I have health insurance and need emergency care

A guide to help you know your rights in emergency care situations

You have legal protections against emergency room, out-of-network “surprise medical bills” — which are described in this guide.

Downloads

In emergency situations, you often don’t choose the ambulance or the hospital. That means you may end up receiving care from a provider who is not part of your health insurance plan’s network. This is called “out-of-network care.”

- Out-of-network care often costs more in copays and coinsurance, and sometimes results in a “surprise medical bill.”

- “Surprise medical bills” occur when a patient is billed for the difference between what their health insurer covers and what an out-of-network provider charges. (This is sometimes called “balance billing.”)

You have legal protections against emergency room, out-of-network “surprise medical bills” — which are described below.

What if I need emergency transportation?

In an emergency, you may find yourself transported to a hospital in one of two ways:

- An “air ambulance” is a helicopter or airplane equipped with medical equipment and staffed with trained paramedics.

- A “ground ambulance” travels by road.

When you call 911, an emergency dispatcher will send the closest available ambulance, which may or may not be part of your insurance network. Because you don’t get to choose the ambulance company — and because requesting an ambulance often means you’re preoccupied with your actual emergency — you may be surprised to later receive an out-of-network ambulance bill.

The No Surprises Act is a national law that protects you from out-of-network “surprise medical bills” from air ambulances, but not from ground ambulances.

Out-of-network air ambulance transportation

The No Surprises Act protects you from out-of-network “surprise medical bills” for emergency air ambulance transportation. You will only be responsible for paying the total amount that would have been charged if that air ambulance was in your health insurance plan’s network.

Remember: The air ambulance company cannot send you an out-of-network “surprise medical bill.”

Out-of-network ground ambulance transportation

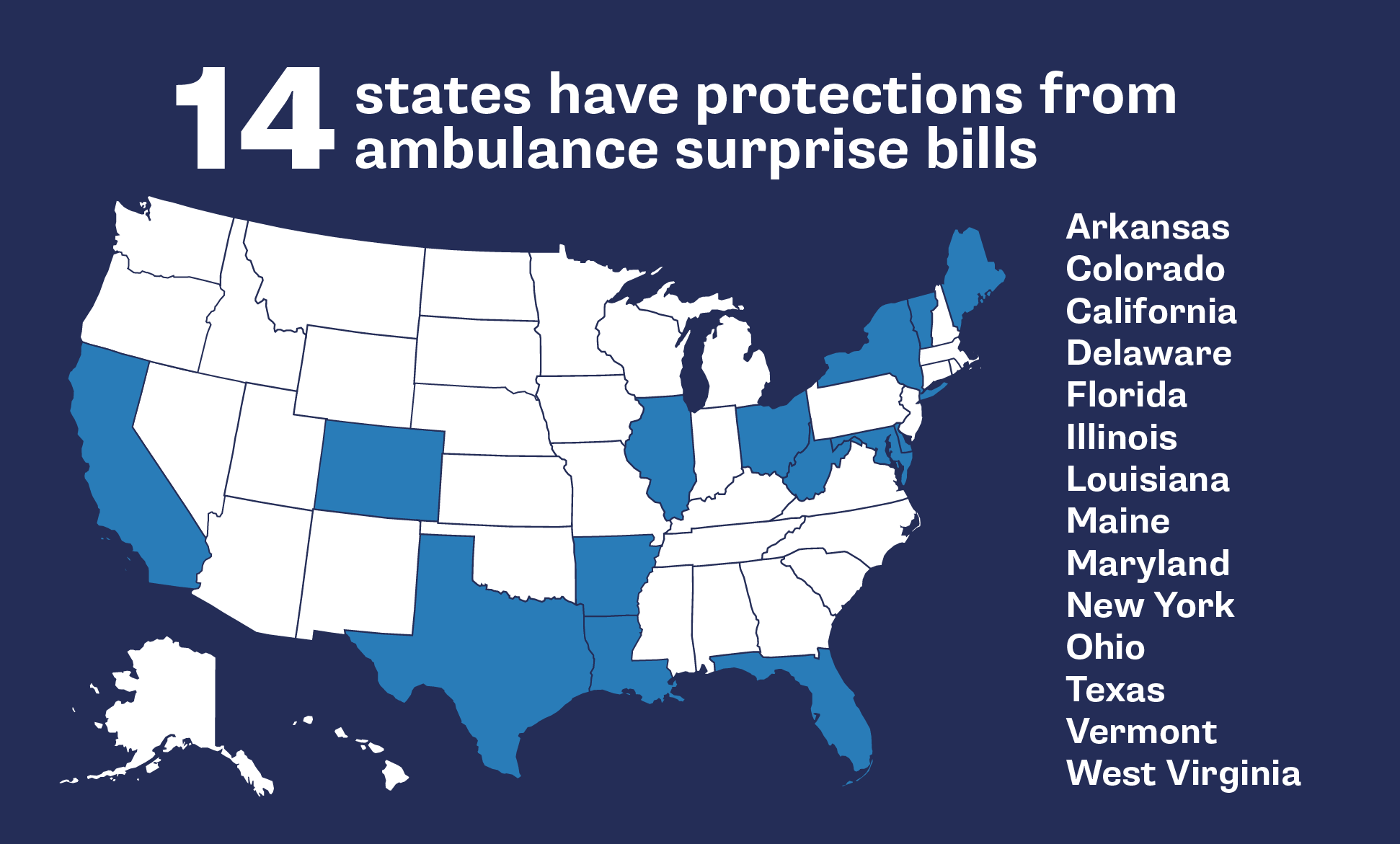

The No Surprises Act does not protect you from out-of-network “surprise medical bills” from ground ambulances. However, as shown in this map, 14 states offer some limited protections from ground ambulance “surprise medical bills.”

