We Join Leading Groups Urging SEC To Strengthen Weak Investor Best Interest Proposal

We've joined leading consumer, civil rights, labor and older American organizations in a comment letter urging the Securities and Exchange Commission (SEC) to strengthen its proposed "Regulation Best Interest" intended to ensure that all broker-dealers and other individuals and firms offering investment advice act do so in a fiduciary capacity, or in the best interest of their investor-clients. (Right now, it doesn't).

We’ve joined leading consumer, civil rights, labor and older American organizations in a comment letter urging the Securities and Exchange Commission (SEC) to strengthen its proposed “Regulation Best Interest” intended to ensure that all broker-dealers and other individuals and firms offering investment advice act do so in a fiduciary capacity, or in the best interest of their investor-clients. Many transactions and relationships today are subject to a lesser “suitability” standard. The Obama Administration Department of Labor had finalized a much stronger rule for retirement savers only. The current administration’s Labor Department delayed that rule long enough for industry opponents to find a court to overturn it. One of the special interest arguments was “Wait for the SEC.” This comment is in response to the SEC proposal.

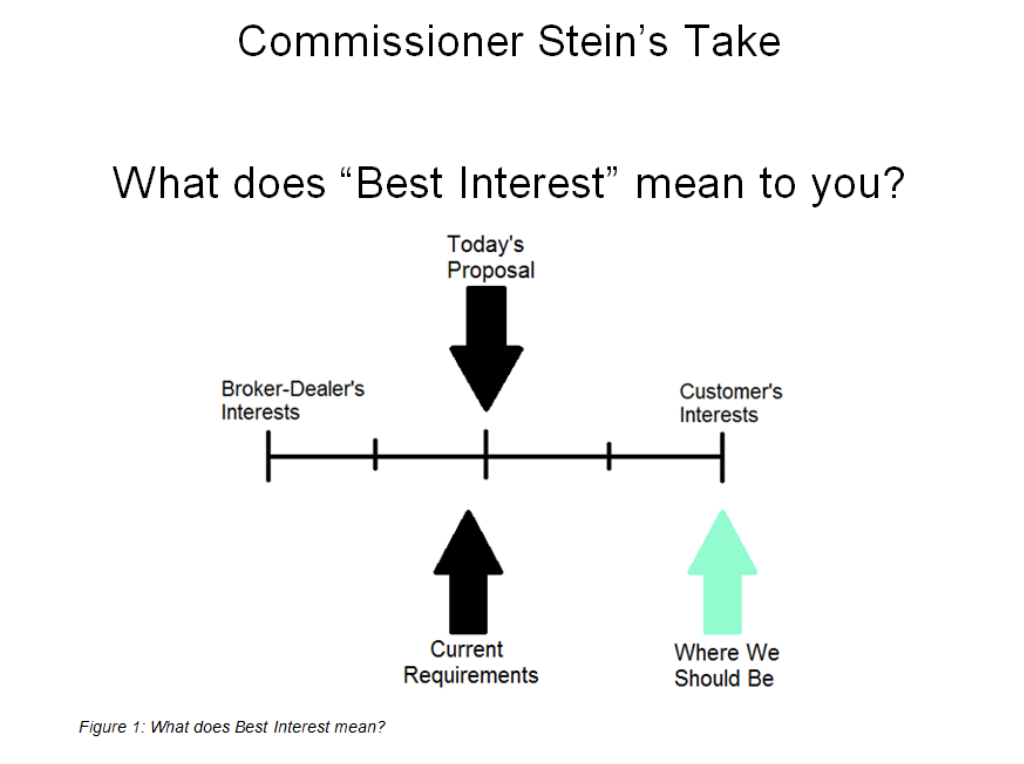

As SEC Commissioner and investor champion Kara Stein pointed out in her own lengthy critique when the Best Interest and related proposals were released in April:

“For at least the last decade, investors have been asking for some type of fiduciary duty standard for broker-dealers who are giving advice. Unfortunately, the proposals before the Commission today squander the opportunity to act in the best interest of investors. Instead, the proposals essentially maintain the status quo.[…] Listening week after week to the Commission’s enforcement staff as they discuss their investigations into fraud,

deceit, and misconduct involving financial professionals, it is clear to me that existing broker-dealer standards are not sufficient. The benchmark against which we should measure the efficacy of today’s proposed regulation is whether it will prevent this type of harm. Or, at a minimum, whether the proposal will make it easier for investors themselves—or the government—to help get their money back. I fear that this proposal may fall short of accomplishing either.”

Commissioner Stein also released a series of helpful slides in her presentation. One is pictured at right.

Despite our concerns with the proposal, our group comment letter suggested the following ways to improve the final version of the rule:

- Clarify that brokers and investment advisers alike must act in the best interests of the customer, meaning that they must make the recommendations they reasonably believe represent the best available option for the investor.

- Clarify that broker-dealers, and their associated persons, are prohibited from allowing their conflicts of interest to influence their recommendations, and firms must have, and enforce, written policies and procedures to achieve compliance with the best interest standard.

- Require brokers to mitigate all material conflicts of interest, and clarify that the Commission will measure compliance with this requirement based on whether the action taken is sufficient to prevent the conflict from undermining compliance with the best interest standard.

- Prohibit brokers from adopting practices, such as sales quotas and contests, that clearly incentivize their representatives to base their recommendations on their own financial interests rather than the customer’s best interests.

The report relied on for the Department of Labor’s earlier, stronger rule had estimated that 401-k and other retirement accounts lost $17 billion annually to investment fees and commissions that enriched the seller at their expense. It will be disappointing if the SEC finalizes a rule that allows firms and their employees to use conflicts of interest, contests or even the promise of trips to Hawaii to continue to sell junky products in their own interest, not the fiduciary best interest of their clients.

Topics

Authors

Ed Mierzwinski

Senior Director, Federal Consumer Program, U.S. PIRG Education Fund

Ed oversees U.S. PIRG’s federal consumer program, helping to lead national efforts to improve consumer credit reporting laws, identity theft protections, product safety regulations and more. Ed is co-founder and continuing leader of the coalition, Americans For Financial Reform, which fought for the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, including as its centerpiece the Consumer Financial Protection Bureau. He was awarded the Consumer Federation of America's Esther Peterson Consumer Service Award in 2006, Privacy International's Brandeis Award in 2003, and numerous annual "Top Lobbyist" awards from The Hill and other outlets. Ed lives in Virginia, and on weekends he enjoys biking with friends on the many local bicycle trails.

Find Out More

Junk fees. Hidden fees. Surprise processing, resort, convenience or service fees. No matter their name – they are wrong

Apple AirPods are designed to die: Here’s what you should know

New report reveals widespread presence of plastic chemicals in our food