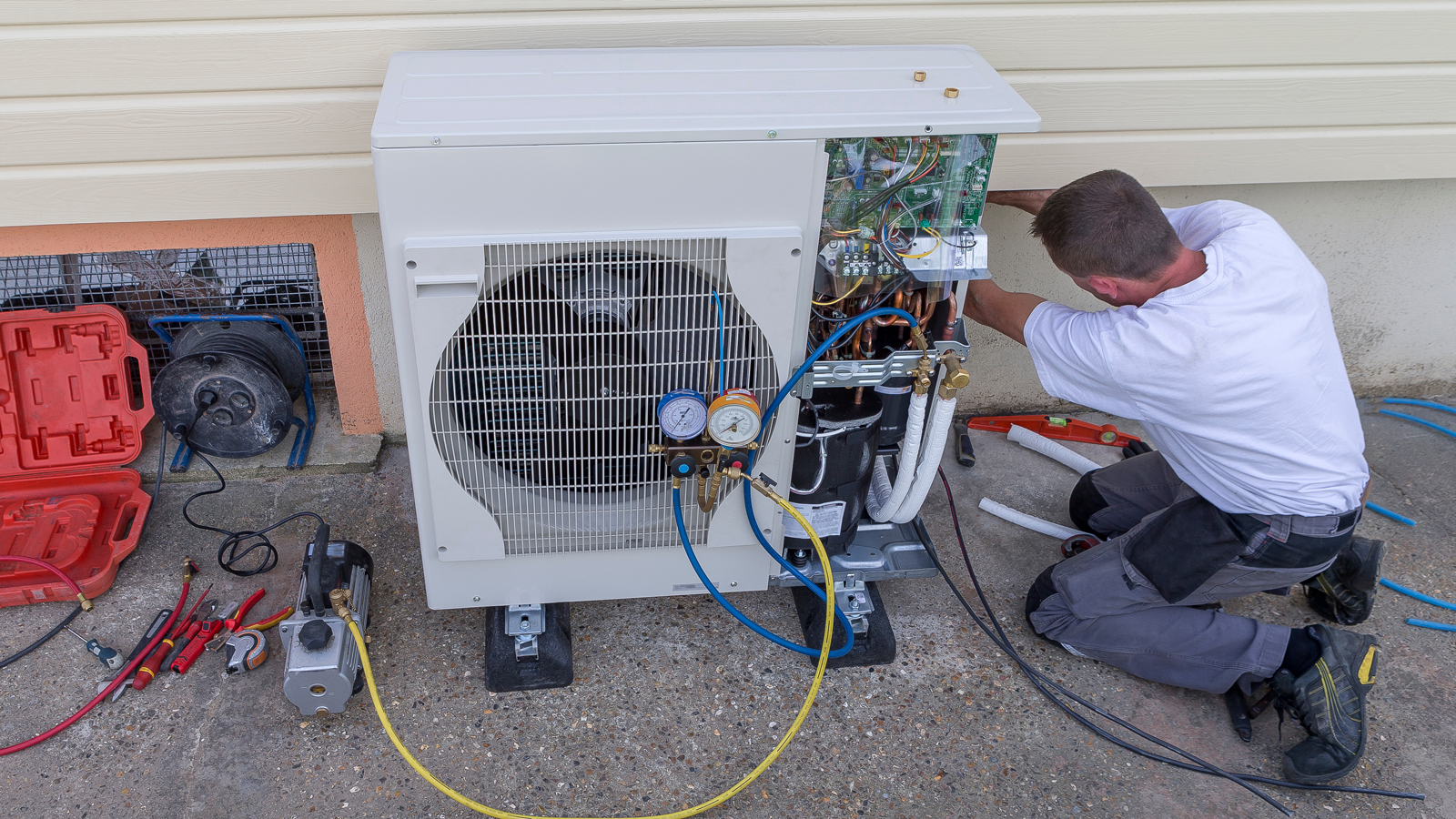

Heat pumps: how federal tax credits can help you get one

Learn more about heat pumps and how new federal clean energy tax credits can help you install one in your home.

