Summer 2018 News Briefs

Consumer Protection

Defending The Protections Americans Rely On

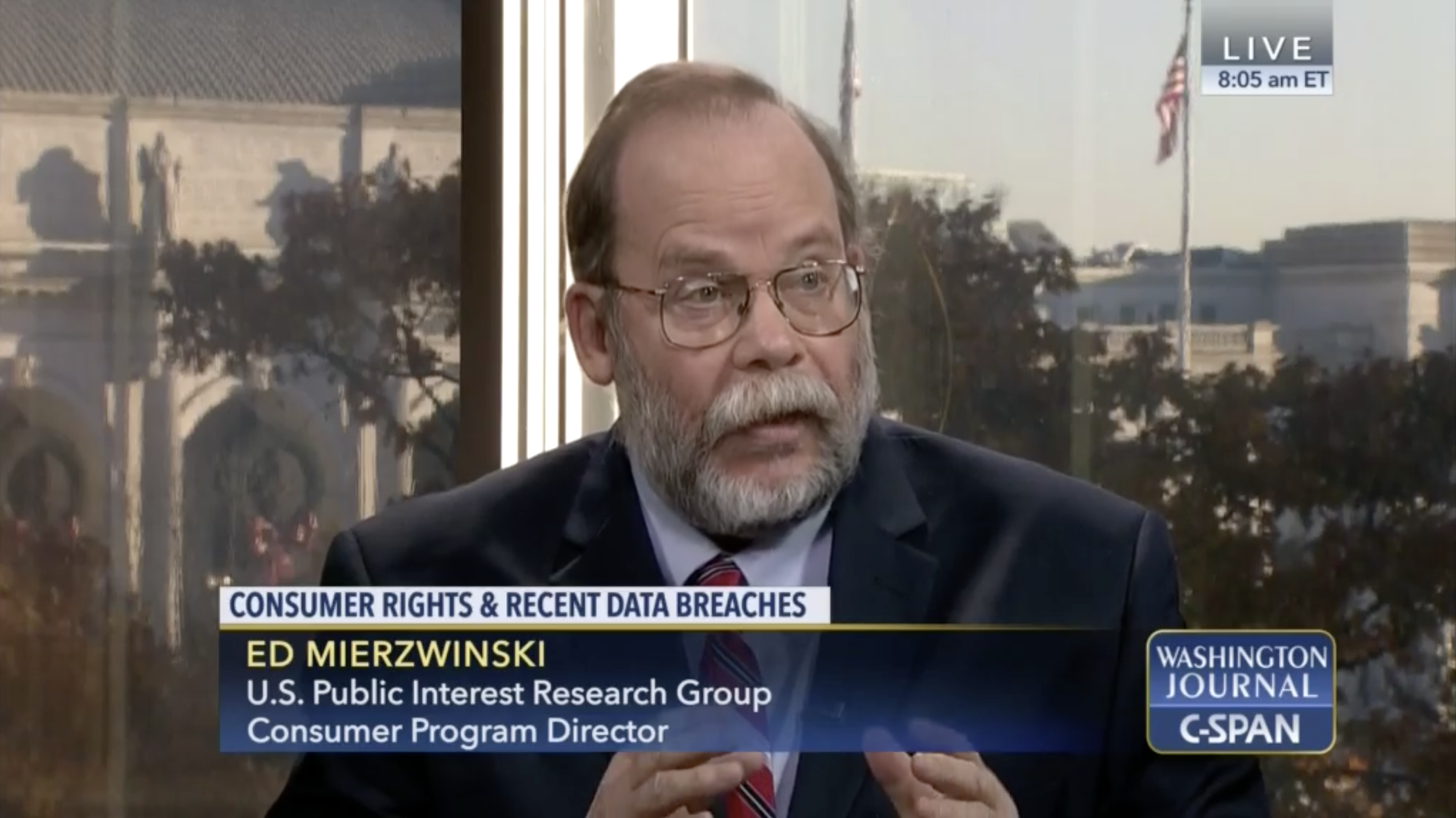

U.S. PIRG’s Ed Mierzwinski speaks to the need for stronger consumer protections after the Equifax data breach and congressional attacks on the Consumer Bureau. Photo: C-SPAN

After the 2008 economic crisis, millions of Americans lost their jobs, their homes, their retirement savings and more. That’s why our national network played a lead role in setting up the Consumer Financial Protection Bureau, and helped put in place rules of the road to keep Wall Street in check.

