Deirdre Cummings

Legislative Director, MASSPIRG

617-747-4319

[email protected]

Legislative Director, MASSPIRG

617-747-4319

[email protected]

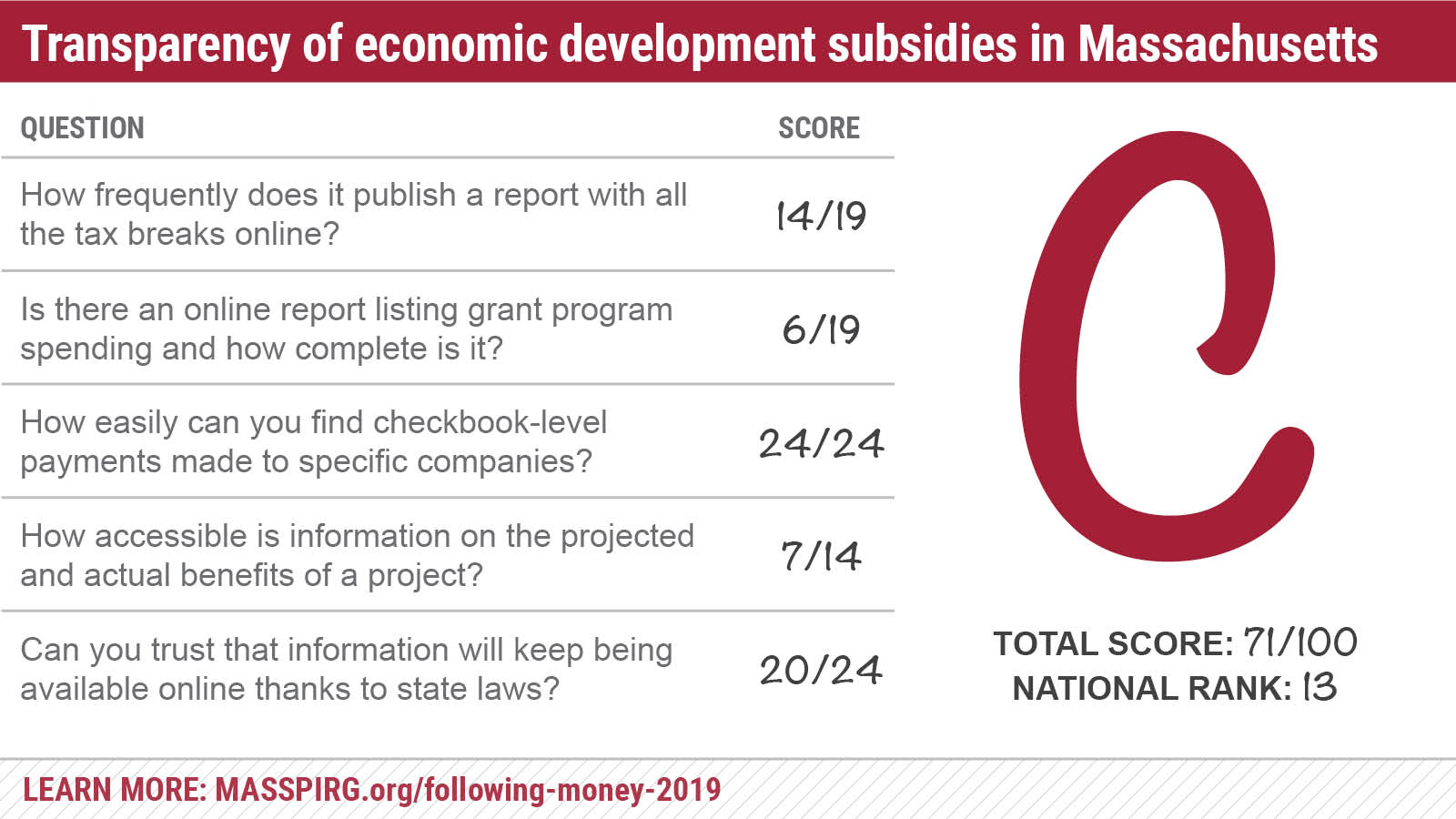

Report: MA gets a “C” for economic development transparency

More than a third of states received an “F”

Boston — Massachusetts received a “C” for making critical information about how governments are subsidizing business projects with taxpayer dollars readily available to the public online, according to a new report from MASSPIRG Education Fund and Frontier Group. Following the Money 2019, the organization’s tenth evaluation of online government spending transparency, gives 17 states a failing grade, while only four states received a grade of “B” or higher.

Massachusetts received a “C” grade because while the state has a good, 21st century on-line state spending portal that details at least some checkbook-level subsidy payments, and also publishes an annual tax expenditure report online, Massachusetts fell short on providing a fully comprehensive view of all subsidy spending in the state. It also fell short in consistently providing the commitments made by companies in exchange for subsidy payments, and the outcomes once companies received that money.

“As taxpayers, we should not only be able to see how government spends our money, but we should also be able to evaluate the impact of that spending,” said Deirdre Cummings, Consumer Program Director for MASSPIRG Education Fund. “That must include the millions of dollars that state and local governments give away each year to lure businesses into their backyards.”

U.S. PIRG Education Fund and Frontier Group’s Following the Money reports have evaluated states on online spending transparency since 2010. While many states have made progress towards providing citizens access to government spending information online, this year’s report finds economic development reporting is still lagging behind.

Massachusetts recently passed a law that established the Tax Expenditure Review Commission under the Department of Revenue to “review each tax expenditure every five years and evaluate its purpose, intent, goal, and effectiveness”. “Hopefully, this can be the opportunity to provide a meaningful, comprehensive review of all our economic development investments,” said Cummings.

“It’s often easier for citizens to see when a state hands a company $50 for printer ink than when it hands a company a million dollars to relocate its headquarters,” said R.J. Cross, report lead author and policy analyst at Frontier Group. “States have moved light years ahead in the last decade when it comes to providing information on basic government spending online. But when it comes to economic development subsidies, most are still in the dark ages.”

The report graded each state’s transparency efforts from “A” to “F” based on the availability of online reports detailing how much the state spends through tax breaks and direct grant programs; the availability of information on individual payments to companies on the state’s transparency site; and the existence of state laws that require ongoing reporting of information on economic development subsidies to the public.

“Transparency checks corruption and enables citizens to hold their elected officials accountable,” finished Cummings. “Without access to information, it’s impossible to know how fully these corporate subsidies are serving the public’s interest.”

To read the full report and see the full list of rankings: https://masspirg.org/reports/map/following-money-2019

###-###-###