Stop Payday Predators

Payday Lenders Are Preying on Wisconsinites

Payday loans are among the most predatory forms of credit on the market. Though they are marketed as having “reasonable” fees or charges, typical interest rates exceed 300 percent. And because the payday lenders’ bottom line actually depends on borrowers’ inability to repay — most payday fees come from borrowers who take out more than 10 loans a year — they target people with low incomes and no other options.

WISPIRG Foundation

Payday loans are among the most predatory forms of credit on the market. Though they are marketed as having “reasonable” fees or charges, typical interest rates exceed 300 percent. And because the payday lenders’ bottom line actually depends on borrowers’ inability to repay — most payday fees come from borrowers who take out more than 10 loans a year — they target people with low incomes and no other options.

This fact sheet’s key findings include:

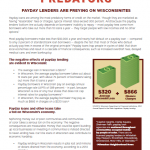

- The average payday loan in Wisconsin is $320 and carries an APR of 589 percent.

- The average Wisconsin payday borrower pays more in finance charges and fees than the cost of the original loan. For example, a typical payday borrower will pay more than $866 in finance charges for a $320 loan.

- The payday and auto-title loan industries contributed more than $242,000 to candidates for state office between 2010 and 2014, and major payday lending companies PLS Financial, Select Management Resources, Advance America, and AmeriCash Loans spent a combined $273,800 lobbying state elected officials in 2015.

Topics

Find Out More

5 steps you can take to protect your privacy now

Too much to recall