Danny Katz

Executive Director, CoPIRG Foundation

Executive Director, CoPIRG Foundation

DENVER — CoPIRG joined Colorado Attorney General Weiser to kickoff Consumer Protection Week and the release of the top consumer complaints from 2022. At the event, CoPIRG released a new analysis of the top complaints Coloradans submitted to federal agencies like the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB).

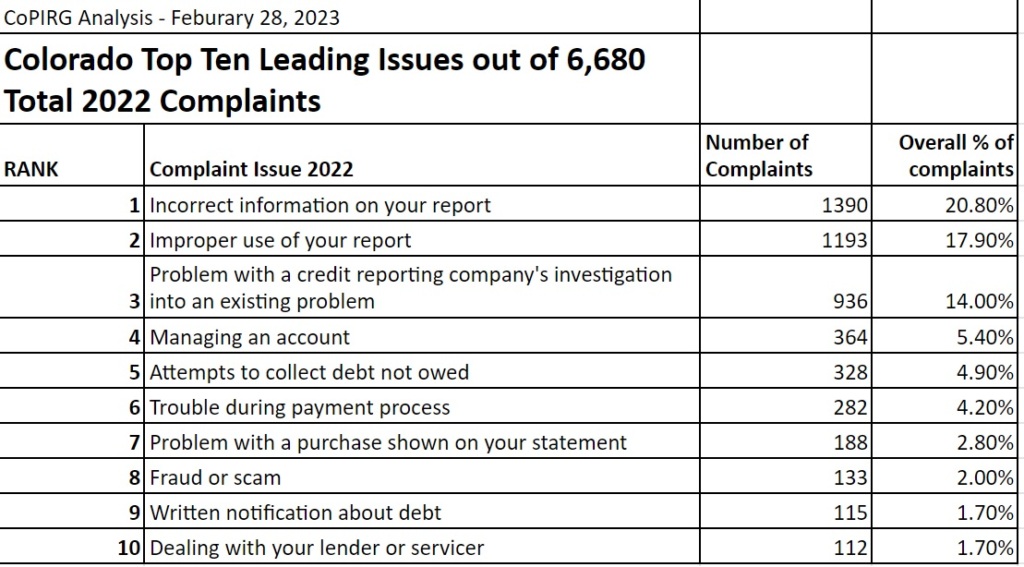

According to CoPIRG’s analysis, the CFPB received 6,680 complaints from Coloradans in 2022. Over half the complaints centered on credit reports including incorrect information on their report, improper use of their report and issues with a credit reporting company’s investigation into an existing problem.

