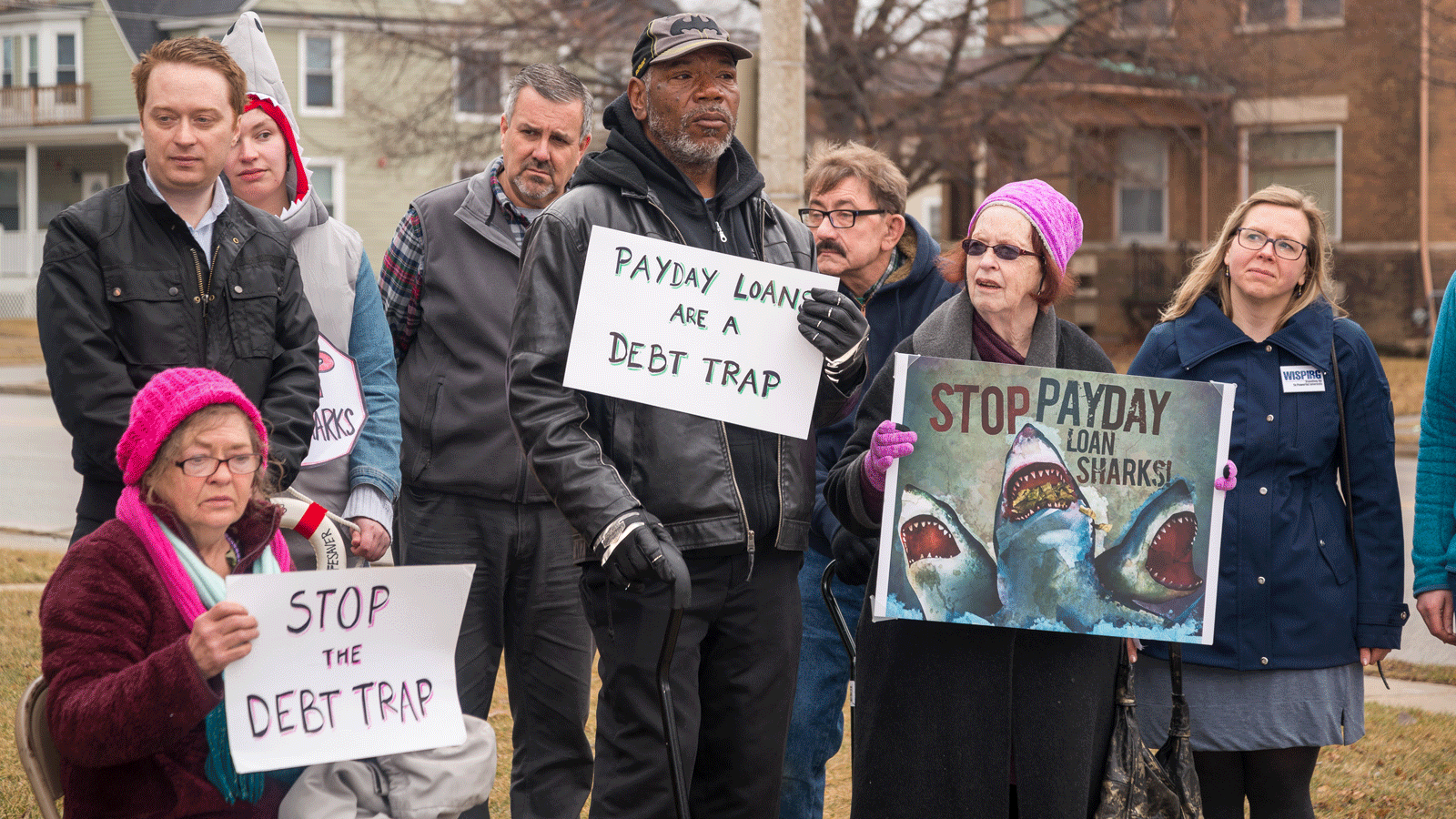

Stop the Debt Trap

Predatory lenders promise quick cash but trap consumers in a cycle of debt. It's time to stop the debt trap.

