Picking Up the Tab 2014

Average Citizens and Small Businesses Pay the Price for Offshore Tax Havens

Every year, corporations and wealthy individuals use complicated gimmicks to shift U.S. earnings to subsidiaries in offshore tax havens – countries with minimal or no taxes – in order to reduce their state and federal income tax liability by billions of dollars. Tax haven abusers benefit from America’s markets, public infrastructure, educated workforce, security and rule of law – all supported in one way or another by tax dollars – but they avoid paying for these benefits. Instead, ordinary taxpayers end up picking up the tab, either in the form of higher taxes, cuts to public spending priorities, or increases to the federal debt.

Downloads

Executive Summary

Every year, corporations and wealthy individuals use complicated gimmicks to shift U.S. earnings to subsidiaries in offshore tax havens – countries with minimal or no taxes – in order to reduce their state and federal income tax liability by billions of dollars. Tax haven abusers benefit from America’s markets, public infrastructure, educated workforce, security and rule of law – all supported in one way or another by tax dollars – but they avoid paying for these benefits. Instead, ordinary taxpayers end up picking up the tab, either in the form of higher taxes, cuts to public spending priorities, or increases to the federal debt.

The United States loses approximately $184 billion in federal and state revenue each year due to corporations and individuals using tax havens to dodge taxes. On average, every filer who fills out a 1040 individual income tax form would need to pay an additional $1,259 in taxes to make up for the revenue lost.

· Tax haven abuse costs the federal government $150 billion in lost tax revenue, or $1,027 per filer.

· Tax haven abuse costs state governments a combined $34 billion in lost tax revenue, or an additional $231 per filer.

