Will Congress fix credit report problem CFPB won’t?

Our latest report, last week, found July set yet a fifth consecutive month of record consumer complaints to the CFPB. Complaints about credit report mistakes, always among the leaders, have surged dramatically during the pandemic. The CFPB hasn't done anything about it, but Congress has an opportunity in its next relief package to ban negative credit reporting.

Our latest report, last week, found that July set yet a fifth consecutive month of record consumer complaints to the CFPB. Complaints about credit report mistakes, always among the leaders, have surged dramatically during the pandemic. The CFPB hasn’t done anything about it, but Congress has an opportunity in its next relief package to ban negative credit reporting.

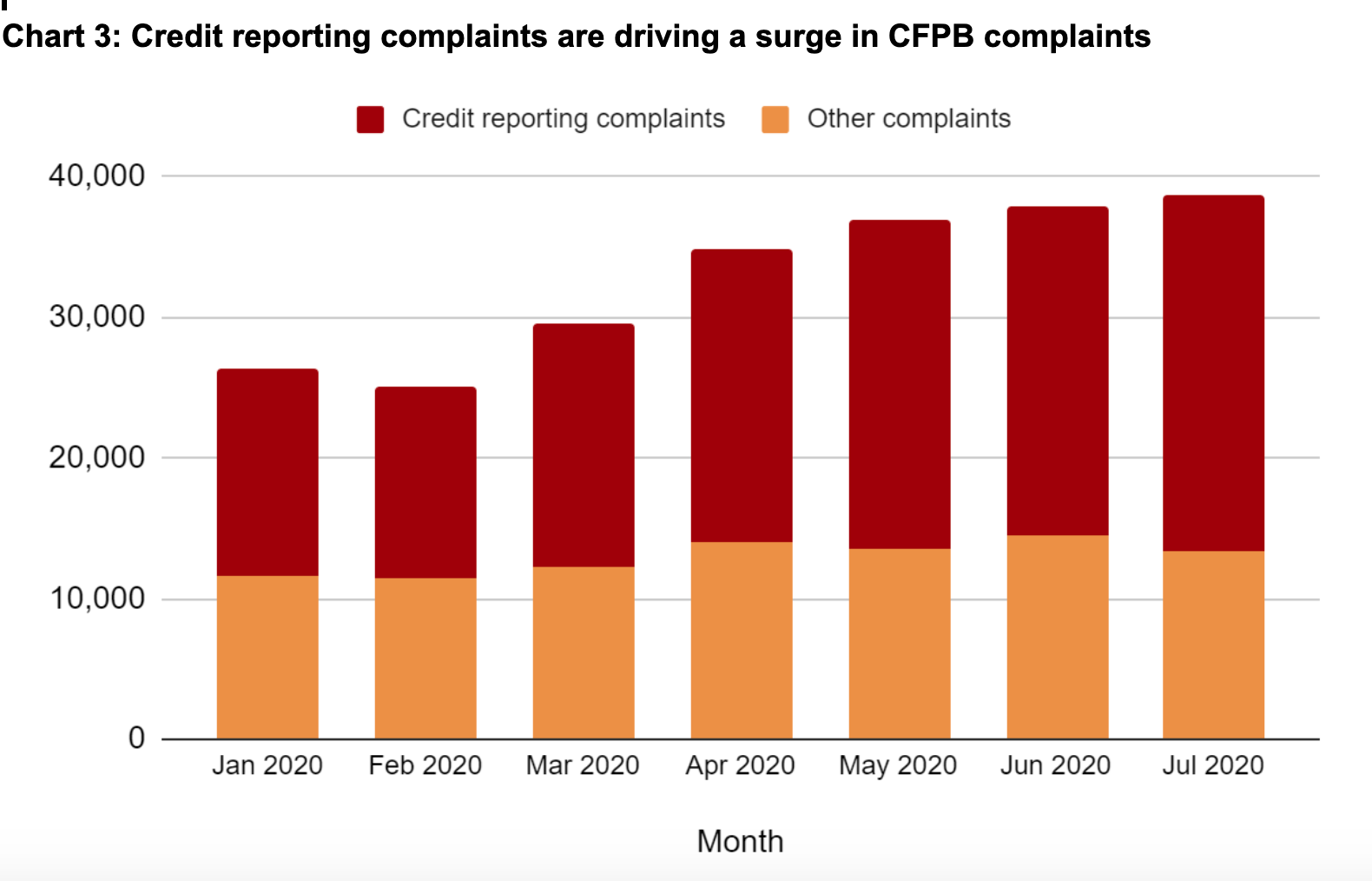

Yup, I’m still reading the CFPB’s mail. The numbers are astonishing. For the fifth consecutive month, in July a record number of consumers filed complaints recorded in the CFPB’s public consumer complaint database. Complaints since the national onset of the COVID-19 pandemic (March-July 2020) are up 50 percent over the same five-month period in 2019.