Heating and cooling our homes is energy intensive. In most homes, space heating is the biggest use of energy and water heating is the second.

Heat pumps are more efficient heating and cooling systems that can temperature regulate your home, heat your water and even dry your clothes more efficiently than other technologies.

If you have an electric furnace or electric baseboard heating, switching to a heat pump can reduce electricity consumption by about 50 percent. And, if like three-of-out-every-four Americans, your home uses fossil fuels to heat the rooms in your home or your water, switching to electric heat pumps could reduce that energy use. Less energy consumption means less pollution. And because heat pumps can run on renewable energy like solar, this could result in even greater reductions in climate harming pollution.

To help the country and individuals move away from fossil fuels, the federal government included tax credits in the Inflation Reduction Act that can help cover the cost of purchase and installation of heat pumps and other energy saving appliances. We’ve created a comprehensive guide, called the Clean Energy Home Toolkit, if you want to learn about all the ways you can take advantage of those tax credits. We’ve pulled out the most commonly asked questions about heat pumps, and answered them below.

Why get a heat pump?

Heat pumps are 3-5 times more efficient than most current fossil fuel heating systems, saving you money on your utility bill and doing less harm to the environment.

According to data from the National Renewable Energy Laboratory, switching to a heat pump can reduce annual heating and cooling bills anywhere from $100 to $1,300 per year with the average homeowner saving $667 per year by switching to a heat pump.

Because heat pumps can use renewable energy to generate electricity, heat pumps are climate-friendly, too.

Environment America Research & Policy Center’s report, Electric Buildings 2021, found that electrifying the majority of America’s buildings by 2050 could reduce net greenhouse gas emissions by about 306 million metric tons of carbon dioxide in 2050.

That is the equivalent of taking about 65 million of today’s cars off the road – almost three times the number of vehicles in Texas.

How do heat pumps work to heat and cool my home?

Heat pumps act as both air conditioners and heating units for your home. There are two types of pumps: central-style heat pumps that utilize your ductwork and mini-split units that can be installed in a wall or as window units.

When heat pumps are in air conditioning mode, they use low-pressure fluid to suck the heat out of your home and dump that excess heat into the air outside. As a heating unit, it pulls in warm air to heat your home. The heat pump switches back and forth if it’s in heating or air conditioning mode.

Heat pumps are so energy efficient because they move existing heat around to regulate temperatures. Instead of burning a fossil fuel like natural gas to create heat and blow that throughout your house, heat pumps are concentrating and moving heat throughout your home, which takes a lot less energy to do.

Can I get a tax incentive or rebate to help pay for a heat pump?

When it comes to paying for your heat pump, there are two ways the Inflation Reduction Act can help: tax credits and rebates.

Tax credits for heat pumps: If you install an efficient heat pump between now and 2032, you are eligible for a federal tax credit that will cover 30% up to $2,000 of the heat pump cost and installation. This tax credit is capped at $2,000 per year, so if you are considering multiple energy upgrades you can maximize the incentives by spacing out your energy efficiency home improvements across years.

There is no income limit for the IRA tax credits- the only qualification required is that you have tax liability. Later this year, there will also be rebates aimed at lower and middle income homeowners, set up by the states.

To qualify for the IRA tax credit, heat pumps and heat pump hot water heaters must meet efficiency requirements, and be in the Consortium for Energy Efficiency’s highest non-”advanced” tier.

Rebates for heat pumps: If you meet the household income requirements, you may also be able to use rebates to get a heat pump. The rebates will all go through the state governments — thus, it’ll vary from state to state what agency is administering those rebates.

Rebates could cover as much as $8,000 for heating and cooling heat pumps and $1,750 for heat pump water heaters.

If your household income is less than 80 percent of your state’s median household income, you are eligible for 100 percent of the rebates available. If you purchase both a heat pump and a heat pump water heater, you can receive up to $9,750 back. If your household income is between 80 and 150 percent of your state’s median household income, you can receive 50 percent of the rebates for a total of $4,875. If your household income is over 150% of your state’s median household income, you do not qualify for heat pump rebates.

