Stay Up To Date

Join our network and stay up to date on our campaigns, get important consumer updates and take action on critical issues.

How states rate in providing online access to government spending data: Economic development subsidies edition

A report created by U.S. PIRG Education Fund and Frontier Group

R.J. Cross and Linus Lu, Frontier Group, and Andre Delattre, U.S. PIRG Education Fund

DOWNLOAD THE REPORT

The ability to see how taxpayer money is spent is fundamental to democracy. Over the last decade, states across the country have taken steps to make detailed information about government spending readily available online — enabling citizens to hold government officials accountable for making smart decisions, prevent corruption and affect how government dollars are spent.

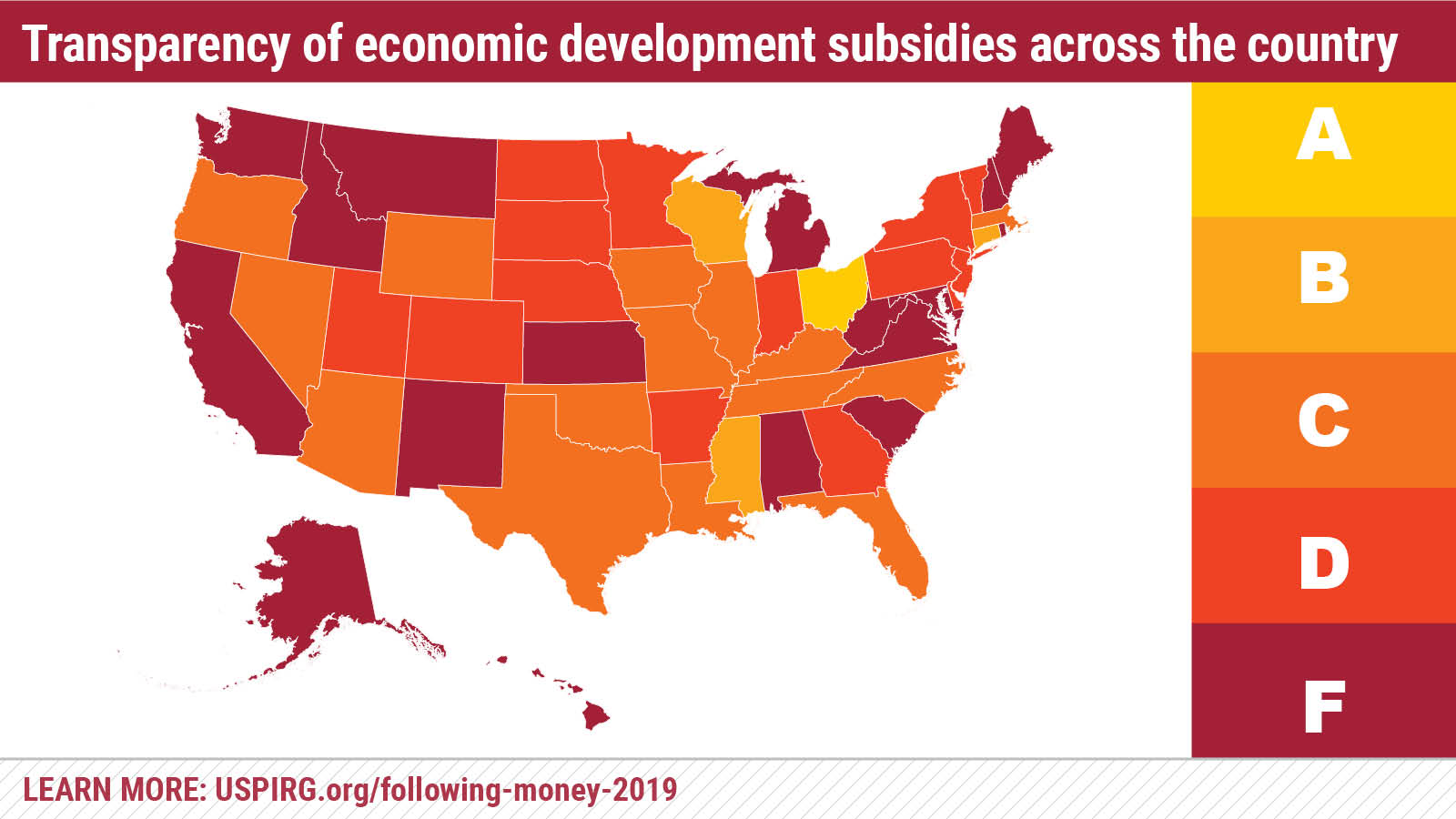

When it comes to government spending on economic development subsidies, however, citizens in many states remain in the dark. Following the Money 2019 — our 10th annual report on government spending transparency — rates all 50 states on the degree to which they make information about corporate tax breaks and other subsidies available online.

What is an economic development subsidy and why should I care?

Economic development subsidies represent a large and growing form of public spending — totaling more than $70 billion a year. These subsidies are awarded to private companies in an effort to stoke investment and job creation, and they come in a dizzying array of forms, from tax breaks for the filming of a movie on location to direct cash grant payments subsidizing the construction of a new sports stadium. These subsidies are often combined in mega-packages designed to lure large corporations to set up shop in an area.

To prevent corruption and ensure government accountability, all public expenditures need to be transparent, and that includes spending to lure businesses to a city or state.

The majority of states, however, struggle to meet even minimum standards of online transparency for economic development subsidies — leaving residents, watchdogs and public officials in the dark about how billions of taxpayer dollars are spent.

How does our state compare when it comes to economic development transparency?

Following the Money 2019 shows that many states fail to disclose even basic information about economic development subsidies to the public in a timely manner, much less provide that information online in an accessible format. More than one-third of states received an “F” for their transparency efforts.

• Only one state, Ohio, is a “Leading State” (“A” range) for economic development transparency, providing citizens with an acceptable and consistent level of information about economic development subsidies across a number of formats, with access to that information guaranteed by law.