And while credit reporting always has been among leading complaint categories, during the pandemic the total number of credit reporting complaints has surged by 86 percent.

As a percentage of overall complaints, credit reporting accounted for 65 percent in July, compared to 54 percent in February. See last week’s analysis by U.S. PIRG and the Frontier Group.

As my Frontier Group colleague Gideon Weissman said in our release: “The record level of consumer complaints is a blaring red light signaling the huge challenges consumers are facing during the COVID-19 emergency.”

That blaring red light should be flashing 24/7 on a computer screen in CFPB Director Kathy Kraninger’s office. If it is, she’s ignoring it. In fact, early in the pandemic, her only public response was to issue a policy guidance telling the credit bureaus she wouldn’t enforce the law if they failed to comply with its reinvestigation deadlines for consumer disputes.

Millions of consumers have lost jobs or income and are choosing between paying credit card bills or feeding their families. Worse, many temporary pandemic protections against falling off a financial cliff recently expired. Consumers are being pushed toward that cliff while the Senate and administration dither. The House has passed the Heroes Act, HR6800, which would extend many protections against unfair financial practices, including to ban both debt collection and negative credit reporting during the pandemic.

Instead of banning negative credit reporting, the CARES Act, which became law in March, included an inadequate provision demanded by the banks and credit bureaus. If a lender grants a voluntary “accommodation,” such as a temporary forbearance, to a consumer in good standing, a “natural disaster” code is supposed to be added to their credit report. There are major problems with this provision. It only helps consumers in good standing, then only if they receive a discretionary accommodation, then if the underpaid frontline call center worker codes it correctly to the credit bureau and then if the user of the credit report accounts for it correctly. (A consumer already delinquent who obtains an accommodation is eligible for a disaster code, but willl continue to be reported as delinquent.)

A consumer advocate explains why the very concept won’t work in the American Prospect story, “The Coronavirus Will Ruin Your Credit Score:”

“Consumers that lose their jobs or are economically devastated from COVID, their inability to pay bills isn’t meaningful at a time like this,” says Chi Chi Wu, an attorney at the National Consumer Law Center. “Nothing going on is a good reflection of the creditworthiness of borrowers.” But because of the seven-year term for negative credit items, the hit would stay with them until 2027, harming their ability to move through financial life because of something completely out of their control.”

That story by David Dayen also quotes from an online speech by Senator Sherrod Brown (OH), chief sponsor of Senate efforts to ban negative credit reporting:

“We thought we had it, we thought we were very close, and then [Senate Majority Leader Mitch] McConnell stripped it out at the behest of the junior senator from Pennsylvania,” he said. That refers to [Sen. Pat] Toomey, an executive at two different banks before entering politics. Toomey, a senior member of the Senate Banking Committee who would be in line to become the chair if Republicans retain the Senate in the November elections, has long been a major recipient of banking industry cash.”

The House-passed Heroes Act (HR6800) would amend the CARES Act (Section 110401) to ban negative credit reporting during a natural disaster, including the pandemic. The section also prohibits the use of new credit scoring models that would “identify a significant percentage of consumers as being less creditworthy than previous models.”

This group letter to Congress explains the Heroes Act’s ban on negative credit reporting in detail. This broader group letter to Congress explains other provisions, including banning debt collection, for the next relief package supported by the coalition Americans for Financial Reform, the state PIRGs and other leading consumer and civil rights groups.

Of course, banning negative credit reporting is a narrow, pandemic-related response to the myriad credit bureau problems consumers face. This recent post explains two bills passed by the House that offer comprehensive and complementary long-term solutions to the credit reporting debacle.

Will Congress fix the credit reporting problems CFPB won’t? Only if it listens to consumers and stops pandering to banks and credit bureaus.

Topics

Authors

Ed Mierzwinski

Senior Director, Federal Consumer Program, PIRG

Ed oversees U.S. PIRG’s federal consumer program, helping to lead national efforts to improve consumer credit reporting laws, identity theft protections, product safety regulations and more. Ed is co-founder and continuing leader of the coalition, Americans For Financial Reform, which fought for the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, including as its centerpiece the Consumer Financial Protection Bureau. He was awarded the Consumer Federation of America's Esther Peterson Consumer Service Award in 2006, Privacy International's Brandeis Award in 2003, and numerous annual "Top Lobbyist" awards from The Hill and other outlets. Ed lives in Virginia, and on weekends he enjoys biking with friends on the many local bicycle trails.

Find Out More

Apple AirPods are designed to die: Here’s what you should know

New report reveals widespread presence of plastic chemicals in our food

Consumers call on Meta to protect kids’ safety in Quest virtual reality