On Tuesday the Consumer Financial Protection Bureau (CFPB) released its annual report on consumer complaints it received about the national credit bureaus – Equifax, Experian, and TransUnion.

The report, required under the Fair Credit Reporting Act (FCRA), looked at 488,000 complaints sent by the CFPB to the national credit bureaus from October 2021 through September 2022.

As PIRG has documented for years, consumers have long complained to the CFPB the most about mistakes on their credit reports and failure by the credit bureaus to fix those errors.

The CFPB’s public Consumer Complaint Database allows a consumer to submit a complaint to report a problem with a financial product or service that hasn’t been resolved with the company. The company will have two weeks to respond before the complaint is made public. The public nature of the complaints typically spurs companies to resolve problems or at least get back to their customers.

However, last year’s CFPB report slammed the credit bureaus for deficiencies in complaint responses during 2020 and 2021.

Following the publication of that report and numerous other actions taken by the CFPB, the credit bureaus have made the following improvements over the past year:

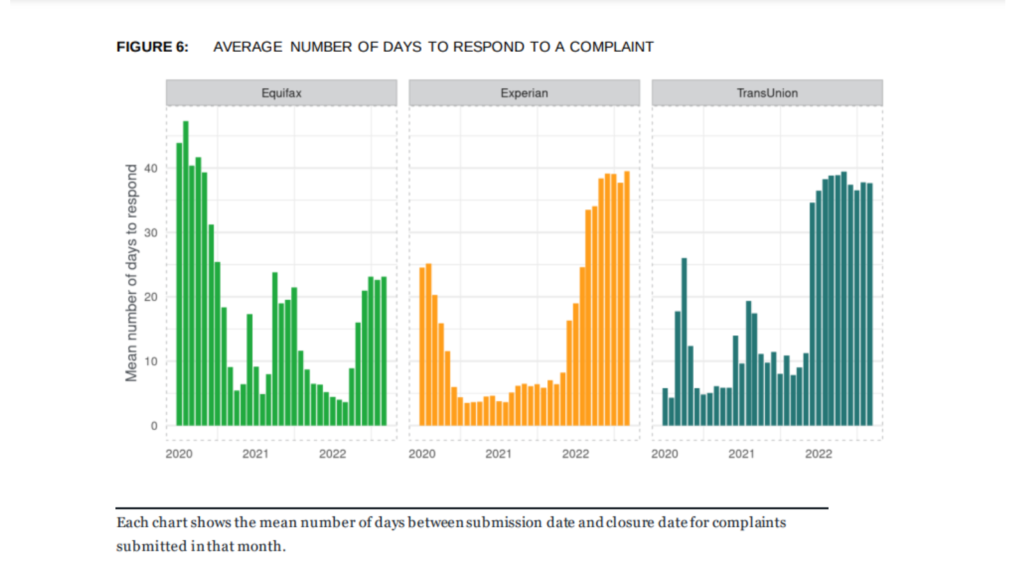

Time spent investigating complaints has increased: The CFPB found that by late 2020 most complaints were closed by the credit bureaus in just a few days, well before they “could feasibly conduct and provide results of the many investigations that may have begun as part of responding to consumers’ complaints.” The following chart suggests that the credit bureaus have taken complaints more seriously since then by taking more time to respond to them.

Photo by CFPB | Public Domain

Complaints that received a tailored response have increased: Most responses now include the outcome of the complaint, and many include tailored responses with information relevant to individual complaints.

Credit bureaus are reporting greater rates of relief in response to complaints: In 2021 the credit bureaus reported providing monetary or non-monetary relief in response to less than 2% of complaints, down from nearly 25% in 2019. Non-monetary relief involves changes to credit reports in response to a complaint. The CFPB noted the following reversal in that trend:

“In 2022, TransUnion reported providing relief in most complaints. Experian reported providing relief in nearly half of complaints. Equifax reported that it did not provide relief, but its written complaint responses suggest otherwise…”

Recommendations

In addition to noting improvements, the CFPB also recommended that the credit bureaus assess:

- Whether automation is putting undue burdens on consumers. For example, are consumers receiving automated responses to disputes that aren’t relevant to their situation?

- How current processes might need to adjust to consumer use of technology. For example, will consumer use of AI programs to generate personal complaint letters get screened out by credit bureau dispute systems for not being legitimate?

- How to give consumers more control over their financial data that makes it onto credit reports

Also notable in this year’s report release was Director Rohit Chopra’s indication that the CFPB “will be exploring new rules to ensure that they are following the law, rather than cutting corners to fuel their profit model.” That’s a welcome news to ring in the new year that PIRG and other advocates have been urging. Here’s to protecting consumers in 2023.