Know the limits of your state’s ground ambulance protections

Even if you live in one of these 14 states with ground ambulance surprise billing protections, the protections are only available for people who are insured by their state-regulated health insurance plans. Call the number on your health plan’s insurance card to find out if your plan is regulated under your state’s law.

What’s more, each of these states offer different types of protections from ground ambulance “surprise medical bills.” To learn more about your state’s protections, contact your state insurance department.

If you do not live in one of these 14 states, you could receive a bill directly from a ground ambulance service if that ambulance is not in your health plan’s provider network.

If you receive an out-of-network bill for a ground ambulance service and you can’t afford it, you can work with your health insurance plan and the ambulance company — or contact a legal aid organization in your area — to negotiate the cost of these additional charges. Need more help? Learn how to negotiate to lower your hospital bill.

What if I need emergency room care?

Emergency care is expensive. This is especially true if you end up in an emergency room that is not in your health insurance plan’s network.

- If you are experiencing a medical emergency, visit the nearest E.R. as quickly as possible — regardless of whether it is in your health insurance plan’s in-network hospital system.

- When patients are transported by any type of ambulance, they cannot choose which emergency room the ambulance brings them to.

- Your health is the priority, and you have rights that will help to protect you against potential out-of-network costs.

Avoid urgent care centers that are not part of your insurance network

Urgent care centers, which are prevalent across the U.S., are not included in No Surprises Act’s list of eligible emergency care facilities — even if they are located near a hospital. That means if you visit an urgent care center that is not in your insurance network, you are not protected against “surprise medical bills.”

Protections from out-of-network emergency room visits

The No Surprises Act protects you from “surprise medical bills” when you receive treatment for an emergency in an out-of-network emergency room and/or from out-of-network emergency room doctors. These protections apply to emergency rooms that are either part of a hospital, independent, free-standing emergency departments, or behavioral health crisis facilities that are licensed to provide emergency care.

- Through No Surprises Act’s protections, you will only owe the out-of-pocket costs that would have been charged if that emergency room and its physicians were in your health insurance plan’s network. These costs also count toward your annual deductible.

- The emergency room and its physicians cannot send you a balance bill. Furthermore, no one can ask you to sign a consent form to waive your out-of-network “surprise medical bill” protections in an emergency room.

- Health insurance plans cannot deny coverage for emergency care if you are deemed reasonable in thinking that you need immediate attention from health professionals.

How long does the No Surprises Act protect me against “surprise medical bills”?

If you are treated for an emergency at an out-of-network hospital, you are protected from “surprise medical bills” under the No Surprises Act.

However, after the medical emergency is over, those billing protections end. This can even occur WHILE you are still in the hospital. In this circumstance, you will be asked to either consent to out-of-network billing, or you will be asked to leave the hospital and seek further services at an in-network health care facility.

Consenting to out-of-network care

You cannot be asked to leave the out-of-network hospital or to consent to the additional out-of-network charges UNLESS your doctors determine that:

- You do not need emergency medical transportation to get to an in-network health care facility.

- The in-network facility is within a reasonable travel distance, considering your medical condition.

- The in-network facility has an available bed for you to use after they admit you.

- You are well enough to understand the reasons why you must transfer to a new hospital and are able to give consent.

You will be given a consent form that looks like this one: sample notice and consent form (PDF). Do you have questions about consent forms? Use this explainer.

What do I do if I receive an illegal “surprise medical bill”?

If you receive an out-of-network “surprise medical bill” from an air ambulance company, emergency room or emergency doctors, follow these steps:

STEP ONE: Contact both your health insurance plan and the health care provider (such as the out-of-network hospital or the air ambulance company) immediately to say: “I believe I have received an out-of-network bill that is illegal under the No Surprises Act. I do not owe more than my in-network amount on this bill.” Then ask the health care provider or the insurer to send you a written or emailed confirmation that you do not owe the amount of the out-of-network “surprise medical bill.”

STEP TWO: File a complaint online or call 1-800-985-3059. Even if you have gotten the company to stop its collection efforts on an illegal bill, it is important to notify the government of companies that are violating the law. After you file a complaint, you will receive information about when to expect a response.

More guides in this series

Topics

Authors

Patricia Kelmar

Senior Director, Health Care Campaigns, U.S. PIRG Education Fund

Patricia directs the health care campaign work for U.S. PIRG and provides support to our state offices for state-based health initiatives. Her prior roles include senior policy advisor at NJ Health Care Quality Institute, associate state director at AARP New Jersey and consumer advocate at NJPIRG. She was appointed to the Ground Ambulance and Patient Billing Advisory Committee in 2022 and works with patient advocates across the U.S. Patricia enjoys walking along the Potomac River and sharing her love of books with friends and family around the world.

Quỳnh Chi Nguyễn

Associate Director, Community Catalyst, Center for Community Engagement in Health Innovation

Quỳnh Chi Nguyễn oversees two major projects on community benefits and economic stability, and hospital equity and accountability. She also supports local and state health advocacy organizations that are working to improve economic stability. Quỳnh Chi has expertise in several policy areas, including affordability, health insurance coverage, prescription drug costs, and health justice. She is similarly experienced in policy research and analysis on community sustainable development, poverty reduction, child protection, and human trafficking in Southeast Asia.

Find Out More

Outpatient outrage: Hospitals charge fees for care at the doctor’s office

PIRG says march-in rights should be used to drive down Rx drug prices

PIRG supports proposed FDA rule which will better protect patients from inaccurate lab tests