Breaking The Cycle Of Debt: Why We Need The Payday Lending Rule

We call them debt traps for a reason: Payday lending has long led to schemes that literally trap consumers in consecutive loans with obscenely high interest rates.

Payday lending has long led to schemes that literally trap consumers in consecutive loans with obscenely high interest rates.

We call them debt traps for a reason.

These tricks marketed to financially vulnerable consumers are exactly why the Consumer Financial Protection Bureau (CFPB), under former Director Richard Cordray, created the Payday Lending Rule, which was finalized in October 2017.

But, in January 2018, the new acting director of the Consumer Bureau, Mick Mulvaney, announced that he is opening this rule up for reconsideration—to delay it, to change it or to roll it back.

No one should be tricked or trapped into entering cycles of unaffordable debt. This is as true today as it was in October.

Let’s break down why:

The average payday loan is $392, and typically must be repaid in one payment after two weeks.

To take out one of these loans, the borrower will typically provide evidence of a paycheck, and write a post-dated check or provide direct access to their bank account for electronic withdrawals. This check or direct access to a bank account is considered collateral and ensures that the payday lender will be paid above all other expenses due that month.

However, many borrowers cannot afford both basic expenses and the cost of the entire loan. So they take out another loan. And another. And another.

And that’s how payday lenders make their money: 75 percent of the industry’s business comes from people who take out 10 or more loans.

With that many loans piled up, borrowers are actually paying more in fees than they received in credit.

According to the Consumer Bureau’s own research, more than four out of five payday loans are re-borrowed within a month, typically around the time that the loan is due.

And the fees? On average, the fees end up at the equivalent of 400 percent annual interest. This is just business as usual—with consumers trapped in cycles of debt.

One unaffordable loan turns into a debt trap from which it is difficult, if not impossible, to break free.

The Payday Lending Rule, finalized by the Consumer Bureau in October 2017, would require payday loan lenders to take steps to make sure that people can afford to repay their loans. Under the rule, payday loans would still be available for people considering their financial options, but protections would be in place to help prevent those loans from snowballing into a debt trap they can’t get out of.

Fifteen states and DC ban payday loans because of the harm they pose. Additionally, Congress also capped loans for active duty service members in all states at 36% because the Department of Defense found that payday loans harmed military readiness.

Alternatives to payday lending include borrowing from relatives or employers, asking creditors for more time or a payment plan, or joining a credit union that might offer lower-cost small dollar loans. (Many consumers are unaware that they are eligible to join credit unions that accept members based on where they live, not just who they work for.) All consumers should strive to save a few dollars a week to build up a buffer of at least $500 in savings in case of financial emergencies.

Predatory loans don’t give consumers a fair choice. So we’ll say it again: No one should be tricked into entering cycles of unaffordable debt. That’s why we campaigned for the Payday Lending Rule in the first place, and we’ll continue defending this important consumer protection every step of the way.

But we can’t do it without you.

Photo: Aliman Senai via Wikimedia Commons, CC By-SA 4.0

Topics

Authors

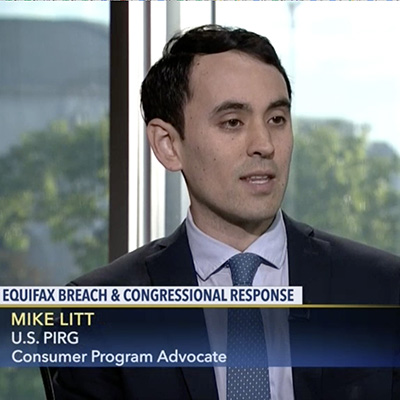

Mike Litt

Director, Consumer Campaign, PIRG

Mike directs U.S. PIRG’s national campaign to protect consumers on Wall Street and in the financial marketplace by defending the Consumer Financial Protection Bureau, and works for stronger privacy protections and corporate accountability in the wake of the Equifax data breach. Mike lives in Washington, D.C.

Find Out More

Apple AirPods are designed to die: Here’s what you should know

New report reveals widespread presence of plastic chemicals in our food

FTC goes after second tax prep firm, H&R BLOCK joins INTUIT TURBOTAX for deceptive claims of “Free tax prep”