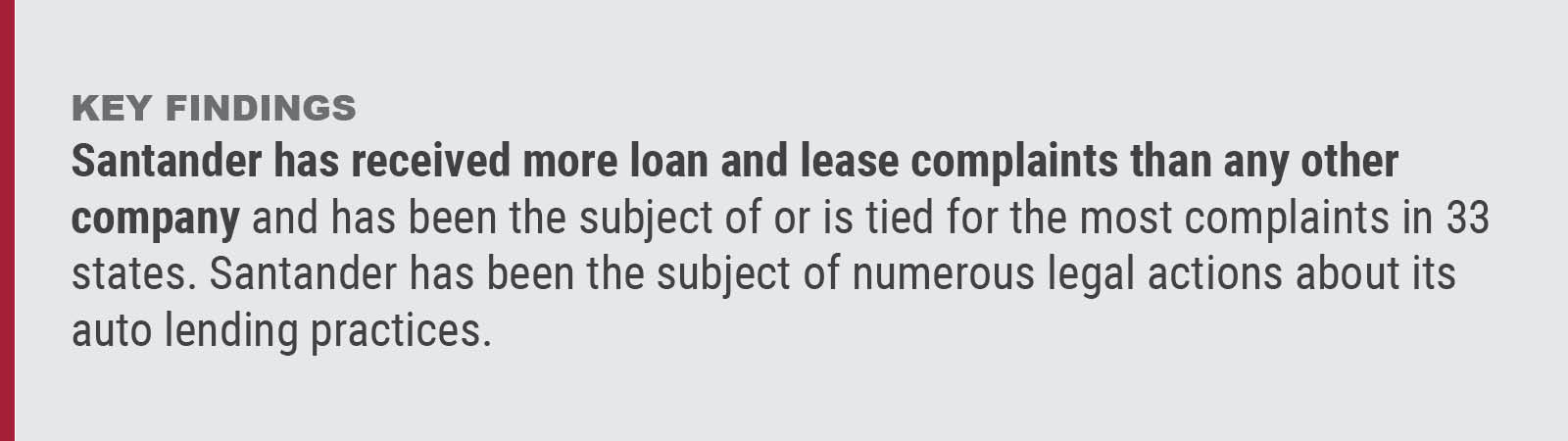

2,347 vehicle loan and lease complaints

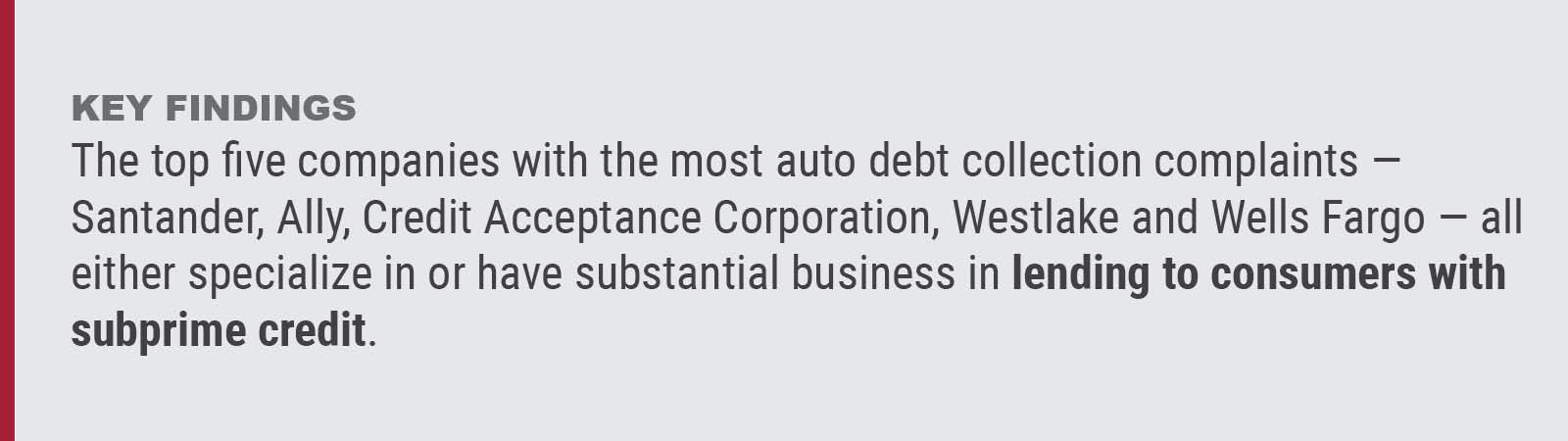

Harmful auto loan practices targeted by CFPB enforcement action: Failed to properly describe “the benefits and limitations of its S-GUARD GAP product, which it offered as an add-on to its auto loan products.” (November 2018)

1,437 vehicle loan and lease complaints

Harmful auto loan practices targeted by CFPB enforcement action: “Discriminatory auto loan pricing practices harming African-American, Hispanic, and Asian and Pacific Islander consumers.” (December 2013)

938 vehicle loan and lease complaints

934 vehicle loan and lease complaints

Harmful auto loan practices targeted by CFPB enforcement action: “[V]iolated the Consumer Financial Protection Act (CFPA) in the way it administered a mandatory insurance program related to its auto loans” (April 2018). Participated in “an illegal marketing-services-kickback scheme” (January 2015).

806 vehicle loan and lease complaints

742 vehicle loan and lease complaints

Harmful auto loan practices targeted by CFPB enforcement action: Charged African-American, Asian and Pacific Islander “higher interest rates than white borrowers for their auto loans, without regard to their creditworthiness.” (February 2016)

689 vehicle loan and lease complaints

Harmful auto loan practices targeted by CFPB enforcement action: Participated in “an illegal marketing-services-kickback scheme.” (January 2015)

677 vehicle loan and lease complaints

539 vehicle loan and lease complaints

515 vehicle loan and lease complaints

465 vehicle loan and lease complaints

Harmful auto loan practices targeted by CFPB enforcement action: Pressured borrowers “using illegal debt collection tactics.” (September 2015)

453 vehicle loan and lease complaints

Harmful auto loan practices targeted by CFPB enforcement action: Harmed African-American, Hispanic, and Asian and Pacific Islander borrowers with discriminatory auto loan pricing. (July 2015)

302 vehicle loan and lease complaints

297 vehicle loan and lease complaints

Harmful auto loan practices targeted by CFPB enforcement action: Used “deceptive marketing and lending practices targeting active-duty military.” (June 2013)

280 vehicle loan and lease complaints