Predatory Loans & Predatory Loan Complaints

This is the seventh in a series of reports that review complaints to the Consumer Financial Protection Bureau. In this report, we explore consumer complaints about predatory loans, categorized in the database as payday loans, installment loans, and auto title loans.

Downloads

Executive Summary

This is the seventh in a series of reports that review complaints to the CFPB. In this report we explore consumer complaints about predatory loans, categorized in the database as payday loans, installment loans, and auto title loans.

This is our first report to incorporate an analysis of consumer narratives or written explanations of problems — an addition to the database we advocated for with Americans for Financial Reform and achieved last year.

This report looks at payday loan complaints from multiple angles:

- The type of problem, such as loan interest that wasn’t expected

- Complaints by company

- Whether and how companies responded to complaints

This report includes a section highlighting the CFPB’s top accomplishments. We also present a history of the fight to rein in the predatory lending industry and discuss the significance of a rule the CFPB is expected to finalize this year. We provide recommendations for this rule, as well as improvements the CFPB can make to enhance the complaint database and its work on behalf of consumers.

Findings

Consumers have submitted nearly 10,000 complaints in the payday loan categories of the database in less than three years.

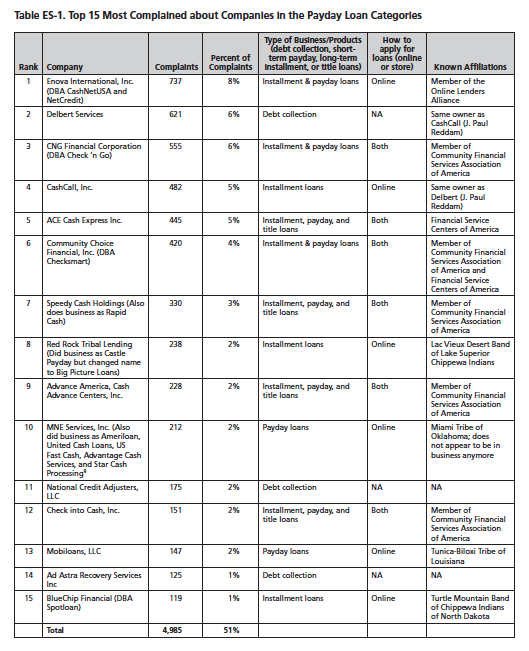

More than half the complaints were submitted about just 15 companies. The other half of the complaints were spread across 626 companies. (See Table ES-1.)

Complaints against these 15 companies cover problems with a full spectrum of predatory products and services.

These 15 companies include:

- Storefront and online lenders;

- Short-term payday, long-term payday installment, and auto title lenders;

- Debt collectors;

- Lenders claiming to operate as tribal lending entities; and

- Members of industry associations, whose members are said to abide by best practices they claim ensure responsible lending.

Enova International (doing business as CashNetUSA and NetCredit) has the most total complaints in the payday categories with 737, making up about 8% of all payday complaints, followed by Delbert Services, CNG Financial Corporation (doing business as Check ‘n Go), CashCall, and ACE Cash Express.

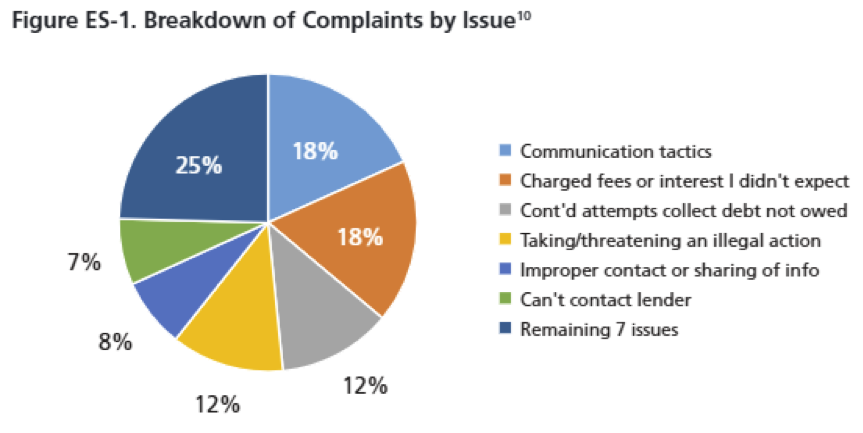

The two largest types of problems under the payday loan categories were with communication tactics and fees or interest that was not expected. These two issues made up about 18% of all complaints each. (See Figure ES-1.)

Beginning in March 2015, the CFPB added an option for consumers to share the written explanations of their problems in the database. Since then, 3,695 complaints in the payday categories have been published. A total of 1,663 or 45% of these complaints include publicly available explanations, also known as narratives, in the database.

- Although consumers may select only one type of problem when filing a complaint, a review of the narratives reveals many complaints involve multiple problems.

- 91% of all narratives showed signs of unaffordability, including abusive debt collection practices, bank account closures, long-term cycles of debt, and bank penalties like overdraft fees because of collection attempts.

Commendations and Recommendations

We commend the CFPB for proposing a rule in June to rein in high-cost lending.

The proposed rule takes an historic step by requiring, for the first time, that payday, high-cost installment, and auto title lenders determine whether customers can afford to repay loans with enough money left over to cover normal expenses without re-borrowing.

However, as currently proposed, payday lenders will be exempt from this requirement for up to six loans a year per customer. To truly protect consumers from the debt trap, it will be important for the CFPB to close exceptions and loopholes like this one in what is otherwise a well-thought-out proposal. The CFPB proposed rule could go further to enhance enforcement tools such as deeming that a loan in violation of state law is an unfair, deceptive, or abusive practice.

Actions the CFPB should take to improve the quality of the Consumer Complaint Database include the following. See further explanation of these recommendations and additional suggestions under the “Conclusions, Commendations and Recommendations” section toward the end of this report.

- Make it easier for consumers to know which categories to select when filing a payday complaint.

- Add more detailed information to the database, such as complaint resolution details.

- Add a field listing company subsidiaries, which are often the firms with which consumers actually interact.

Topics

Find Out More

What the California Consumer Privacy Act means for you

What the New Jersey Privacy Act means for you