But now, in the name of regulatory reform, Wall Street, big banks and their allies in Congress are working to strip away these rules and dismantle the Consumer Bureau. With the support of our members, U.S. PIRG is on the ground in Denver and Washington, D.C., keeping an eye on threats to commonsense consumer protections.

Opposing Anti-Consumer Attacks In Washington

We’ve been successful in stopping legislation that would change the funding and leadership structure of the Consumer Bureau, both of which are key to the agency’s past success and continued independence. And we’ve been hard at work opposing the anti-consumer moves of Mick Mulvaney, who has been limiting the Consumer Bureau’s capabilities since the president put him in charge of the agency last November.

Another major threat to consumers is S.2155, a bank deregulation bill that will likely increase mortgage fraud, racial discrimination and risky banking practices; replace stronger state laws against identity theft; and more.

With your support, our advocates fiercely opposed this legislation to let Equifax and big banks off the hook, and are calling on decision-makers at the state and national levels to instead enact reforms to give consumers more control over our financial lives.

Solutions To Problems We All Face

Whether it’s defending the original mission of the Consumer Bureau or opposing bills that ignore the painful lessons of the 2008 financial crisis, U.S. PIRG works to unite people from across the political spectrum around commonsense solutions to problems we all face.

But we couldn’t do any of this without the support of our members. With you by our side, we’ll continue defending consumers and working toward a safer, healthier, more secure future.

21st Century Transportation

Paving The Way For Electric Transportation

CoPIRG staff celebrate the adoption of Colorado’s first-ever electric vehicle plan with Gov. Hickenlooper. The plan will use funds from the Volkswagen emissions scandal settlement to fund clean transit infrastructure. Photo: Alejandro Silva

Sales of electric vehicles nationwide increased 38 percent in 2016, and another 32 percent in 2017, according to a February report from CoPIRG Foundation and Frontier Group.

These clean car purchases reflect Americans’ values, including a desire to protect the health of our communities, reduce global warming pollution, and stop using so much oil.

New commitments by Colorado show how the Centennial State is paving the way for the overdue transition away from fossil fuels. In January, Colorado Gov. John Hickenlooper officially adopted our state’s first-ever electric vehicle plan, which lays out a series of actions and strategies to electrify Colorado’s transportation corridors and accelerate adoption of electric vehicles in our state. Elements of the plan, including electric vehicle charging stations and electric buses, will be funded by $68 million in settlement money stemming from the Volkswagen emissions scandal.

By transitioning away from gasoline and diesel, we can all breathe easier and see more clearly. With your support, we can put our communities on a fast track to a cleaner, healthier future.

Check out U.S. PIRG Foundation’s latest reports here.

Consumer Protection

Taking Aim At Predatory Payday Loans

Photo: Tony Webster via Flickr (CC BY 2.0)

Payday lenders prey on everyday Coloradans struggling to make ends meet.

Currently, outrageous and exploitative interest rates attached to payday loans ensure consumers who use these loans remain trapped in a cycle of debt that keeps them coming back. Consider this: The average annual percentage rate (APR) for credit cards is between 12 and 30 percent, according to the Consumer Financial Protection Bureau. But for payday loans in Colorado, the average APR is a staggering 129 percent.

CoPIRG is part of a team working to end this abusive lending practice by putting forward a ballot initiative that would cap payday lending rates at 36 percent. The cap would dramatically reduce predatory lenders’ power over Coloradans who use payday loans and protect consumers in the state from falling victim to the payday debt trap.

Protect Your Credit

Victory: Free Credit Freezes For Minors

CoPIRG Director Danny Katz (right) joins Gov. John Hickenlooper at the signing of a bill that allows parents and guardians to freeze the credit of minors in their care free of charge. Photo: Staff

When Equifax lost the critical financial data of nearly 148 million Americans last year, it was a startling reminder that we need a lot more control over our personal information.