Consumers complain at record levels, credit bureaus don’t help

The U.S. Consumer Financial Protection Bureau (CFPB) is buried under an onslaught of consumer complaints, according to our search of its public consumer complaint database.

I took another hard look at the CFPB’s public consumer complaint database for our new report Big Credit Bureaus, Record Complaints.

I wasn’t too surprised that the Big 3 credit bureaus — TransUnion, Equifax and Experian — led complaints against all companies. That’s been mostly true since 1990, but the raw numbers were astonishing:

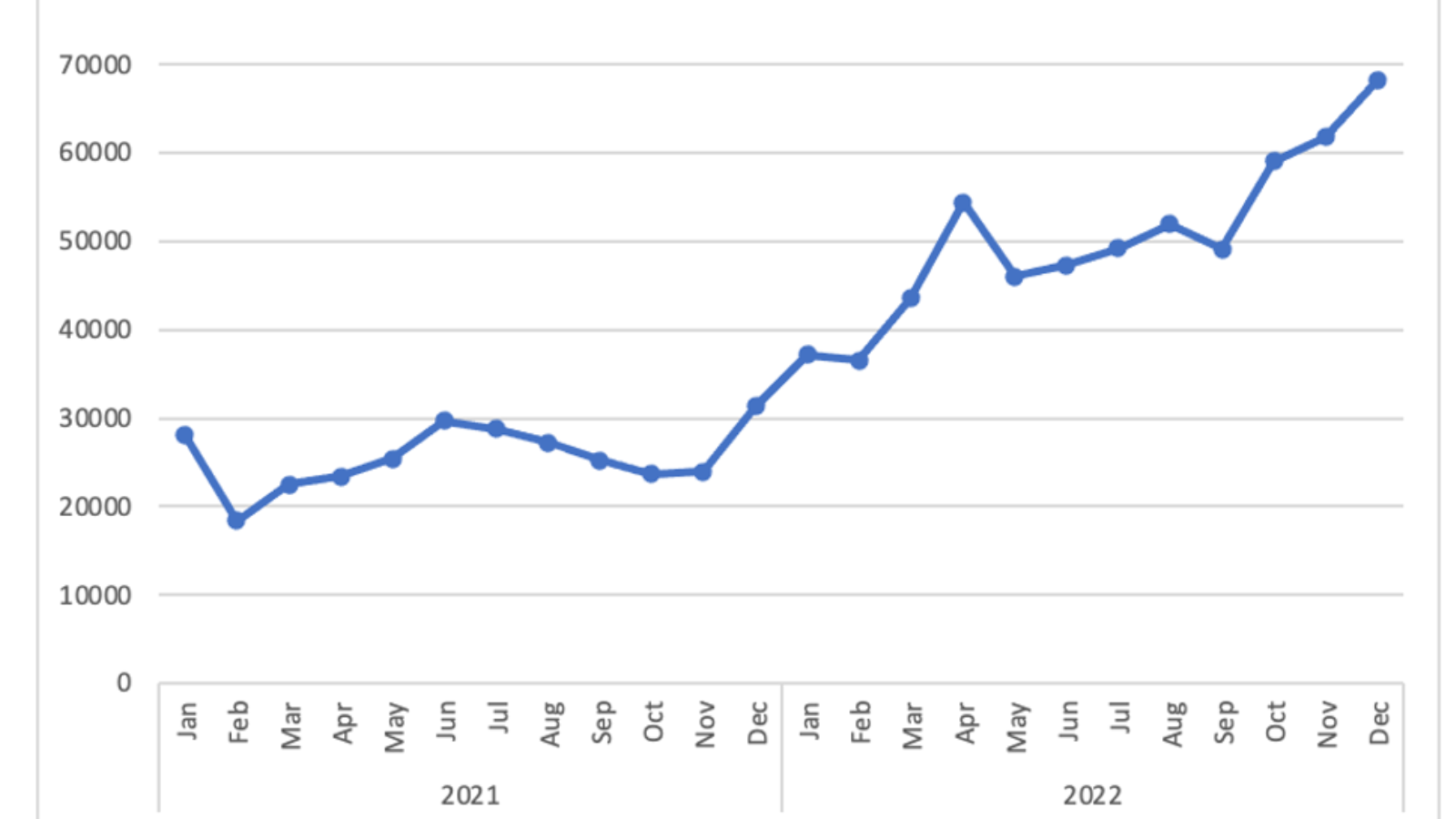

- Complaints about credit reports nearly doubled in 2022.

- Seven out of ten complaints against all financial firms were about the “Big 3” credit bureaus in 2022.

- Total complaints increased 61% from 2021 thru 2022. Over 800,000 complaints!

Big credit bureaus are gatekeepers to financial or employment opportunity. You can’t “vote with your feet” if you don’t like your credit bureau. Only tough regulation can hold the bureaus accountable.

In this tough economy, consumers need to ensure their credit reports and credit scores are accurate to obtain fairly-priced credit, to rent or buy a home, or to get a job.

The CFPB has been taking strong actions against the credit reporting industry. The CFPB, as we explained in our report, has rejected the Big 3’s excuses since the pandemic started.

When, early in the pandemic, the bureaus said all complaints using similar language were “bogus,” falsely blamed credit repair firms and refused to investigate complaints that the bureaus claimed were “frivolous” under the law, the CFPB pushed back…hard.

First, the CFPB said, you have a responsibility to investigate all complaints to determine if they are frivolous.

Second, the CFPB said that consumers were obtaining sample form letter language from the CFPB’s consumer assistance pages and other government websites.

And, the CFPB added, consumers are now using artificial intelligence programs such as ChatGPT to generate their own form letters.

The CFPB’s recent actions have resulted in a big increase of complaining consumers obtaining corrections to their credit reports. We confirmed that such “non-monetary relief” increased from only 9% to 40% of credit reporting complaints in 2022.

When I think of the credit bureaus, I think of Bart Simpson. He is a perpetually 10-year old cartoon character. He can repeatedly use the “It’s not my fault, I wasn’t there, you can’t prove anything” defense. Multi-billion dollar consumer reporting agencies, not so much.

It’s good to see a strong CFPB protecting consumers against an unfair credit reporting system. The CFPB is also investigating other financial markets, from debt collection to credit cards and bank accounts.

If you want to learn more, check out our video on how to search the CFPB database.

How-to video on using the CFPB complaint database

Topics

Authors

Ed Mierzwinski

Senior Director, Federal Consumer Program, PIRG

Ed oversees U.S. PIRG’s federal consumer program, helping to lead national efforts to improve consumer credit reporting laws, identity theft protections, product safety regulations and more. Ed is co-founder and continuing leader of the coalition, Americans For Financial Reform, which fought for the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, including as its centerpiece the Consumer Financial Protection Bureau. He was awarded the Consumer Federation of America's Esther Peterson Consumer Service Award in 2006, Privacy International's Brandeis Award in 2003, and numerous annual "Top Lobbyist" awards from The Hill and other outlets. Ed lives in Virginia, and on weekends he enjoys biking with friends on the many local bicycle trails.

Find Out More

Apple AirPods are designed to die: Here’s what you should know

New report reveals widespread presence of plastic chemicals in our food

Consumers call on Meta to protect kids’ safety in Quest virtual reality