Danny Katz

Executive Director, CoPIRG

Executive Director, CoPIRG

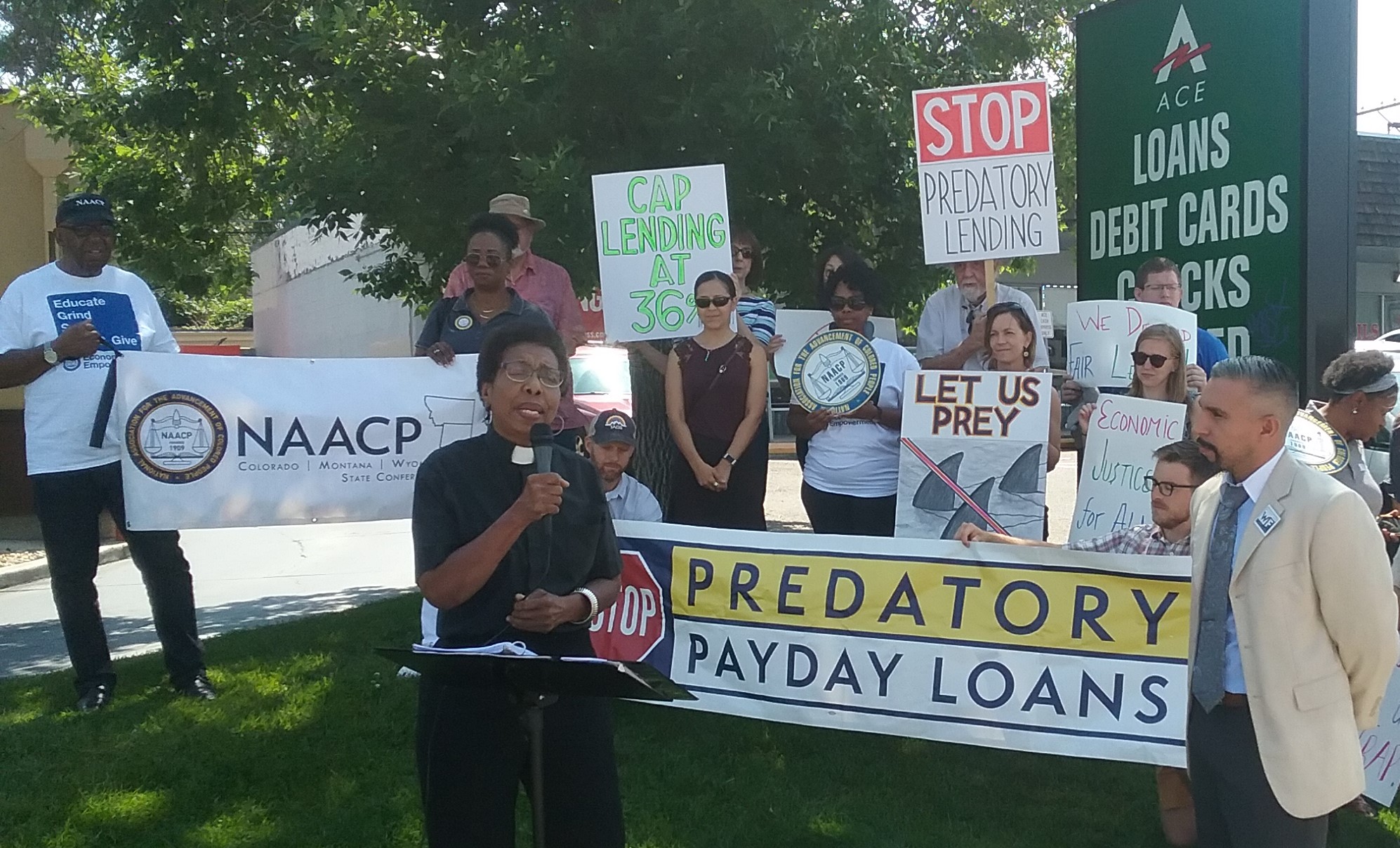

Today, CoPIRG stood with the leaders of the Coloradans to Stop Predatory Payday Loans campaign in front of an ACE Cash Express payday loan store to celebrate the campaign’s success in gathering over 180,000 signatures to qualify a ballot measure for the November 2018 election.

Payday loans are small loans with extremely high APRs. For example, a Colorado payday loan borrower pays an average of $119 in fees and interest to borrow $392. That’s an average annual percentage rate (APR) of 129% but it can go as high as 215%.

The ballot measure, Initiative 126, will decrease those rates from over 200 percent to 36 percent, inclusive of fees. 36 percent is the current state usury cap that only payday loans are exempted from.

“A 200 percent APR is ridiculous, unconscionable, and needs to be reined in,” said Danny Katz, CoPIRG Director. “This fall, because of the hard work of a broad coalition, Coloradans will have the chance to stop these predatory payday lenders.”

Payday loans force struggling families into cycles of debt by charging extremely high interest rates on loans that make repayment very difficult. The ballot measure is supported by a broad and diverse coalition including faith leaders, veterans, advocates for low-income families and consumers.

“Payday lenders are preying on our families and our communities,” said ballot measure proponent Reverend Dr. Anne Rice-Jones. “This initiative is going to ensure that they can’t continue to trap people in cycles of debt. Coloradans know it and that’s why they eagerly signed onto this ballot measure. While payday lenders pretend to serve struggling communities, they are actually making things worse, charging up to 200 percent interest in a system that forces many of their customers into default. We are done carving out loopholes for these predatory companies. It’s time for them to play by the same rules as every other financial institution in the state and have rates capped at 36 percent.”

Payday lenders drain $50 million per year from struggling Coloradans. When a borrower takes out a payday loan, the payday lender gains access to their bank accounts, meaning they can collect their fees regardless of whether people have the money to pay.

“Payday lenders target folks on fixed incomes, like military veterans, seniors and families struggling to make ends meet”, said Air Force Veteran Leanne Wheeler of Wheeler Advisory Group LLC, who lobbies with the United Veterans Committee of Colorado. “These lenders know that their consumers are desperate, and out of that desperation will allow direct access to their bank accounts. Consumers are set up to fail. We must stop accepting predatory lending as an option for anyone in our state. This measure will help us do just that.”

Fifteen states and the District of Columbia already stop predatory payday lending within their borders by enforcing interest rates caps of 36 percent or less. Studies have shown that access to credit doesn’t change in states that cap interest rates.

After North Carolina closed payday lending completely, studies found that there was no significant impact on the availability of credit for households. Former payday borrowers there and in other payday-free states report that they now build on savings and cut back on expenses, as well as access other resources that are much cheaper and less harmful than payday loans.

Colorado will now join four other states that put this initiative on their ballot, including Arizona, Ohio, Montana and South Dakota, where interest rate caps passed overwhelmingly.