Danny Katz

Executive Director, CoPIRG

Executive Director, CoPIRG

Statement from CoPIRG Director Danny Katz

“Today Governor Hickenlooper stood up for Coloradans and vetoed HB15-1390, a last minute, special interest bill that would have increased borrowing costs on hard-working families across Colorado. This was rushed through with little debate, the proponent’s arguments were not supported by facts and the clear losers would have been the thousands of Coloradan’s whose interest rates would have jumped arbitrarily. We applaud the Governor for stopping this special interest giveaway. That’s not how we do business in Colorado.”

Background

HB15-1390 is bad for Coloradans and is not the way Colorado should do business. HB15-1390 is a last minute, special interest bill passed with limited debate that will raise the costs of borrowing for hard-working Colorado families without any facts to back it. The Legislature should not have acted without full debate and discussion with consumer advocacy and civil rights groups that understand the impact this kind of legislation has on every day Coloradans. This bill simply takes money from Colorado family pockets and sends it to Wall Street and out-of-state investors. That’s not how Colorado should do business or treat its families. Today Governor Hickenlooper stood up for every day Coloradans and due process and vetoed the bill.

The only arguments used to support the case for raising these interest rates are not factual and are misleading.

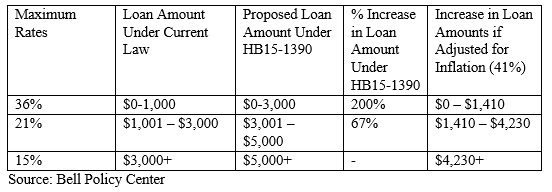

If the goal of this legislation was to raise the amount of the loan that can be charged the maximum interest rates to account for inflation, it has overshot the mark. According to an analysis by the Bell Policy Center, over the past 15 years inflation as measured by consumer prices has grown by 41 percent in Colorado. This legislation increases the amount of the loan that can be charged the maximum interest rates by 200 and 67 percent. The chart below shows how much higher the loan amounts have been set under HB15-1390 compared to where they would be set just to adjust for inflation, the stated purpose by proponents for the changes in HB15-1390.

Contrary to what proponents of the legislation claim, these loans are quite profitable and there is no evidence that the products will be lost to Coloradans if the loan amounts subject to the maximum interest rates are not raised to the level HB15-1390 proposes. The most recent data from the Colorado Attorney General’s Office shows that supervised lenders made 30,940 closed-end/fixed-term loans totaling $248 million in 2013. This is an increase over 2012 and the highest amount since 2009.

HB15-1390 is a last minute sneak attack by a powerful special interest. A profit grab designed to pad the profits of a few companies at the expense of average Colorado borrowers.