How to fill out a check from your bank account

Checks are easy to complete, but it's important to do it carefully

People don’t rely on checks as much as they did in the 1990s, but checks still are needed from time to time and you should know how to fill one out if you have a checking account.

It’s important to realize that a check is a legal document. If you give a check to someone, you’re saying you agree to pay them this much money. You should fill checks out carefully and also protect your blank checks. They can be stolen and written out to someone and cashed, even without your actual signature. Yes, you generally can get your money back if this happens, but it can take weeks, and there’s no guarantee.

You can order checks through your bank or third-party companies. No matter what, you should make sure the company is a member of the Check Payment Systems Association or complies with the security features that checks must have, such as watermarks.

To make out a check to a person or business:

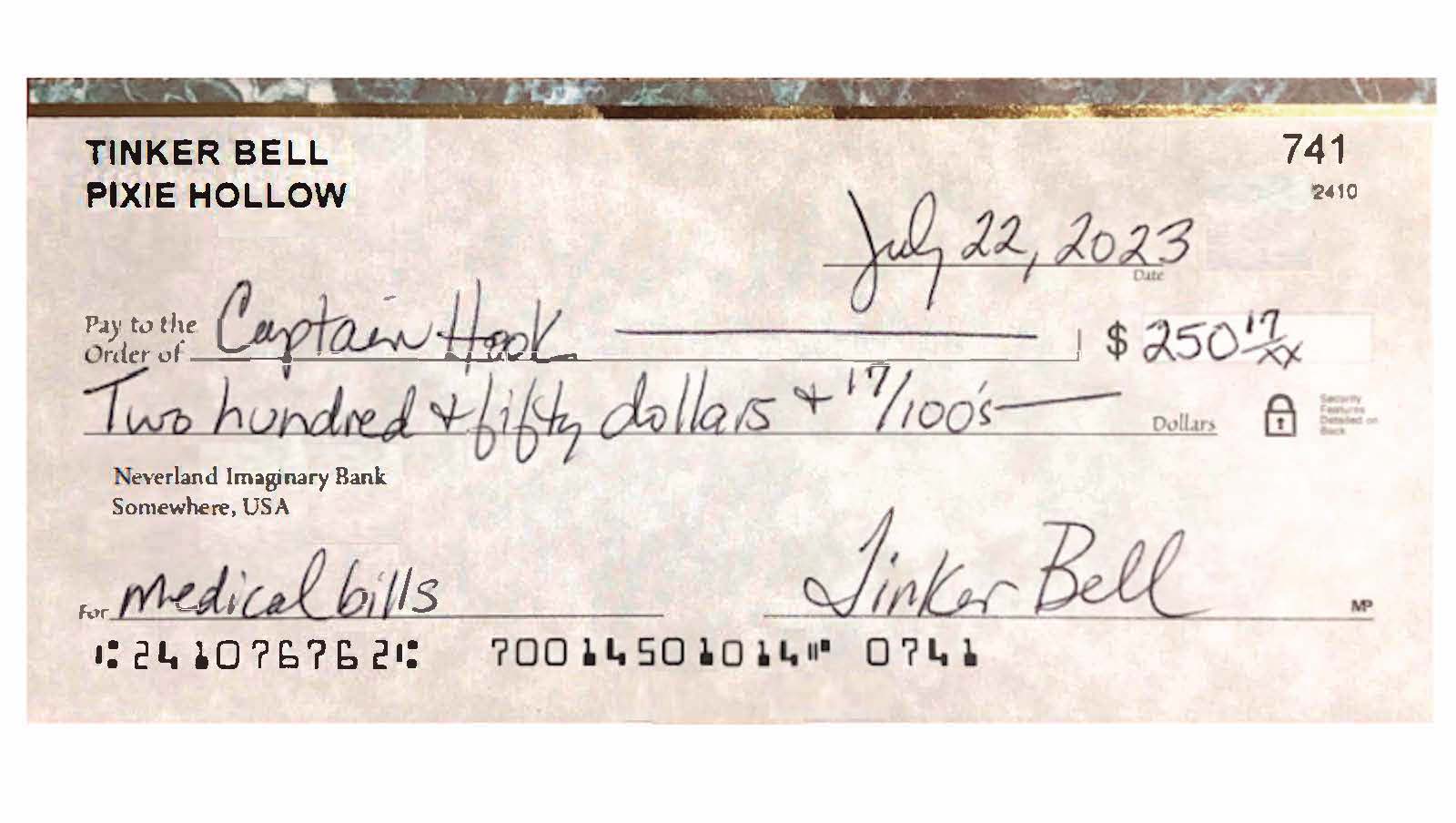

- Where it says “Pay to the order of,” write out who you’re paying, either first and last name or the complete business name. Then draw a horizontal line through any empty space to prevent something from being added. Do not leave this blank.

- Fill in the date in the upper right-hand corner. You really shouldn’t write a check for a future date and think that will prevent it from being cashed until that date. That’s not how it works.

- The amount of a check is obviously really important. That’s why you have to fill it in twice.

On the right side by the dollar sign, you write the numerals, with a clear decimal point. Or you can use a regular size for the dollars and write the cents smaller, with two small x’s under the numbers.

Under the line under the payee, write out the amount in words. If the check is for $250.17 cents, you write out Two hundred, fifty dollars and 17/100’s. If it’s for an even dollar amount, such as $27, just write Twenty-seven dollars and 00/100’s. Don’t leave space at the beginning of the line or after what you’ve written. Start at the far left side and if there’s any space on the right, draw a horizontal line until you get to the word “DOLLARS.”