For too long, predatory lenders have gotten away with trapping consumers in vicious cycles of debt. Most commonly, this happens through high-cost loans such as payday, installment or auto title loans. Marketed as fast cash that can be applied for in minutes, but often carrying triple digit interest rates, these loans are debt traps, plain and simple.

To better protect consumers from these predatory practices, PIRG is working to pass bipartisan legislation called the Veterans and Consumers Fair Credit Act (VCFCA). The bill would extend existing protections from predatory interest rates that exist for active duty service members by capping annual rates at 36% APR for all consumers, including veterans.

Types of high-cost loans

Payday loans

Payday loans, which use uncashed paychecks as collateral, are typically for “two weeks until payday.”

Many people take out these high-cost loans to help make ends meet. But once someone has taken out a payday loan, the lender automatically withdraws payments from their bank account when due. The excessive interest rates of payday loans are so high that they often cut into other expenses, so many customers end up taking out another loan, and another loan after that, falling into a vicious cycle of perpetual debt.

Installment loans

High-cost installment loans are typically for larger amounts to be paid back over longer periods of time and are often less regulated than payday loans.

Installment loans don’t require automatic bank account withdrawals like payday loans do, but many people struggle with paying back installment loans because of terms that lock them into owing two or three times the original loan amounts.

Even if an installment loan customer makes regular payments on time and has already paid more than the original loan amount, just one illness, an accident or a loss of income can result in missed payments and negative reporting to the credit bureaus, making it even harder for them to land back on their feet.

Title loans

Auto title loans are similar to installment loans but use automobiles as collateral.

With title loans, the same bad terms found in an installment loan could also lead to the repossession of a person’s car — possibly with their belongings still inside. For a borrower, losing their means of getting to work could lead to job losses or the inability to land a job, worsening their financial situation even more.

High-cost lenders set up shop in high concentrations outside military bases like “bears on a trout stream” due to common vulnerabilities of service members, including their youth and their low but reliable incomes. To protect service members from predatory lending, the Military Lending Act was passed by Congress in 2006 and revised in 2015 by the Department of Defense to cap interest rates at 36% APR on high-cost loans sold to active duty servicemembers.

But servicemembers are not the only targets. High-cost lenders tend to be located in communities with higher proportions of racial and ethnic minority and low-income households, and the typical payday borrower is more likely to be a woman or a renter.

That’s why the 36% rate cap should be extended to all consumers as a base level of protection from triple digit debt traps. The VCFCA would also allow states to enact even more protective caps.

Support for rate caps crosses party lines

We are amplifying the wide bipartisan public support that rate caps on consumer loans enjoy. Polls show that around 70 percent of Americans support such caps — and in particular, voters in blue and red states alike have demonstrated overwhelming support for rate caps on payday loans.

Rep. Glenn Grothman (R-WI-6) testifies before the United States Senate Committee on Banking, Housing, and Urban AffairsPhoto by Screenshot | Public Domain

“While I normally do not like the federal government regulating business, the fact that so many loans are provided online today leaves the federal government no choice but to act on this issue.” — Rep. Glenn Grothman (R-WI-6)

Rep. Jesús “Chuy” Garcia (D-IL-4) testifies before the United States Senate Committee on Banking, Housing, and Urban AffairsPhoto by Screenshot | Public Domain

“[The Military Lending Act of 2006] worked, and it provided us with a robust model for regulating consumer loans. It’s time to extend those same protections to veterans, servicemembers’ families, and other consumers.” — Rep. Jesús “Chuy” Garcia (D-IL-4)

PIRG has been a leading voice sounding the alarm on predatory loans for decades and have helped pass state interest rate caps, most recently in Illinois.

With growing bipartisan support nationwide, now is the time to pass rate caps that will protect all consumers. You can help us build momentum to stop the debt trap.

Topics

Authors

Mike Litt

Director, Consumer Campaign, PIRG

Mike directs U.S. PIRG’s national campaign to protect consumers on Wall Street and in the financial marketplace by defending the Consumer Financial Protection Bureau, and works for stronger privacy protections and corporate accountability in the wake of the Equifax data breach. Mike lives in Washington, D.C.

Find Out More

Apple AirPods are designed to die: Here’s what you should know

New report reveals widespread presence of plastic chemicals in our food

Consumers call on Meta to protect kids’ safety in Quest virtual reality