CONSUMER COMPLAINTS TO CFPB HIT ANOTHER RECORD; CREDIT REPORT PROBLEMS TOP THE LIST

Complaints filed with the Consumer Financial Protection Bureau (CFPB) hit another record in 2021, led by issues with credit reports.

Analyzing CFPB complaints is one of the ways that CALPIRG PIRG Education Fund keeps a pulse on issues consumers are most concerned about.

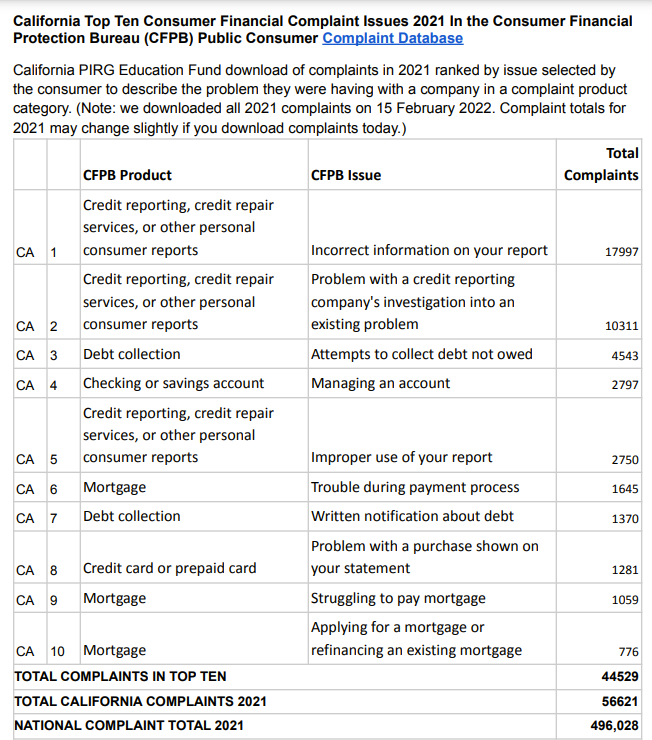

Complaints filed with the CFPB’s Public Consumer Complaint Database hit 496,028 in 2021, an increase of nearly 12% from 2020. 56,621 of those complaints were from Californians.

The No. 1 Californian complaint was “Incorrect information on your credit report,” representing one-third of the complaints, or 17,997 complaints.

The No. 2 issue was directly related: “Problem with a credit reporting company’s investigation into an existing problem,” with 10,311 complaints, or 18% of the total.

It’s troubling that almost 50 percent of complaints concerned erroneous information on people’s credit reports or their unsuccessful attempts to resolve the mistakes.

Credit reports are a key part of Americans’ financial identity, whether they like it or not or consent to their information being collected or not. Information on credit reports drives decisions on whether someone is approved for a loan or credit card, the interest rate of loans and credit cards, whether a tenant is approved to rent a house or apartment, the premiums paid on auto or homeowners’ insurance and even whether someone is offered a job.

Consumers are strongly encouraged to get copies of their credit reports regularly from the three major credit bureaus: Equifax, TransUnion and Experian. By law, consumers are entitled to a free copy once a year from each of the bureaus. Through April 20, you’re entitled to one free copy each week from each bureau, because of pandemic legislation passed by Congress. Go to annualcreditreport.com or call 1-877-322-8228.

Credit reports were also the topic of the No. 5 complaint – “Improper use of your report.”

The other big bucket for complaints: debt collection. The No. 3 issue was “attempts to collect debt not owed,” with 4,543 complaints. The No. 7 complaint concerned “written notification about debt.”

Other issues among the top 10 complaints concerned checking or savings accounts, trouble when making a mortgage payment, a problem with a purchase on a credit card statement and struggling to pay a mortgage.

Complaints to the CFPB have been climbing for years. Besides last year’s nearly 500,000 national complaints, the 2020 total – 444,551 complaints — represented a 60 percent increase from the 277,366 complaints in 2019.

Because complaints involving credit reports always top the list, here are a few resources to help you:

-

Your credit report is a long document, and confusing to many. Here’s a guide on where to look to quickly find mistakes or information most likely to hurt your credit score.

-

Easy-to-understand tips to walk you through freezing and thawing your credit files.

-

22 ways to protect yourself from identity theft, fraud and headaches

Topics

Authors

Jenn Engstrom

State Director, CALPIRG

Jenn directs CALPIRG’s advocacy efforts, and is a leading voice in Sacramento and across the state on protecting public health, consumer protections and defending our democracy. Jenn has served on the CALPIRG board for the past two years before stepping into her current role. Most recently, as the deputy national director for the Student PIRGs, she helped run our national effort to mobilize hundreds of thousands of students to vote. She led CALPIRG’s organizing team for years and managed our citizen outreach offices across the state, running campaigns to ban single-use plastic bags, stop the overuse of antibiotics, and go 100% renewable energy. Jenn lives in Los Angeles, where she enjoys spending time at the beach and visiting the many amazing restaurants in her city.

Find Out More

Laundry pods: 8.2 million bags recalled because they can open easily, poison children

Apple AirPods are designed to die: Here’s what you should know

A look back at what our unique network accomplished in 2023