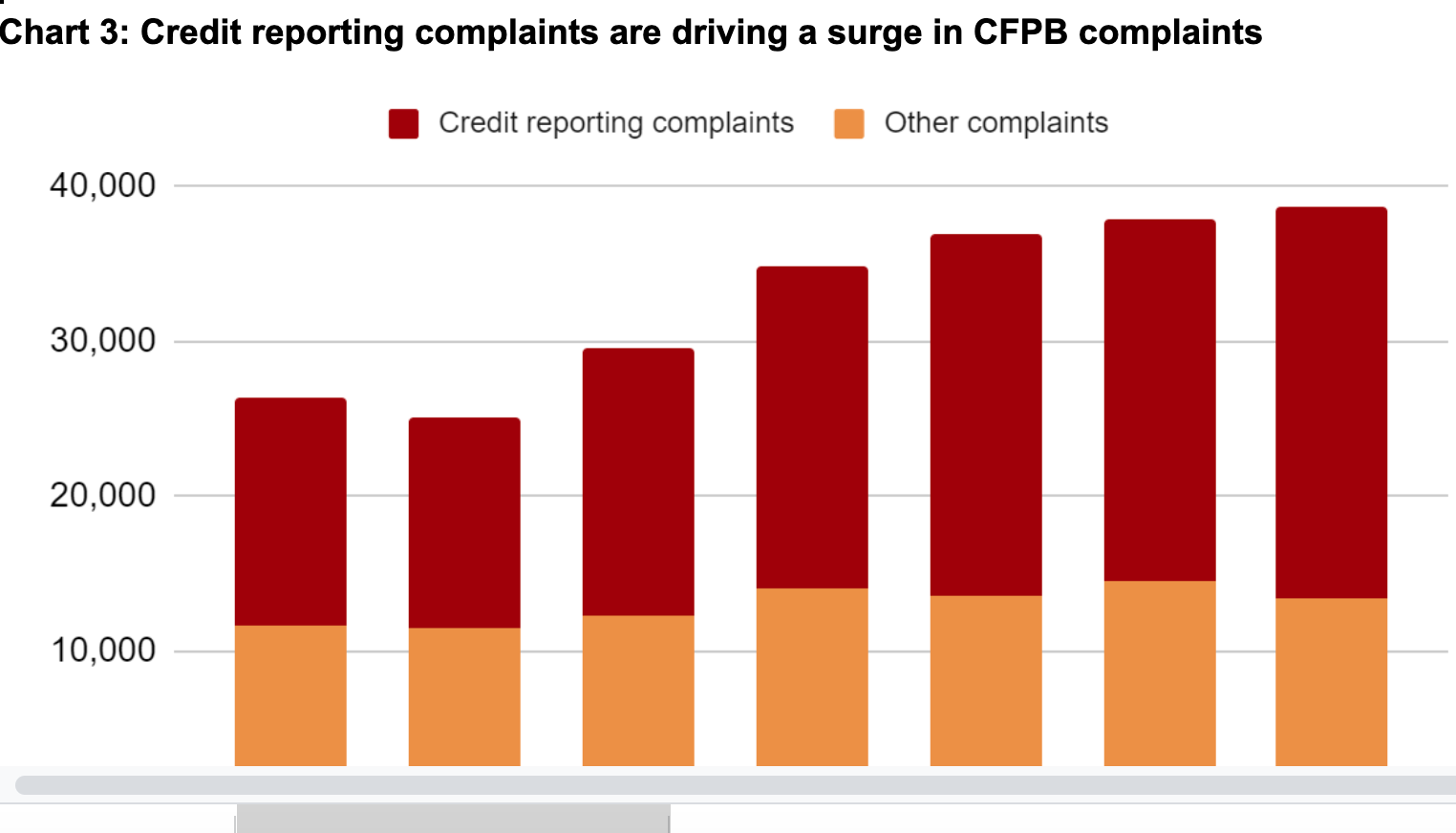

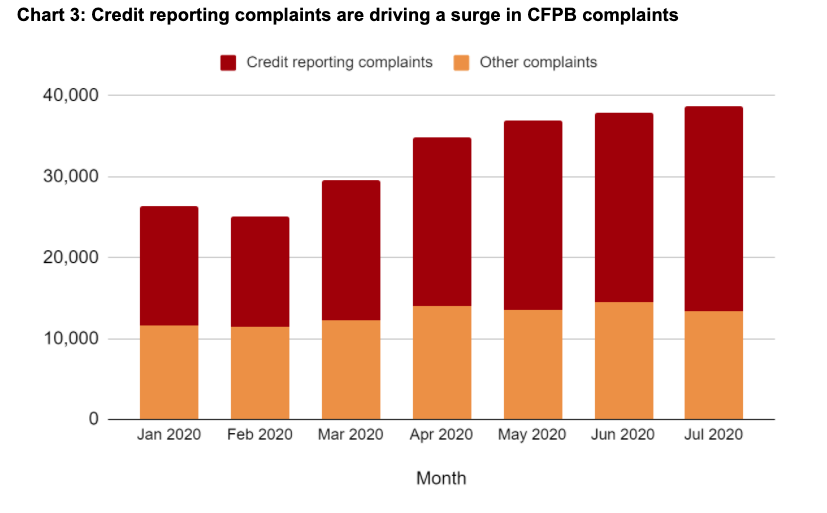

Analysis: CFPB Complaints Surge During Pandemic, Led By Credit Report Complaints

For the fifth consecutive month, consumer complaints to the CFPB set a new monthly complaint volume record in July, according to an analysis by U.S. PIRG and the Frontier Group. This snapshot focuses on spikes in complaints about credit reporting. While credit reporting complaints have always been among the leading complaint categories, during the pandemic the total number of credit reporting complaints has surged by 86 percent. As a percentage of overall complaints, they accounted for 65 percent in July, compared to 54 percent in February.

For the fifth consecutive month, consumer complaints to the CFPB set a new monthly complaint volume record in July, according to an analysis by U.S. PIRG and the Frontier Group. This snapshot focuses on spikes in complaints about credit reporting. While credit reporting complaints have always been among the leading complaint categories, during the pandemic the total number of credit reporting complaints has surged by 86 percent. As a percentage of overall complaints, they accounted for 65 percent in July, compared to 54 percent in February.

The accuracy of credit reports is important because consumer reporting agencies act as gatekeepers to financial or employment opportunities. Few creditors will issue credit without reviewing a credit report or credit score derived from it. Increasingly, employers, landlords and insurers also now use credit reports.

Topics

Find Out More

What the California Consumer Privacy Act means for you

What the New Jersey Privacy Act means for you