Positive Steps on Arbitration Clauses

Today, I had the honor of speaking with members of the Consumer Financial Protection Bureau (CFPB) who were in town to announce positive steps to protect consumers when in comes to forced arbitration clauses. Forced arbitration clauses eliminate Americans’ access to the courts, forcing them instead into a private system set up by corporations to favor corporations.

Today, I had the honor of speaking with members of the Consumer Financial Protection Bureau (CFPB) who were in town to announce positive steps to protect consumers when in comes to forced arbitration clauses.

What’s forced arbitration clauses and why should consumers care? Well, in the fine print of most of our consumer contracts, from credit cards and student loans, and even to payday loans, forced arbitration clauses eliminate Americans’ access to the courts, forcing them instead into a private system set up by corporations to favor corporations.

Companies use forced arbitration because the system allows them to greatly reduce or sometimes completely escape accountability for cheating consumers, committing fraud, and other corporate wrongdoing. They also use these terms to eliminate class actions, a tool that consumers need to band together to seek remedies for small-dollar injuries and to hold corporations to account for widespread, systematic practices.

In Denver today, the CFPB, led by their Director Richard Cordray, briefed a room full of consumer adovcates, lawyers, and industry representatives on its comprehensive 3-year examination of the use of arbitration clauses in financial services contracts. The CFPB study supports what previous empirical research and consumers’ experiences have long revealed. Due to forced arbitration, corporations have a virtual get-out-of-jail free card and are shielded from being held accountable for bad behavior.

I was encouraged by the CFPB’s proposal today to restrict class action bans in forced arbitration clauses. If finalized, it will restore some accountability in the financial services market by permitting consumers to band together over small-dollar harms.

I also appreciate the CFPB’s recognition that it can’t enforce those laws alone. Consumers need to be able to go to court for themselves and to band together with others as well.

Today’s announcement by the CFPB was not perfect though. Arbitration clauses will still exist under the draft CFPB proposal, posing a continued risk that arbitration will remain biased in favor of the financial industry. Consumers should never have to give up their rights– just to do the everyday things in their lives like open a bank account or take out an auto loan or student loan.

This was the message I delivered to CFPB staff and we’ll be participating in the rule making process to ensure they follow through.

Put into context, today’s announcement is a small part of the CFPB’s work. It’s important to thank the CFPB for its continued good work in protecting consumers in the financial world.

As we say at CoPIRG, the idea of the CFPB needs no defense, only more defenders.

Authors

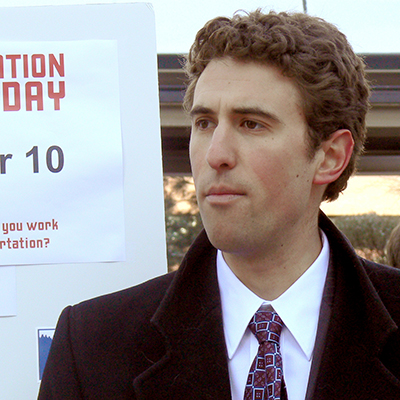

Danny Katz

Executive Director, CoPIRG

Danny has been the director of CoPIRG for over a decade. Danny co-authored a groundbreaking report on the state’s transit, walking and biking needs and is a co-author of the annual “State of Recycling” report. He also helped write a 2016 Denver initiative to create a public matching campaign finance program and led the early effort to eliminate predatory payday loans in Colorado. Danny serves on the Colorado Department of Transportation's (CDOT) Efficiency and Accountability Committee, CDOT's Transit and Rail Advisory Committee, RTD's Reimagine Advisory Committee, the Denver Moves Everyone Think Tank, and the I-70 Collaborative Effort. Danny lobbies federal, state and local elected officials on transportation electrification, multimodal transportation, zero waste, consumer protection and public health issues. He appears frequently in local media outlets and is active in a number of coalitions. He resides in Denver with his family, where he enjoys biking and skiing, the neighborhood food scene and raising chickens.