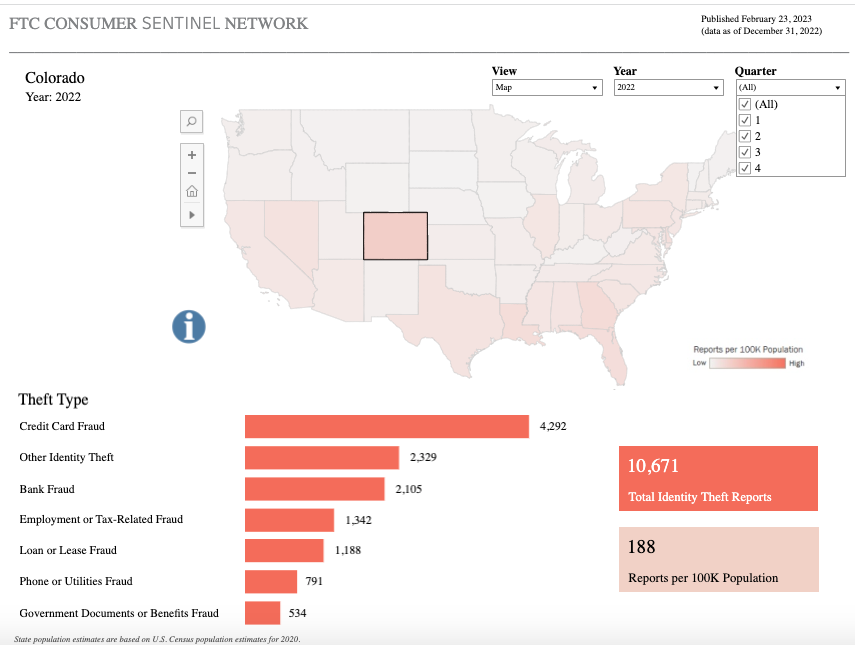

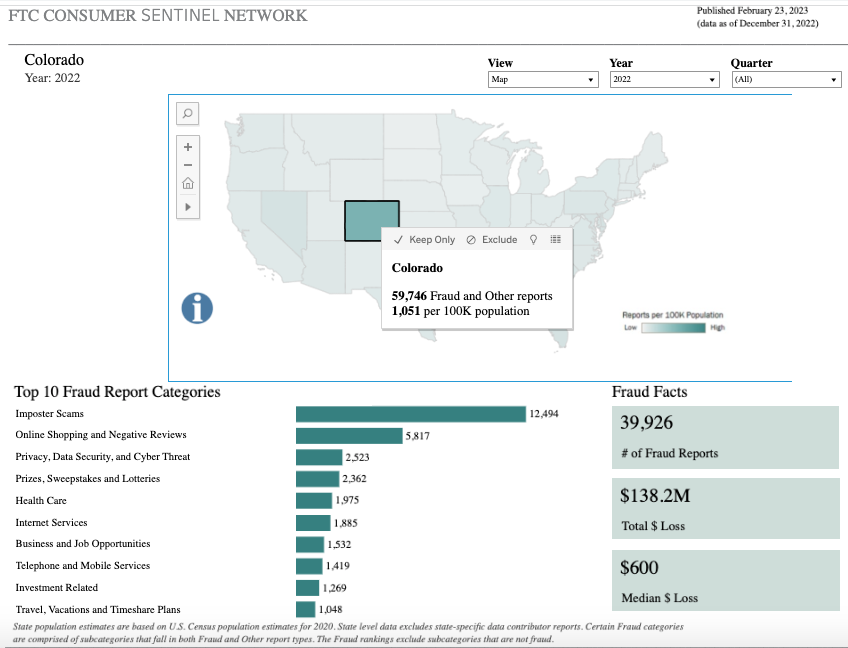

CoPIRG’s analysis also found, in 2022, the FTC received 10,671 identity theft reports from Coloradans, with 40% involving credit card fraud, and 39,926 fraud reports from Coloradans totaling $138.2 million in losses, with a median loss of $600.

“Being a good consumer used to mean simply saving money for the future, comparing prices before you made a big purchase and paying your bills on time,” said Danny Katz, CoPIRG executive director. “Today, with so many threats facing us, being a good consumer can feel like a second job. I’ve got two pieces of advice for consumers. First, let the Attorney General and other consumer agencies know when there is a problem so they can take action to help you and protect the next person. Second, think of yourself as your own individual little enterprise – You Inc. Whether it’s surprise medical bills, protecting your credit, getting an airline refund or stopping the deluge of robocalls and other scams, we’ve got the tools to help you be an informed, engaged consumer because no one will take care of You Inc. as well as you.”

Throughout Consumer Protection Week, CoPIRG is highlighting consumer protection tips and tools to help Coloradans address a wide range of common consumer issues. CoPIRG is also encouraging people to flag problems with the Attorney General and other consumer agencies.

For example, the Federal Trade Commission uses consumer complaint reports to investigate and bring cases against fraud, scams, and bad business practices. They also share reports of fraud with more than 2,800 law enforcers including the Colorado Attorney General. You can submit a complaint here.

According to FTC data, the top identity frauds reported by Coloradans in 2022 were credit card, other identity theft, bank fraud and employment or tax-related fraud.

Colorado identity theft complaints reported to the FTC in 2022Photo by Staff | TPIN

When it comes to fraud, the top categories of fraud reported by Coloradans in 2022 to the FTC were imposter scams, online shopping/negative reviews and privacy/data security/cyber threats.

Colorado fraud complaints from Colorado reported to the FTC in 2022Photo by Staff | TPIN

The federal Consumer Financial Protection Bureau (CFPB) also has a consumer complaint system for financial issues related to credit cards, credit reports, and loans. The CFPB will submit consumer complaints to companies for a response. Most respond within 15 days, which can result in restitution for the consumer.

In 2022, 51% of complaints submitted to the CFPB involved credit reporting. Problems with banking accounts and debt collectors round out the top five complaints from Colorado. For a complete breakdown of CFPB complaints from Colorado click here.

Complaints from Coloradans to the CFPB – 2022Photo by Staff | TPIN