Deirdre Cummings

Legislative Director, MASSPIRG

617-747-4319

[email protected]

Legislative Director, MASSPIRG

617-747-4319

[email protected]

Study: CFPB complaints shattered records in 2020, exposing how the COVID-19 pandemic battered consumer finances

Confirmation of President Biden’s nominee Rohit Chopra will pivot agency back to only job: protecting consumers

Boston — Consumer complaints about problems with financial companies such as banks, credit bureaus and debt collectors rose by more than 50 percent in 2020 and set new records for each month of the year, according to a new report from the MASSPIRG Education Fund. The report, Consumers In Peril, which analyzed complaints received by the Consumer Financial Protection Bureau (CFPB), was released Monday to kick off National Consumer Protection Week.

More than half of total complaints to the CFPB were grievances against the Big 3 credit reporting agencies; the firms Experian, TransUnion and Equifax, in that order, led complaints against all companies. Overall, the number of complaints about credit reporting doubled in 2020, demonstrating what a headache this industry causes for Americans.

“Mistakes in credit reports lead to lower credit scores and denial of credit, housing or employment, but under President Trump, the CFPB gave the credit bureaus a free pass from handling consumer disputes in a timely manner,” said Deirdre Cummings, MASSPIRG Education Fund’s Consumer Program Director. “That hands-off approach couldn’t have happened at a worse time. It exacerbated family finance problems during a pandemic that had already left many consumers teetering on the edge of financial ruin.”

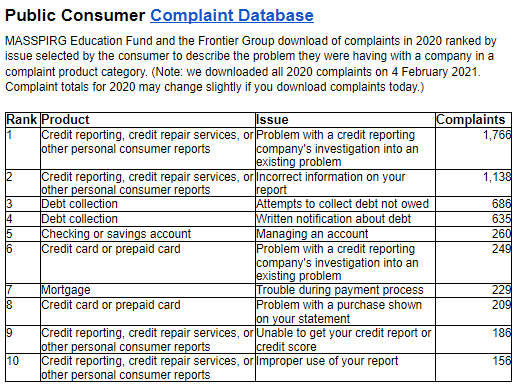

The report also ranked the Top Ten issues Massachusetts consumers complained to the CFPB about. The Number 1 problem in Massachusetts was with the credit reporting company’s investigations into existing problems. The second most complained about issue was incorrect information in consumer credit reports.

The report recommends numerous remedies to Congress and the CFPB, including three key steps to take immediately: mitigating the financial harms posed by the COVID-19 pandemic; rescinding the actions the Trump administration took to weaken CFPB rules against predatory payday lending; and rolling back Trump-era rules that allow debt collectors to harass debtors and other consumers.

“The surge in complaints is a signal of the strain the pandemic put on consumers, and of the minefield of tricks and traps they face in the financial marketplace,” said Gideon Weissman, Frontier Group analyst and report co-author. “Americans who share their stories are telling us exactly what kinds of help they need, and the CFPB would do well to start listening and responding.”

Currently, the CFPB has an acting director, Dave Uejio, while President Joe Biden’s nominee Rohit Chopra awaits confirmation.

“Dave Uejio has acted swiftly to get the CFPB back on track to protecting consumers,” concluded MASSPIRG Education Fund’s Cummings. “The next step is Senate confirmation of Rohit Chopra to direct the Bureau. Chopra helped build the CFPB from the start and he is the right person Americans need in the driver’s seat.”

See full week of consumer news and tips for consumer protection week.