- Home Heating and Cooling (HVAC) Heat Pump:

- 100% rebate (up to $8,000) for low income*

- 50% rebate for moderate income**

- 30% tax credit (up to $2,000) for higher income

- Hot Water Heat Pump

- 100% rebate (up to $1,750) for low income

- 50% rebate for moderate income

- 30% tax credit (up to $2,000) for higher income

- Electric Panel Upgrade

- 100% rebate (up to $4,000) for low income

- 50% rebate for moderate income

- 30% tax credit (up to $600) for higher income

- Electric Wiring

- 100% rebate (up to $600) for low income

- 50% rebate for moderate income

* Any household making less than 80 percent of AMI is considered low income

** Any household making between 80 and 150 percent AMI is considered moderate income

What kind of heat pump should I get?

There are lots of different heat pump sizes that can cover a whole range of home sizes and environments.

Depending on your home’s size and the climate you live in, the cost to install a heat pump before incentives can range from $3,500 to $35,000. It’s a good idea to get multiple quotes from several contractors to get a complete picture of your options.

When making any big purchase, check the warranty- the length of it and what it covers. EnergyStar, the Northeast Energy Efficiency Project, and Consumer Reports both offer resources that give more information about different heat pump brands and models. However, for the most part, the important things are making sure that you’re getting the heat pump that’s right for your home and climate, which is something you’ll want a trustworthy contractor’s help with.

Some heat pumps are super quiet, while others can be noisier. You should include noise in the criteria that you specify to the contractor.

When talking to a contractor, it’s good to ask if they have installed a heat pump before, if they have a customer reference, and if they have knowledge of concepts like energy efficiency and air sealing. It’s also good to check their license and see how long they’ve been operating.

If you are a renter, you can encourage your landlord or management company to invest in a heat pump or heat pump hot water heater by pointing out that, while there is an upfront cost, over time, they’ll be saving money on the property’s electric bill if they’re paying for utilities. If you and other renters are paying for utilities, a lower heating and cooling bill makes a home more attractive to potential tenants. If they install before 2032, they can also access the tax incentives to help cover up-front costs.

Does a heat pump work in cold climates?

Today’s cold-climate heat pumps can heat a home efficiently even when the temperature drops below -10 degrees Fahrenheit. Even at this temperature, cold-climate heat pumps are more energy efficient than furnaces and boilers.

In fact, one study in Providence, R.I., found that heat pumps not only held up in the crisp New England winters, but also saved consumers thousands of dollars compared to either propane or heating oil.

Do heat pumps help the environment?

Heat pumps are an environmentally friendly option for your home, helping us move away from fossil fuels to more renewable energy technologies. Space heating and cooling accounts for more than half of home energy use, so using an electric HVAC (heating, ventilation and air conditioning) system alone can make a big difference in transitioning America’s homes to run on clean energy.

We need to power more of the country with clean, renewable energy, and starting with your own home can have a big impact. But we all need to be on board, and big companies like Walmart, which have large, flat roofs, perfect for solar panels should do their part.

We are calling on Walmart to install solar panels on its superstores wherever viable, powering clean energy in communities across America and protecting our planet from fossil fuels.

You can support this effort by adding your name to our petition today.

For more information, visit our Clean Energy Home Toolkit, and find other resources about heat pumps on our website or by watching the video below.

Topics

Authors

Johanna Neumann

Senior Director, Campaign for 100% Renewable Energy, Environment America Research & Policy Center

Johanna directs strategy and staff for Environment America's energy campaigns at the local, state and national level. In her prior positions, she led the campaign to ban smoking in all Maryland workplaces, helped stop the construction of a new nuclear reactor on the shores of the Chesapeake Bay and helped build the support necessary to pass the EmPOWER Maryland Act, which set a goal of reducing the state’s per capita electricity use by 15 percent. She also currently serves on the board of Community Action Works. Johanna lives in Amherst, Massachusetts, with her family, where she enjoys growing dahlias, biking and the occasional game of goaltimate.

