New report: Analysis of CFPB database reveals the most-complained about debt collectors

CFPB data show consumer complaints by company

VIEW THE REPORT

Executive Summary

Created in the wake of the 2008 financial crisis, the Consumer Financial Protection Bureau, or CFPB, has been a critical ally for consumers in the financial marketplace. Over its history the CFPB has secured $12 billion in relief for wronged consumers, provided recourse to consumers facing problems with financial companies, and taken action against companies that break the law.

The Trump administration, however, has worked to undermine the effectiveness of the CFPB, retreating from critical investigative work and seeking to slash the CFPB’s budget and limit its ability to protect consumers. The CFPB has also reduced the usefulness of its research on consumer financial complaints. Its latest such report, spotlighting debt collection complaints, does not include the names of companies that receive the most complaints for abusive debt collection practices.

An analysis of CFPB consumer complaint data fills in the gaps of the bureau’s report, telling the story the Trump administration won’t about the problems consumers face with debt collection agencies across America.

Encore Capital Group is the most complained-about debt collection company.

- Among complaints published in the CFPB’s Consumer Complaint Database as of April 2018, the companies that have received the most debt collection complaints are Encore Capital Group, Portfolio Recovery Associates, ERC, Citibank, and Synchrony Financial.

- The top 10 companies for debt collection complaints account for more than a fifth of all such complaints. Four of these companies – Encore Capital Group, Portfolio Recovery Associates, Citibank and Transworld – have been the subject of CFPB enforcement actions for deceptive or illegal debt collection activities.[1]

Georgia leads all states in debt collection complaints per capita.

- The states with the most debt collection complaints per capita are Georgia, Delaware, Florida, Nevada and Maryland. Washington, D.C., has more complaints per capita than any state, possibly due to local familiarity with the CFPB.

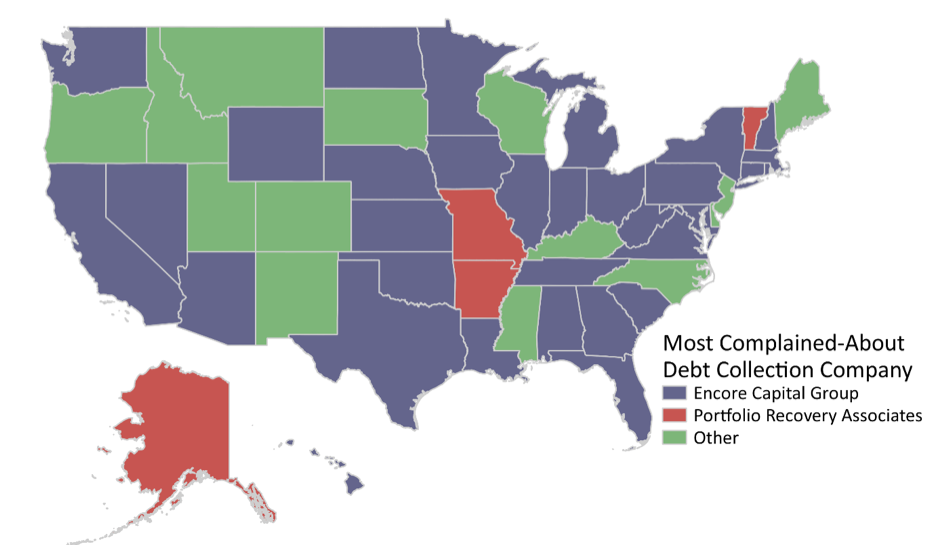

- Encore Capital Group, the nation’s most complained-about debt collection company, is also the most complained-about company in 32 states and Washington, D.C. Portfolio Recovery Associates is the most complained-about company in four states.

With a Senate-confirmed consumer champion at its helm, the CFPB can be a powerful ally for American consumers, giving consumers recourse when they are wronged and helping to create a fair marketplace for financial services.

Under the Trump administration, the CFPB’s future has been put at risk, and its ongoing efforts to protect consumers have been severely hampered. To ensure American consumers are protected in the financial marketplace, the president should swiftly nominate a consumer champion to the director position of the CFPB. Policymakers should oppose attempts to defund or defang the CFPB, even if recommended by its acting director.

To fulfill its mission of protecting consumers, the CFPB should:

- Reinstate all delayed or terminated rulemakings, investigations and enforcement actions.

- Complete a strong debt collection rule improving protections for consumers.

- Maintain public access to a vibrant, transparent and complete consumer complaint database that encourages consumers, competitors, academics, other researchers and the complained-about companies themselves to study ways to make the marketplace work better.

- Resume monthly publication of consumer complaint analyses and include data on complaints by company.

Figure ES-1. Encore Capital Is the Most Complained-About Company in 32 States

[1]Encore Capital Group and Portfolio Recovery Associates: Consumer Financial Protection Bureau, CFPB Takes Action Against the Two Largest Debt Buyers for Using Deceptive Tactics to Collect Bad Debts, 9 September 2015, archived at http://web.archive.org/web/20180405103809/https://www.consumerfinance.go… Citibank: Consumer Financial Protection Bureau, CFPB Orders Citibank to Pay $700 Million in Consumer Relief for Illegal Credit Card Practices, 21 July 2015, archived at http://web.archive.org/web/20180305042053/https://www.consumerfinance.go… Transworld: Consumer Financial Protection Bureau, CFPB Takes Action Against National Collegiate Student Loan Trusts, Transworld Systems for Illegal Student Loan Debt Collection Lawsuits, 18 September 2017, archived at http://web.archive.org/web/20180329112110/https://www.consumerfinance.go….

Topics

Authors

Ed Mierzwinski

Senior Director, Federal Consumer Program, U.S. PIRG Education Fund

Ed oversees U.S. PIRG’s federal consumer program, helping to lead national efforts to improve consumer credit reporting laws, identity theft protections, product safety regulations and more. Ed is co-founder and continuing leader of the coalition, Americans For Financial Reform, which fought for the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, including as its centerpiece the Consumer Financial Protection Bureau. He was awarded the Consumer Federation of America's Esther Peterson Consumer Service Award in 2006, Privacy International's Brandeis Award in 2003, and numerous annual "Top Lobbyist" awards from The Hill and other outlets. Ed lives in Virginia, and on weekends he enjoys biking with friends on the many local bicycle trails.

Find Out More

Safe At Home in 2024?

What the California Consumer Privacy Act means for you

What the New Jersey Privacy Act means for you