As an option, you could write Two hundred, fifty and 00/100s. The “dollars” is implied. Eliminating that word is helpful if you write big or the written out number takes up a lot of space, as in One thousand, four hundred and seventy-five dollars. - If you’d like, you can write something in the memo. If you’re paying a bill, say to an electric company or dentist’s office, it’s a good idea to write your account number with the electric company or dentist on the memo line to make sure it gets credited to your account. Or you can write a reminder of what it’s for: birthday gift or dog medication.

- Sign the check with your normal signature.

- Carefully look over everything before you give it to someone or mail it.

- You generally can’t cross out anything and rewrite it, especially the numbers or entire payee. If you mess up and can’t write over it cleanly, you should write VOID really big on the check and start over.

Always use a pen, not pencil. You may opt for a gel pen that makes it more difficult for someone to alter the check with rubbing alcohol or fingernail polish.

Always keep a record of checks you write, along with other payments, so you don’t overdraw your account. You can use Excel or any spreadsheet, an old-fashioned checkbook ledger or a phone app, such as Balance My Checkbook by LingsDesigns (a favorite of mine). Whatever system that you’ll use and keep up with is great.

Remember that a check provides proof that you paid someone. If there’s a question later about whether a bill or debt was paid, the bank can provide you with documentation.

Review your account activity at least once a week to check off what has cleared and make sure that all transactions match the amount you thought they were.

Topics

Authors

Teresa Murray

Consumer Watchdog, U.S. PIRG Education Fund

Teresa directs the Consumer Watchdog office, which looks out for consumers’ health, safety and financial security. Previously, she worked as a journalist covering consumer issues and personal finance for two decades for Ohio’s largest daily newspaper. She received dozens of state and national journalism awards, including Best Columnist in Ohio, a National Headliner Award for coverage of the 2008-09 financial crisis, and a journalism public service award for exposing improper billing practices by Verizon that affected 15 million customers nationwide. Teresa and her husband live in Greater Cleveland and have two sons. She enjoys biking, house projects and music, and serves on her church missions team and stewardship board.

Find Out More

Food for Thought 2024

Safe At Home in 2024?

What the California Consumer Privacy Act means for you