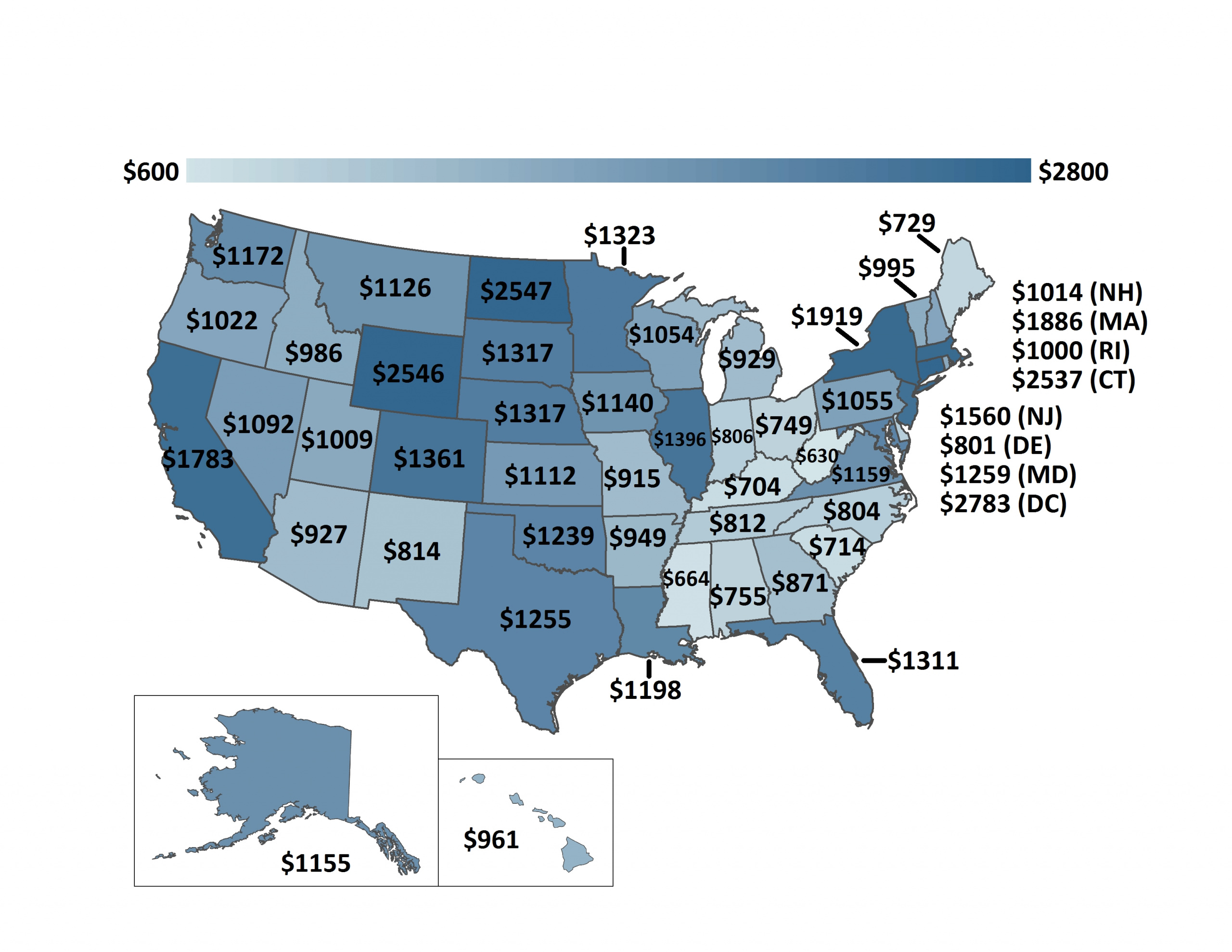

· The burden on tax filers varies across the 50 states based on the differing average contributions to the Treasury made by filers in each state (see Figure ES-1).

Figure ES-1. Picking Up the Tab: The Average Amount Individual Tax Filers in Each State Would Need to Pay to Make Up For State and Federal Revenue Lost To Offshore Tax Havens

The taxes avoided by multinational corporations make up the majority – $110 billion – of the government revenue lost to offshore tax havens. Every small business would need to pay an average of $3,923 in additional taxes if they were to pick up the full tab for income lost to corporations exploiting tax havens.

· Corporate tax haven abuse costs the federal government $90 billion in lost tax revenue. Every small business would need to pay an additional $3,206 in federal taxes to account for the revenue lost.

· Corporate tax haven abuse costs state governments $20 billion in lost tax revenue. Every small business would need to pay an additional $717 in state taxes to account for the revenue lost.

Some of America’s biggest companies use tax havens to avoid tax obligations in the United States, including many that have taken advantage of government bailouts or rely on government contracts. In 2012, 82 of the 100 largest publicly traded U.S. corporations booked revenues to offshore tax haven countries.

· Pfizer, the world’s largest drug maker, paid no U.S. income taxes between 2010 and 2012 despite earning $43 billion worldwide. In fact, the corporation received more than $2 billion in federal tax refunds. In 2013, Pfizer operated 128 subsidiaries in tax haven countries and had $69 billion offshore and out of the reach of the Internal Revenue Service (IRS).

· Microsoft maintains five tax haven subsidiaries and stashed $76.4 billion overseas in 2013. If Microsoft had not booked these profits offshore, they would have owed an additional $24.4 billion in taxes.

· Citigroup, bailed out by taxpayers in the wake of the financial crisis of 2008, maintained 21 subsidiaries in tax haven countries in 2013, and kept $43.8 billion in offshore jurisdictions. If that money had not been booked offshore, Citigroup would have owed an additional $11.7 billion in taxes.

To restore fairness to the tax system, decision makers should prevent corporations and wealthy individuals from booking their income to offshore tax havens by eliminating the incentives and mechanisms used to shift money overseas.

· End the ability of multinational corporations to indefinitely defer paying taxes on the profits they attribute to their foreign entities.

· Eliminate the “look through” rule, which allows U.S. multinational corporations to defer tax liabilities on income generated by one of its foreign subsidiaries from sources of income such as royalties, interest or dividends.

· Eliminate the active financing exception, which exempts income generated through banking and financial services from being taxed immediately when it is earned.

· Reject a “territorial” tax system, which would allow companies to temporarily shift profits to tax haven countries, pay minimal tax under those countries’ laws, and then bring the profits back to the United States tax-free.

· Put an end to the “check-the-box” rule, which currently allows multinational companies to make inconsistent claims about their corporate status. To maximize their tax advantage, corporations can tell one country that they are one type of entity while telling another country that the same entity is something else entirely.

· Stop companies from deducting interest expenses from their U.S. tax liability when that interest is paid to a foreign affiliate.

· Reduce the incentive for corporations to license intellectual property (for example, patents and trademarks) to shell companies in tax haven countries before paying inflated – and tax-deductible – fees to use them in the United States.

Decision makers should also strengthen enforcement and increase transparency by:

· Requiring multinational corporations to report their profits on a country-by-country basis.

· Equipping the Department of Treasury with the enforcement power it needs to stop tax haven countries and their financial institutions from impeding tax collection in the United States.

· Strongly implementing the Foreign Account Tax Compliance Act (FATCA) which was passed by Congress in 2010 but has since been stalled by multinational companies in a protracted stakeholder process.