversight to schools reporting the details of their cash management contracts.

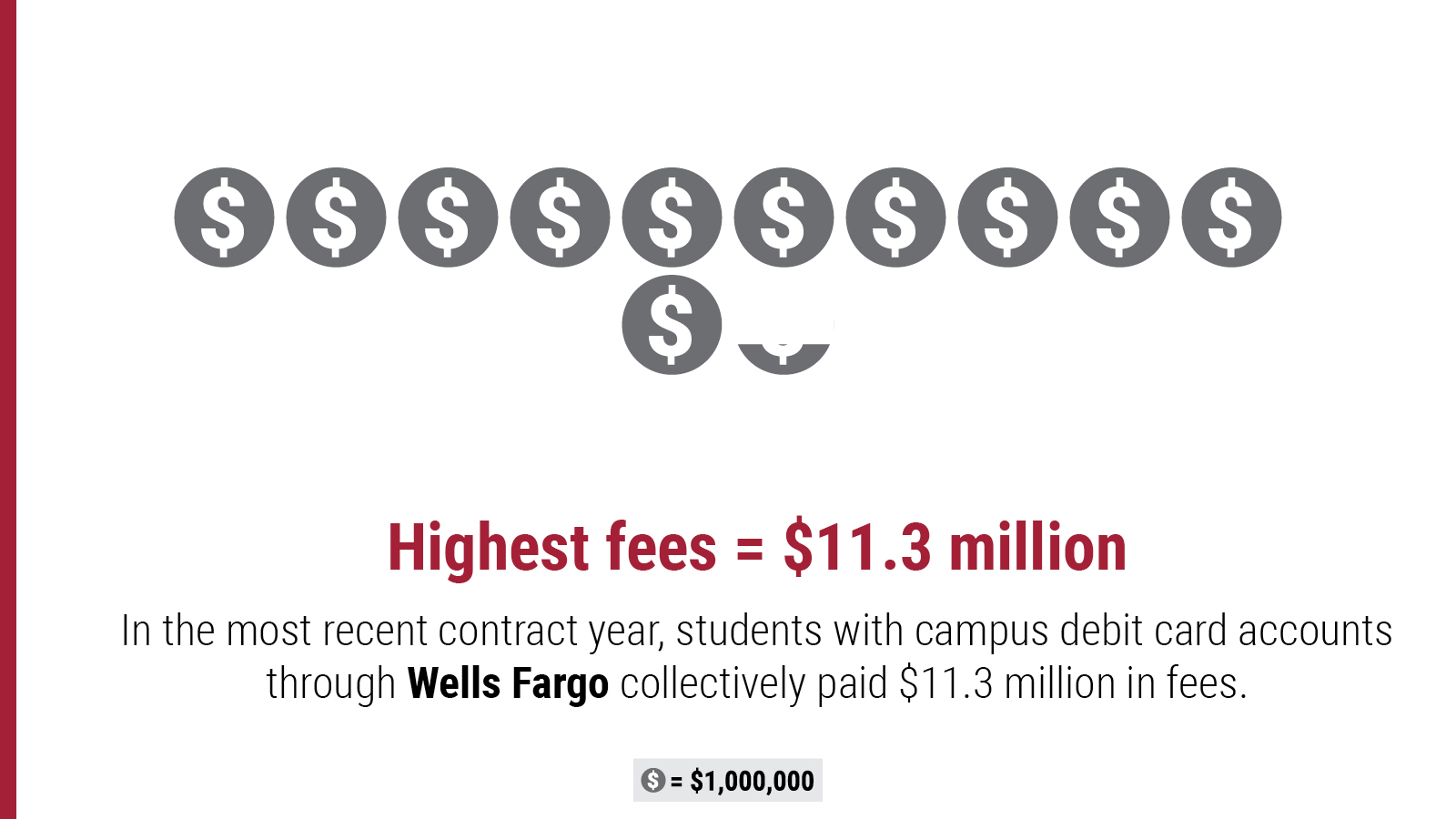

In order to protect students, existing regulations need to be enforced and stronger, more comprehensive regulations need to be put in place. Banks and financial firms should be prevented from charging exorbitant fees and offering revenue sharing agreements that facilitate “push marketing” on college campuses. Furthermore, because of the clear and persistent problems and high average fees associated with Wells Fargo’s agreements, the Department of Education should consider launching an investigation into Wells Fargo to determine if its accounts are truly in students’ best interests.