Andrea Laureano

Former Campaign Associate, Environment Texas Research & Policy Center

Matt Casale

Former Director, Environment Campaigns, PIRG

Find Out More

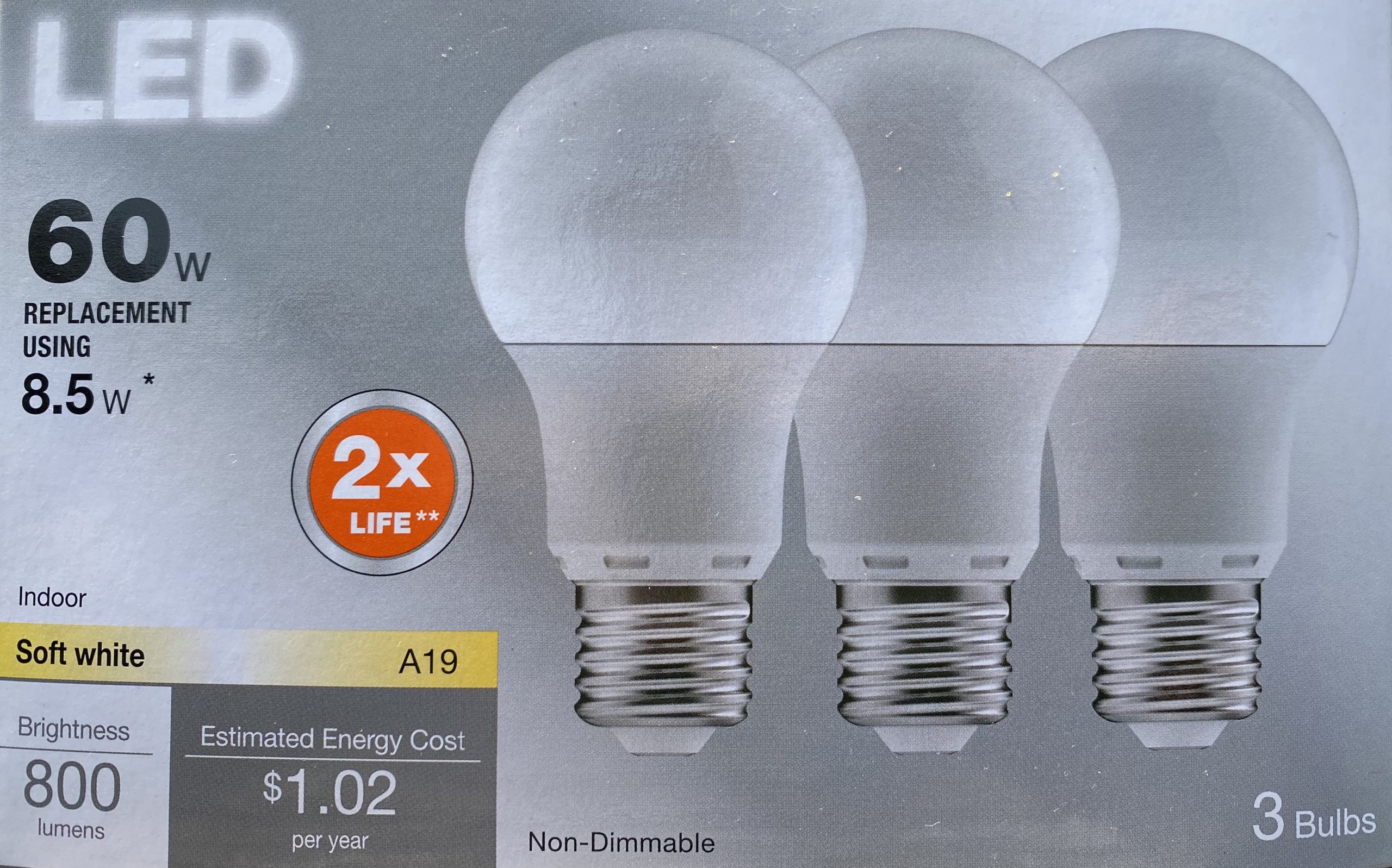

Buying LED bulbs: What to look for

Common questions and answers about heat pumps

How federal tax credits can help you reduce energy waste in your home