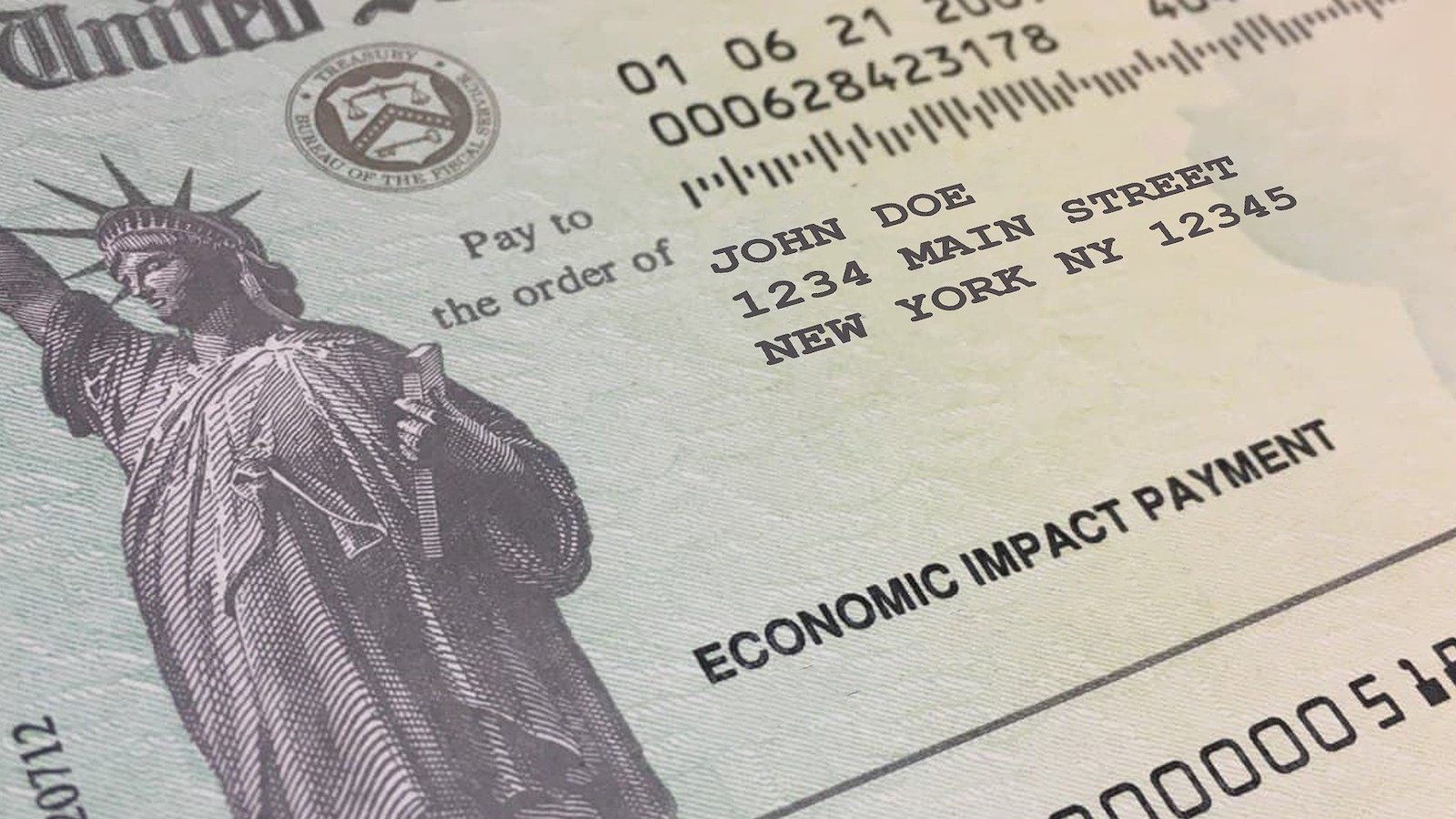

With $1,400 payments on the way, here’s what to do, and not do

85 percent of Americans are expected to get money -- without the need for you do anything, including clicking any email links, providing any information by phone or paying any fees.

COVID-19 continues to pose a challenge for our country. Together we can do more to protect our health and ensure we're better prepared for any future pandemics.

85 percent of Americans are expected to get money -- without the need for you do anything, including clicking any email links, providing any information by phone or paying any fees.

There are many reasons for optimism, particularly the huge turnaround that started in the second half of December when vaccines started rolling out. We found that has led to a decline in nursing home cases exceeding 80 percent. But this is not a time to act irresponsibly or get overly confident.

Consumer complaints about problems with financial companies such as banks, credit bureaus and debt collectors rose by more than 50 percent in 2020 and set new records for each month of the year, according to a new report from the U.S. PIRG Education Fund.

A new analysis by the U.S. PIRG Education Fund and Frontier Group found that 8 percent of nursing homes nationwide as of Dec. 27 had a critical shortage of surgical-grade N95 masks, which are the best protection against spreading the virus. Additionally, 4 to 6 percent of nursing homes reported shortages in at least one other category of personal protective equipment.

At any given time throughout most of 2020, more than 200,000 Americans resided in nursing homes that admit they were suffering through staff shortages.

Con-artists are preying on people's fear of infection or desperation for money