Media Contacts

Consumer Program Director, MASSPIRG Education Fund

617-747-4319

[email protected]

BOSTON — Complaints to the U.S. Consumer Financial Protection Bureau about credit reporting problems nearly doubled from 2021 to 2022, according to an analysis released Thursday by the MASSPIRG Education Fund. At the top of this dubious list: the so-called “Big 3” credit bureaus — TransUnion, Equifax and Experian — received more complaints than any other financial firms in 2022.

“These record credit reporting complaints show that consumers are frustrated with a system that won’t let them show their true qualifications to prospective creditors, employers or landlords,” said Deirdre Cummings, consumer program director with MASSPIRG Education Fund. “Americans describe a system rigged against them in the stories they file into the CFPB database.”

Among the key findings of the report, “Big Credit Bureaus, Record Complaints: a look at increases in CFPB consumer complaints 2021-2022:”

- Complaints against the Big 3 credit bureaus totaled 69% of all complaints in 2022. The Top Ten most-complained-about companies totaled 78% of all complaints.

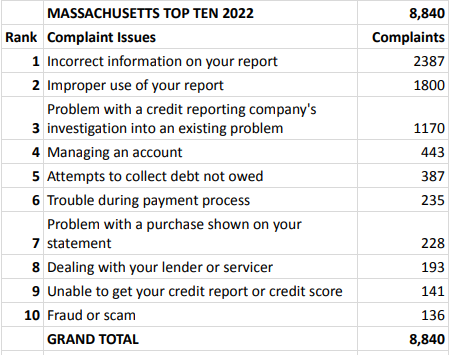

- In Massachusetts, the top 3 most complained about issues were incorrect information on credit report; improper use of credit report; problem with the credit reporting company’s investigation in an existing problem.

- The CFPB compiles complaints in nine product categories. Complaints in the eight categories besides credit reporting rose slightly from 2021 to 2022, led by more complaints regarding student loans, checking and savings accounts and credit card or prepaid card complaints.

- New financial technologies cracked the Top Ten. The 10th-most common national complaint was “frauds and scams” in the digital wallet, virtual currency and credit repair sub-product categories.

MASSPIRG Education Fund based its analysis on a study of complaint totals in the CFPB’s public consumer complaint database. To aid consumers, reporters and others, PIRG is also releasing a short video showing how easy it is to use the database.

Thursday’s report is Part 1 of a 2-part series on the CFPB. This report discusses problems. The upcoming report discusses solutions. Next Thursday, March 16, we will release “Watching Wall Street: Top 20 Actions the CFPB Took in 2022 Making the Marketplace Safer for Consumers.”

“For the CFPB to do its only job, protecting consumers, as effectively as possible, it’s important to hear directly from people what’s going wrong,” said Cummings. “The complaints in this database act like an alarm system. When the CFPB reads them, it’s alerted to problems, who the culprits are and what actions it needs to take.”

Photo by TPIN staff | TPIN

More information on MA top ten complaints is here.