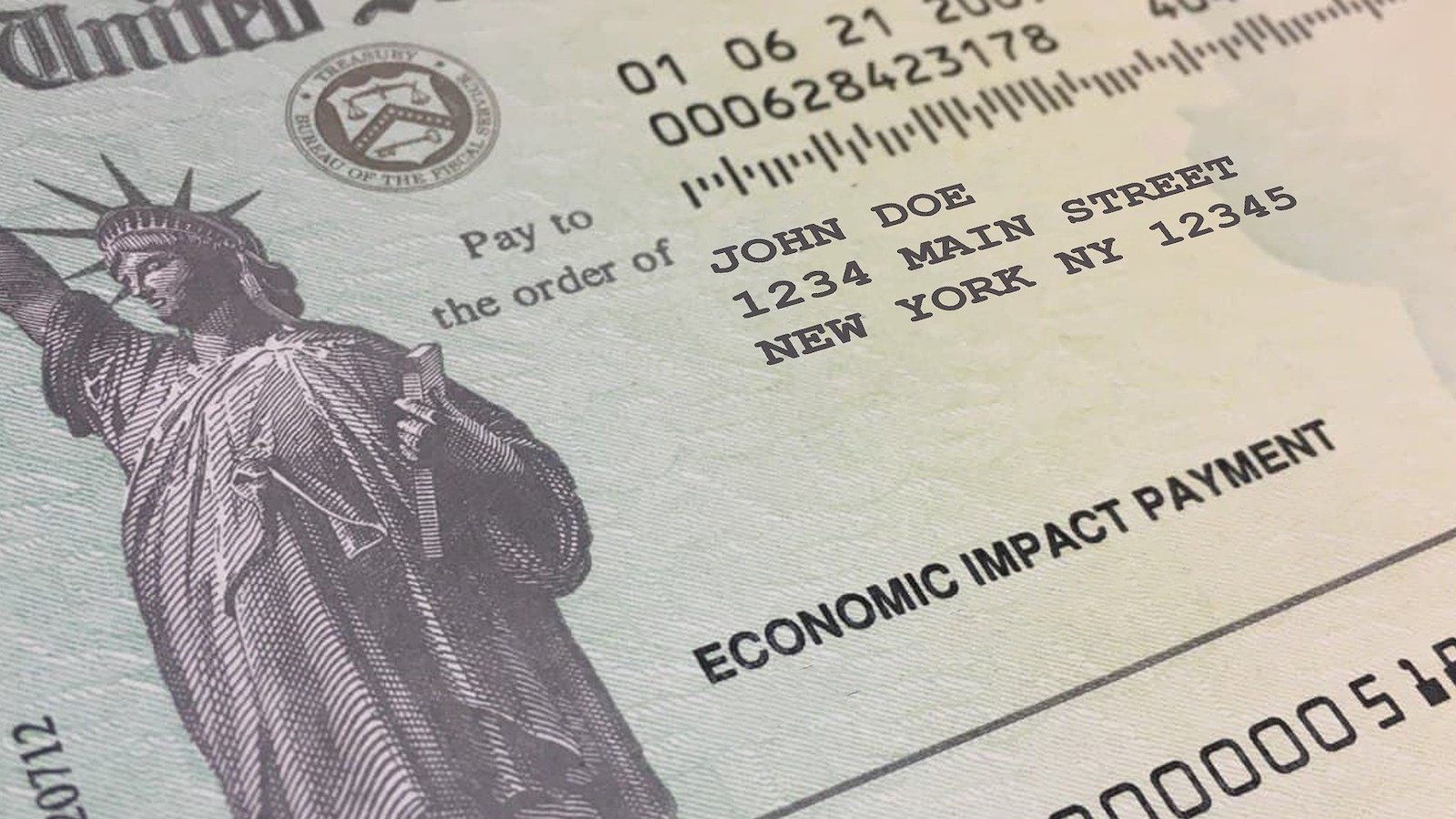

With $1,400 payments on the way, here’s what to do, and not do

85 percent of Americans are expected to get money -- without the need for you do anything, including clicking any email links, providing any information by phone or paying any fees.

COVID-19 continues to pose a challenge for our country. Together we can do more to protect our health and ensure we're better prepared for any future pandemics.

85 percent of Americans are expected to get money -- without the need for you do anything, including clicking any email links, providing any information by phone or paying any fees.

Consumer complaints to the Consumer Financial Protection Bureau (CFPB) regarding vehicle loans and leases have increased sharply during the coronavirus pandemic, according to a new report by the TexPIRG Education Fund and Frontier Group. The analysis suggests that consumers in Texas and across the United States are facing abusive and deceptive practices from the automobile lending industry. “Personal car ownership was once a symbol of freedom in the United States. Now, for too many Americans, owning a vehicle isn’t a choice, but an expensive necessity,” said Bay Scoggin, Director of TexPIRG Education Fund. “That’s why making it easier to get around without a car, including by building more pedestrian- and bicycle-friendly infrastructure and improving the cost and availability of public transit, is an important step to help Americans reduce their exposure to auto debt.”

The COVID-19 pandemic presents a whole new situation for college students. This guide outlines items that students should pack when they return to campus.

Many airlines offer only vouchers, not refunds, even though you are legally entitled to a full refund.

In the midst of the novel coronavirus (COVID-19) pandemic, American consumers are experiencing numerous public health and financial challenges, including virus-related scams, fake products promising cures and price gouging. To help address concerns as they arise, TexPIRG Education Fund is publishing new tip guides each week to help consumers navigate this crisis.

The novel coronavirus (COVID-19) pandemic has left many Americans wondering how they’re going to pay their monthly bills. U.S. PIRG Education Fund new advice on how to negotiate with banks, utilities delaying payments, waiving of overdraft fees and other ways to stay financially secure.