Ringing in Our Fears

One year after new law, robocalls are down and compliance is up, but skyrocketing robotexts are the latest problem

Riley Williams II thought the year-old federal law that was supposed to reduce scam robocalls was working alright. For the last year, the Oklahoma pharmacist had been getting only four or five calls a week on his cell phone marked as “scam likely.” He never answered them. They often didn’t leave messages.

But in the last month, the volume has doubled or tripled, to 10 to 15 robocalls per week. And they’re leaving messages: It’s someone asking whether he wants to sell his house (or more likely defraud him). His bank account needs attention. (Yeah, sure.) Some of the messages are in Chinese, which he doesn’t speak.

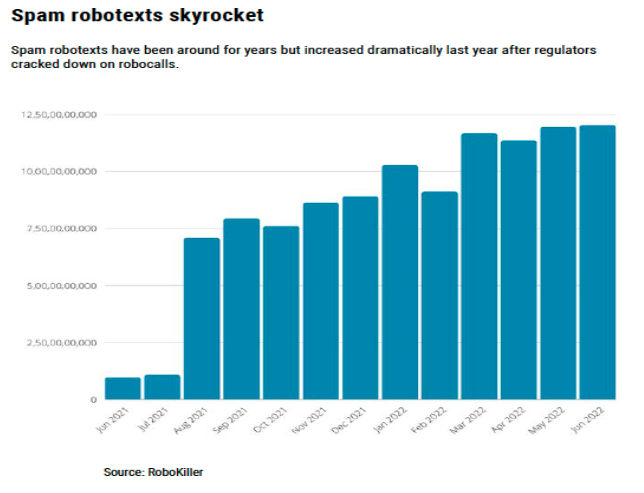

Williams has also seen a similar increase in robotexts, which aren’t directly covered by the federal law that took effect on June 30, 2021.

The calls and texts are annoying. They’re time-suckers. He wants them to stop.

Don’t we all.

Meanwhile, Bill Rucki of Ohio has enjoyed more consistent improvement. The retired electrical engineer used to get 10 to 20 spam robocalls a day on his cellphone last year and about the same volume on his home phone. Now he’s down to one or two a day on his cell and a half-dozen on his landline. “It’s been in the last six months that I really noticed it,” he says happily.

While even one unwanted call is bad, there indeed is some good news in this years-long effort by regulators and lawmakers to fight one of American consumers’ biggest problems:

-

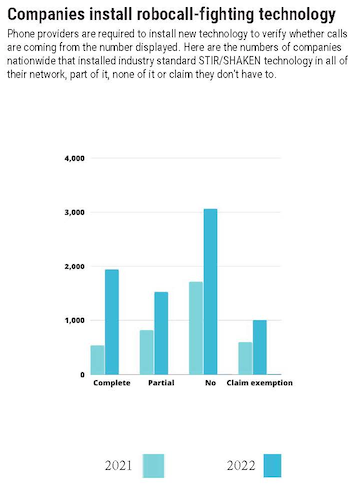

The number of voice providers that have installed the preferred robocall-blocking technology has nearly quadrupled since last year, according to U.S. PIRG Education Fund’s new analysis of the Federal Communications Commission’s robocall database.

-

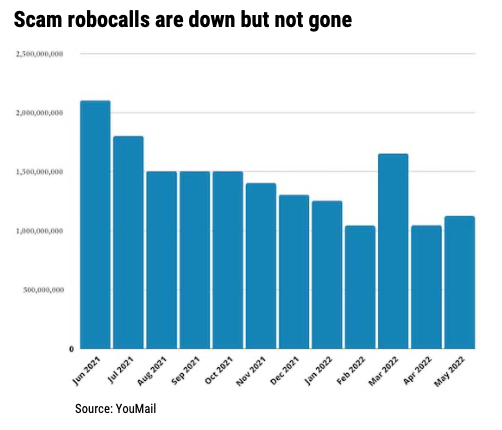

Scam robocalls nationwide have declined by about 47 percent since last June, according to YouMail, one of the largest robocall- and robotext-blocking companies in the United States.

-

More cellphone and home phone companies are filtering calls and offering customers new services such as flagging suspicious calls to give the receiver the choice of answering, sending them to voicemail or blocking them.

-

Regulators are requiring phone companies that serve as “gateway” providers – which often funnel scam calls from overseas – to do more to block them.

-

Regulators are requiring smaller phone providers, which didn’t have to follow the robocall technology rules last year, to now comply just like large companies. All 50 attorneys general last year pushed the FCC to crack down on small companies, which originally had exemptions until June 2023, because scam callers were leveraging the income-hungry small providers to bypass technology installed by large companies.

- The FCC has started partnering with state attorneys general on robocall investigations, sharing information and using the criminal enforcement powers of states, which often can respond more nimbly. Just two weeks ago, the FCC and the Ohio attorney general worked together to go after one robocall operation that they allege is responsible for 8 billion illegal robocalls since 2018, most about auto warranties.

- The Federal Communications Commission (FCC) has taken enforcement actions against two companies on grounds they didn’t install the required Caller ID technology last year. It’s only two out of hundreds who may not be complying, but it’s a step.

Here’s a recording of a tax debt robocall that is common right now. (Courtesy of Nomorobo.)

Topics

Authors

Teresa Murray

Consumer Watchdog, U.S. PIRG Education Fund

Teresa directs the Consumer Watchdog office, which looks out for consumers’ health, safety and financial security. Previously, she worked as a journalist covering consumer issues and personal finance for two decades for Ohio’s largest daily newspaper. She received dozens of state and national journalism awards, including Best Columnist in Ohio, a National Headliner Award for coverage of the 2008-09 financial crisis, and a journalism public service award for exposing improper billing practices by Verizon that affected 15 million customers nationwide. Teresa and her husband live in Greater Cleveland and have two sons. She enjoys biking, house projects and music, and serves on her church missions team and stewardship board.

Find Out More

Apple AirPods are designed to die: Here’s what you should know

A look back at what our unique network accomplished in 2023

Avoiding scams, incorrect medical bills, privacy invasions and more