• Three states are “Advancing States” (“B” range). These states include itemized grant payments to companies in their online spending portals, and most publish an annual report detailing statewide spending on economic development grants.

• Fifteen states are “Middling States” (“C” range). These states fulfill the most basic and important modern transparency requirement by including payments made by the primary economic development agency in the state’s transparency checkbook portal. However, only seven of these states provide both the projected and actual benefits of subsidy payments and only nine publish an annual tax expenditure report.

• Fourteen states are “Lagging States” (“D” range). Economic development subsidy reporting in these states fails to provide critical information to citizens in a readily accessible format.

• Over a third of the states (17) are “Failing States” (“F” range) and do not meet even basic standards of online spending transparency for economic development subsidies. Only 10 of these states publish any kind of annual grants report, while only two include grant payments made by the primary economic development agency in the state’s online checkbook.

How can our state improve transparency for economic development subsidies?

All 50 states can take steps toward improving the transparency of their economic development subsidy programs. To ensure transparency and accountability of economic development spending, states should prioritize the following actions:

• States should publish an annual tax expenditure report detailing the impact of tax credits, exemptions and deductions on the state budget and make it available online.

• Every state should publish a comprehensive annual report that details economic development spending across all agencies, programs and funds to provide a statewide view of how much these expenditures cost and the benefits they have delivered.

• States should include economic development subsidy payments in the online checkbook portals they use to report other state spending. Each payment should specify the name of the recipient company and be identifiable as a payment for economic development. Excellent portals will additionally allow users to search and sort the data by program and fund.

• States should publish information on both projected and actual benefits associated with specific economic development subsidies received by specific companies.

• Provisions for online reporting of economic development subsidies should be included in state statutes, and state public records laws should guarantee public access to information about economic development subsidy programs.

Join our network and stay up to date on our campaigns, get important consumer updates and take action on critical issues.

Sign Up